Personal Loan EMI Calculator

You may calculate your personal loan EMI instantly using the Personal Loan EMI Calculator, which is available on our website under the Financial Tools area. To obtain the result, all you need to do is enter three essential pieces of information about the loan to be obtained: the loan amount, repayment term (in years), and interest rate. After entering your information, click the Enter button to instantly find out your EMI.

Calculator Information

The Equipment Finance Calculator calculates the type of repayment required, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate. The Product selected determines the default interest rate for personal loan product. The Equipment Finance Calculator also calculates the time saved to pay off the loan and the amount of interest saved based on an additional input from the customer. This is if repayments are increased by the entered amount of extra contribution per repayment period. This feature is only enabled for the products that support an extra repayment. The calculations are done at the repayment frequency entered, in respect of the original loan parameters entered, namely amount, annual interest rate and term in years.Calculator Assumptions

Length of Month

All months are assumed to be of equal length. In reality, many loans accrue on a daily basis leading to a varying number of days interest dependent on the number of days in the particular month.Number of Weeks or Fortnights in a Year

One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.Rounding of Amount of Each Repayment

In practice, repayments are rounded to at least the nearer cent. However the calculator uses the unrounded repayment to derive the amount of interest payable at points along the graph and in total over the full term of the loan. This assumption allows for a smooth graph and equal repayment amounts. Note that the final repayment after the increase in repayment amount.Rounding of Time Saved

The time saved is presented as a number of years and months, fortnights or weeks, based on the repayment frequency selected. It assumes the potential partial last repayment when calculating the savings.Amount of Interest Saved

This amount can only be approximated from the amount of time saved and based on the original loan details.Calculator Disclaimer

The results from this calculator should be used as an indication only. Results do not represent either quotes or pre-qualifications for the product. Individual institutions apply different formulas. Information such as interest rates quoted and default figures used in the assumptions are subject to change.

Feel free to use our Equipment Finance Calculator

Sorry

This video does not exist.

| Period | Payment | Interest | Balance |

|---|

Calculator Disclaimer

The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.

What is a Personal Loan EMI Calculator?

A Loan Against Property The EMI Calculator is an online tool for calculating mortgage loan payments. As you enter loan against property (LAP) information such as amount, rate of interest, and term, the calculator will automatically produce monthly installments and a loan amortisation schedule. You can easily utilise a free Loan EMI Calculator 24 hours a day, seven days a week on lender and aggregator websites and applications. Using an EMI Calculator allows you to make informed borrowing decisions.

Table of Contents

ToggleWhat is EMI?

EMI, or H. equivalent monthly installment, is a fixed amount that has to be paid every month over the entire term of the loan. It consists of an interest portion and an equity portion. EMIs tend to remain constant throughout the period.

If you use a variable interest rate, your EMI will change according to periodic interest rate fluctuations.

If a loan is availed at a fixed rate, the EMI remains constant for the duration of the loan unless prepayment is made.

For each prepayment, there is an option to reduce the EMI or contract period.

Shortening the term is a better option and can make the loan more economical by reducing the overall cost of the loan.

We recommend calculating your EMI using a personal loan EMI calculator so that you can make an informed decision on the loan amount.

How to calculate EMI for personal loans?

A personal loan EMI calculator enables you to calculate the EMI by entering the loan amount, tenure and rate of interest. Being aware of your repeated monthly commitment for the opted tenure helps you balance the monthly budget. The mathematical formula for calculating the EMI is P x R x (1+R)^N / [(1+R)^N-1]. Here

P is the principal

R is the rate of interest

N is the tenure

Manual calculation using the formula can be cumbersome and prone to errors. Whereas with a personal loan EMI calculator, the calculation becomes easy and with 100% accuracy.

The main factors that decide monthly EMI are the rate of interest and tenure. If you have a good income, a high credit score and working for a reputed organisation and have just started your career, you can negotiate with the lender for a better interest rate. Also, with the personal loan EMI calculator excel, you can compare the EMIs of different financial institutions and choose the deal that is best for you.

How To Reduce The Personal Loan EMI?

The only criterion for deciding on a personal loan is not how easily the loan is available. Just because personal loans are easily available, don’t take them out on an irregular basis. If you make wise decisions, you can live a life free of financial stress. Otherwise, you will end up paying EMIs for the rest of your life.

There are various ways to reduce your personal loan EMI. Borrow only when you need it: Personal loans are easy to obtain and the qualifications are high, but you should discuss the amount you actually need and borrow within that range.

Otherwise, you will find yourself in unnecessary financial hardship in the future. The EMI may seem affordable at first as it depends on the loan amount. However, if your income remains the same but your financial obligations increase, it can become difficult to repay your loan on time.

To make the EMIs worth your wallet, you should borrow only the amount you need. Conduct market research to determine the best deal. Another factor on which EMI depends is the interest rate.There are several providers on the market that offer personal loans at competitive interest rates. Compare the current interest rate and the EMI for your desired loan amount and choose the best deal. For comparison, you can use the personal loan EMI calculator in Excel.

Choose a longer term: The term of the loan also plays an important role while determining the EMI. If you are young and plan to work for years to come, you can opt for a longer tenure to reduce the EMIs on your personal loan. If your financial situation allows, you can make prepayments to shorten the term and pay off your loan before its due date.

Ensuring on-time repayments: EMI defaults are the biggest problem in lending. The concept of EMI was introduced to simplify loan repayments by paying a fixed amount every month. Loan repayment becomes stressful when the repayment amount increases due to EMI default. Moreover, in case of missing EMIs, you will have to bear additional costs in the form of penalties. Another effect is a deterioration of your credit score, which will affect your future loan applications. To prevent this from happening, you need to repay your loan promptly.

Decoding the fine print: You should always read the fine print in the terms and conditions to understand if there are any hidden additional costs beyond interest, such as: Examples: processing fees, garnishment fees, late payment fees, etc. These charges may come up unexpectedly and increase your EMI payments.

Annual EMI Revision: Many lenders offer the facility of revising your EMI every year as per your income growth. This allows you to pay off your loan before it’s due, reducing the overall cost of your loan. Prepay whenever possible. Make regular advance payments apart from regular EMIs. This shortens the term of the loan and reduces interest costs on the loan.

Consolidate your debts: If you have multiple loans and have to pay multiple EMIs, you can save yourself the hassle of EMIs by consolidating all your debts. If you take a personal loan and repay all your small loans, you won’t have to remember multiple EMI due dates. This will help you pay off your loan quickly and maintain a good credit standing.

Know your EMI in advance: Calculate your EMI using online personal loan EMI calculator before applying.

Factors Affecting Personal Loan EMI

The key elements influencing the Personal Loan EMI are as follows.

- Loan amount: The loan amount directly affects the personal loan EMI. The bigger the loan amount, the higher the EMI.

- Tenure: A longer tenure results in a lower EMI, whereas a shorter term results in a higher EMI.

- Interest Rate: The interest rate has a significant impact on the monthly installment of a personal loan. The higher the EMI, the higher the loan’s total cost.

The way interest is calculated also affects the EMI of a personal loan. If a flat rate rate applies, interest will be charged on the amount originally approved for the life of the loan. Therefore, the loan interest rate remains unchanged. On the other hand, if interest is calculated using the declining balance method, the allocation of EMI amount to the principal increases as the period progresses. In the case of early repayment, the principal amount will be reduced and the interest portion will also be reduced accordingly. In such cases, you have the option to change the EMI to shorten the loan tenure and ensure that the loan ends within the tenure. So, using an online personal loan EMI calculator, you can calculate the EMI multiple times by changing the values of the components until you get an EMI that suits your pocket.

How is personal loan interest calculated?

When banks/NBFCs sell loan products by emphasizing the interest rate offered, it refers to the annualized interest rate.

In other words, the interest rate stated is the interest rate charged over a period of one year.

There is no fixed interest rate for all financial institutions.

It is important to understand how this annual interest rate translates into monthly EMI.

A personal loan EMI calculator will help you convert this annual interest rate into a monthly interest rate to calculate your EMI.

The conversion is done automatically by the personal loan EMI calculator. To manually convert the annual rate into a monthly rate, the annual rate has to be divided by 12. For instance, if the interest rate calculated for the loan amount is 6.75%, the monthly rate will be 0.56%.

What is a loan amortization schedule?

First and foremost, we need to clarify that the EMI you get on a loan is adjusted for both principal and interest.

A repayment schedule is nothing more than a graph that clearly shows the distribution of EMIs between lenders and interest over the selected period.

You can also see that the interest component adjustment is high in the first few years and decreases in the second half of the period, since capital accounts for a large portion initially.

The repayment schedule tells you when you can get the most benefit from paying off your loan early.

Amortization Table

| Year | Opening Balance | Amount paid by customer (EMI*12) | Interest paid during the year | Principal paid during the year | Closing Balance |

|---|---|---|---|---|---|

| 1 | ₹5000000 | ₹499190 | ₹435013 | ₹64177 | ₹4935823 |

| 2 | ₹4935823 | ₹599028 | ₹514259 | ₹84769 | ₹4851054 |

| 3 | ₹4851054 | ₹599028 | ₹504917 | ₹94111 | ₹4756944 |

| 4 | ₹4756944 | ₹599028 | ₹494546 | ₹104482 | ₹4652461 |

| 5 | ₹4652461 | ₹599028 | ₹483031 | ₹115996 | ₹4536465 |

| 6 | ₹4536465 | ₹599028 | ₹470248 | ₹128780 | ₹4407685 |

| 7 | ₹4407685 | ₹599028 | ₹456056 | ₹142972 | ₹4264714 |

| 8 | ₹4264714 | ₹599028 | ₹440300 | ₹158728 | ₹4105986 |

| 9 | ₹4105986 | ₹599028 | ₹422808 | ₹176220 | ₹3929766 |

| 10 | ₹3929766 | ₹599028 | ₹403388 | ₹195640 | ₹3734126 |

| 11 | ₹3734126 | ₹599028 | ₹381828 | ₹217200 | ₹3516926 |

| 12 | ₹3516926 | ₹599028 | ₹357892 | ₹241136 | ₹3275790 |

| 13 | ₹3275790 | ₹599028 | ₹331318 | ₹267710 | ₹3008079 |

| 14 | ₹3008079 | ₹599028 | ₹301815 | ₹297213 | ₹2710866 |

| 15 | ₹2710866 | ₹599028 | ₹269061 | ₹329967 | ₹2380899 |

| 16 | ₹2380899 | ₹599028 | ₹232697 | ₹366330 | ₹2014569 |

| 17 | ₹2014569 | ₹599028 | ₹192327 | ₹406701 | ₹1607868 |

| 18 | ₹1607868 | ₹599028 | ₹147507 | ₹451521 | ₹1156346 |

| 19 | ₹1156346 | ₹599028 | ₹97748 | ₹501280 | ₹655066 |

| 20 | ₹655066 | ₹599028 | ₹42505 | ₹556523 | ₹98543 |

| 21 | ₹98543 | ₹99838 | ₹1295 | ₹98543 | ₹0 |

| Year | Opening Balance | Interest paid during the year | Closing Balance |

|---|---|---|---|

| 1 | ₹5000000 | ₹435013 | ₹4935823 |

| 2 | ₹4935823 | ₹514259 | ₹4851054 |

| 3 | ₹4851054 | ₹504917 | ₹4756944 |

| 4 | ₹4756944 | ₹494546 | ₹4652461 |

| 5 | ₹4652461 | ₹483031 | ₹4536465 |

| 6 | ₹4536465 | ₹470248 | ₹4407685 |

| 7 | ₹4407685 | ₹456056 | ₹4264714 |

| 8 | ₹4264714 | ₹440300 | ₹4105986 |

| 9 | ₹4105986 | ₹422808 | ₹3929766 |

| 10 | ₹3929766 | ₹403388 | ₹3734126 |

| 11 | ₹3734126 | ₹381828 | ₹3516926 |

| 12 | ₹3516926 | ₹357892 | ₹3275790 |

| 13 | ₹3275790 | ₹331318 | ₹3008079 |

| 14 | ₹3008079 | ₹301815 | ₹2710866 |

| 15 | ₹2710866 | ₹269061 | ₹2380899 |

| 16 | ₹2380899 | ₹232697 | ₹2014569 |

| 17 | ₹2014569 | ₹192327 | ₹1607868 |

| 18 | ₹1607868 | ₹147507 | ₹1156346 |

| 19 | ₹1156346 | ₹97748 | ₹655066 |

| 20 | ₹655066 | ₹42505 | ₹98543 |

| 21 | ₹98543 | ₹1295 | ₹0 |

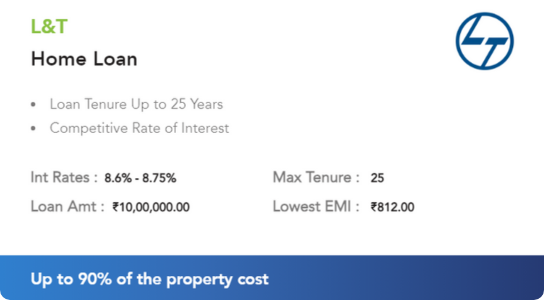

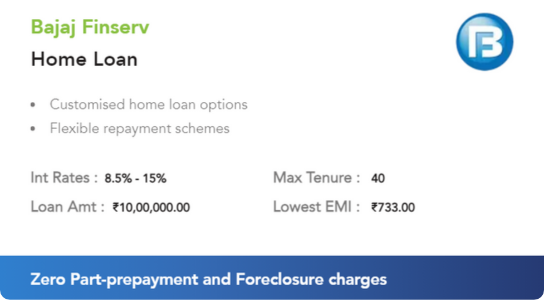

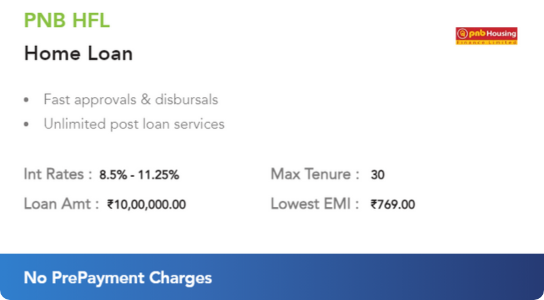

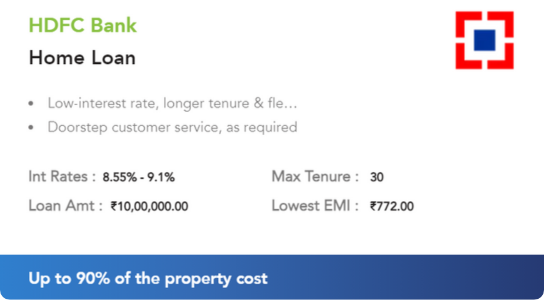

Best Deals

From Our Blog

Personal Loan EMI Calculator FAQs

The EMI calculator using Excel sheet is as accurate as the personal loan EMI calculator.

However, the advantage of calculating using a personal loan EMI calculator is its speed and accuracy.

The bank and the EMI calculator both use the identical formula to calculate the EMI. You should ensure that the components, i.e., loan tenure, interest rate, and loan amount, considered by the bank and the calculator, are all the same. Don’t forget to include professional costs in the loan amount when calculating the EMI. If this is done, the EMI provided by the bank and the EMI determined by the calculator will be the same.

Arriving at the EMI before applying for a loan will allow you to make an informed decision.

The prepayments made on the personal loan will reduce the principal to that amount. Because the interest application is based on the declining balance, prepayments lower the loan’s costs.

Personal loan EMI calculators will assist you in performing many computations by reducing the value of the components until you find a deal that converts into the lowest EMI.

Apply For Personal loan

HDFC Bank Personal Loan

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

ICICI Bank Personal Loan

Apply For Personal loan

HDFC Bank Personal Loan

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

ICICI Bank Personal Loan

Personal Loan Interest Rates

HDFC Bank Personal Loan Interest Rates

IDFC First Bank Personal Loan Interest Rates

Bajaj Finserv Personal Loan Interest Rates

ICICI Bank Personal Loan Interest Rates

HDFC Bank Personal Loan EMI Calculator

IDFC First Bank Personal Loan EMI Calculator

Bajaj Finserv Personal Loan EMI Calculator

SBI Personal Loan EMI Calculator

HDFC Bank Personal Loan Eligibility

Bajaj Finserv Personal Loan Eligibility

Bank of Baroda Personal Loan Eligibility

Bank of India Personal Loan Eligibility

ICICI Personal Loan Eligibility

IDFC First Personal Loan Eligibility

HDFC Bank Personal Loan EMI Calculator

IDFC First Bank Personal Loan EMI Calculator

Bajaj Finserv Personal Loan EMI Calculator

SBI Personal Loan EMI Calculator

Best Loan Apps

Fibe Loan

Money View Loan

Moneytap Loan

Paysense Loan

Loan against LIC Policy

Loan on Credit Card

Loan on SBI Credit Card

Loan on HDFC Credit Card

Loan on ICICI Bank Credit Card

Line of Credit

Best Loan Apps

Fibe Loan

Money View Loan

Moneytap Loan

Paysense Loan

Loan against LIC Policy

Loan on Credit Card

Loan on SBI Credit Card

Loan on HDFC Credit Card

Loan on ICICI Bank Credit Card