Business Growth

Loan.

Apply for quick business loans of up to 2 crore at competitive interest rates for manufacturing, trading, and services. Special plans are available for female entrepreneurs, new start-ups, and existing small businesses. Use an online calculator to determine your eligibility for a business loan and the applicable interest rate.

Let's find the best Business

loan for you

Get high business loan eligibility

Before asking for a loan, create a business strategy, know your credit score, determine the loan amount, conduct market research on accessible business loan options, and have the papers ready.

Common documents required

Proof of address and picture identity of promoters, business proof, income proof, partnership deed for a partnership firm, articles of association, memorandum of association, board resolution, PAN card, and so on.

Get high business loan eligibility

Applicants should be between the ages of 21 and 65, with a minimum company vintage of three years. The minimum business turnover and yearly turnover specified in the ITR will be required. For at least the previous year, the business should have been profitable.

Let’s find the best Business loan for you.

You’re just a few steps away from getting the best business loan near you. LoansWala representative will contact you with the finest cash loan offer once you submit your contact name, email address, and mobile number.

Get high business loan eligibility

Before asking for a loan, create a business strategy, know your credit score, determine the loan amount, conduct market research on accessible business loan options, and have the papers ready.

Common documents required

Proof of address and picture identity of promoters, business proof, income proof, partnership deed for a partnership firm, articles of association, memorandum of association, board resolution, PAN card, and so on.

Get high business loan eligibility

Applicants should be between the ages of 21 and 65, with a minimum company vintage of three years. The minimum business turnover and yearly turnover specified in the ITR will be required. For at least the previous year, the business should have been profitable.

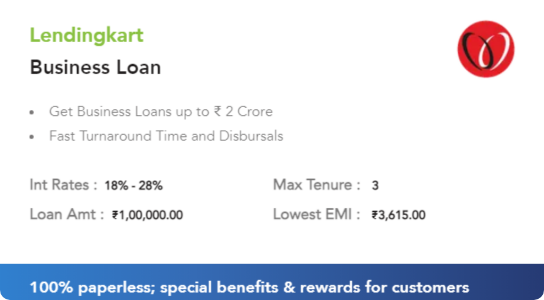

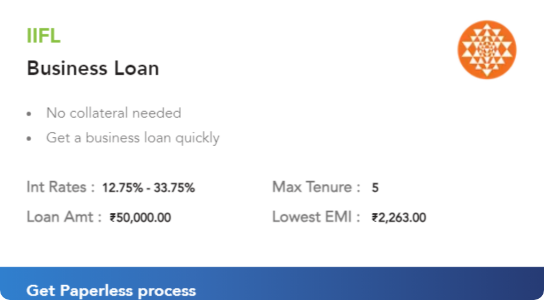

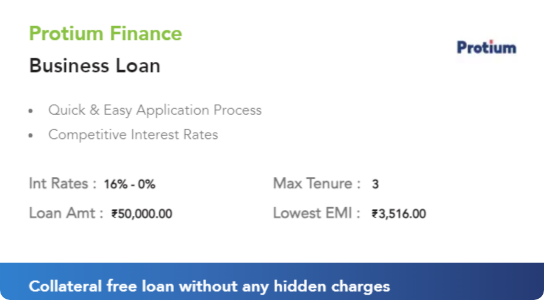

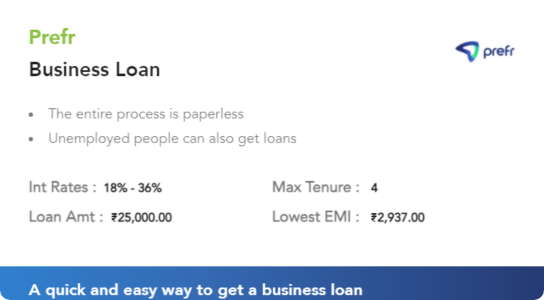

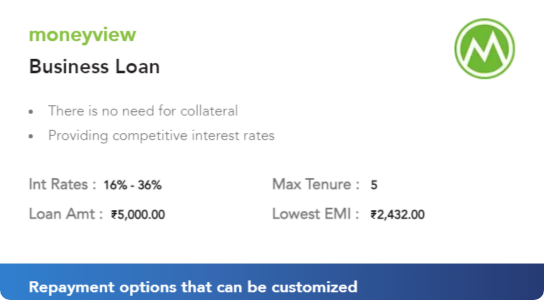

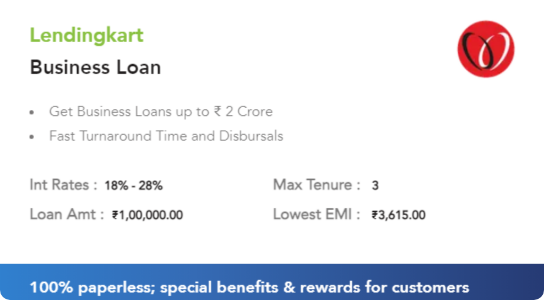

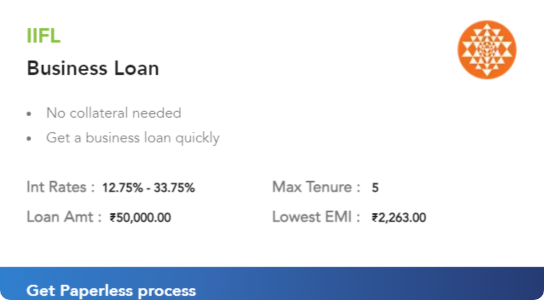

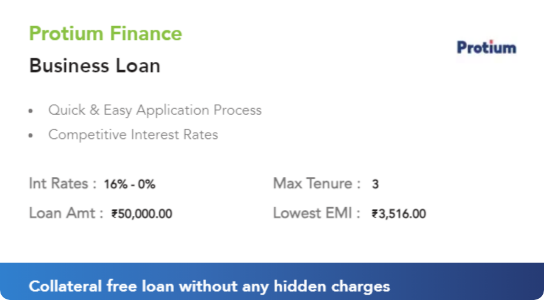

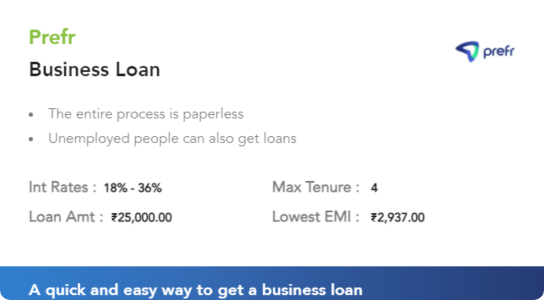

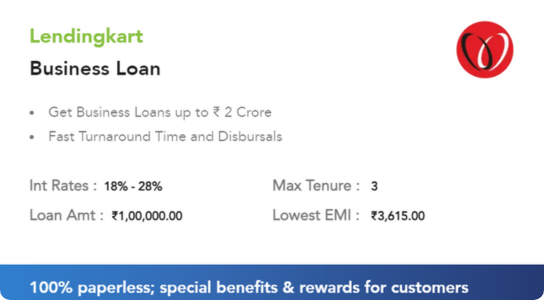

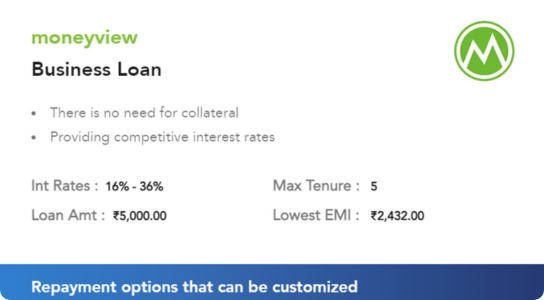

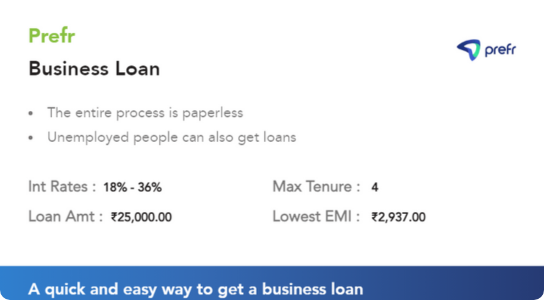

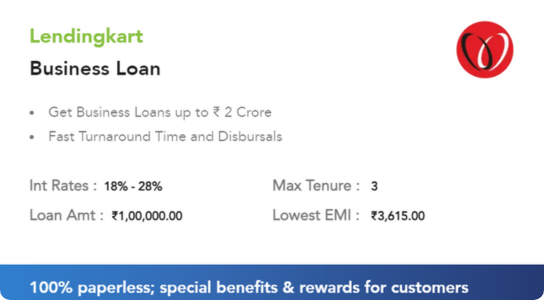

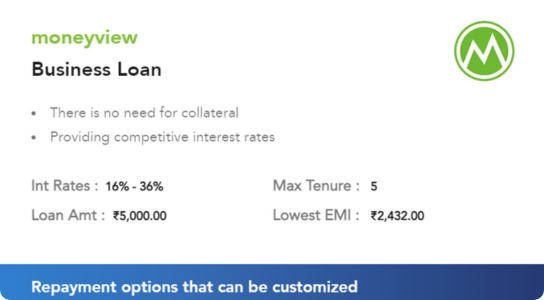

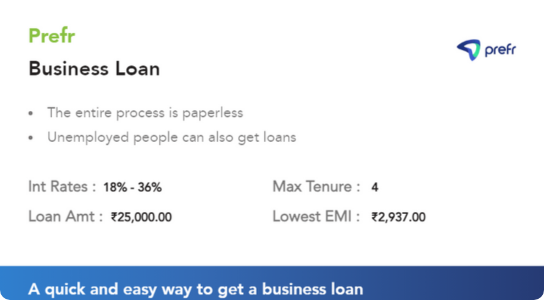

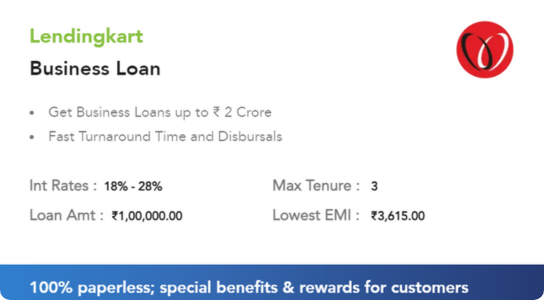

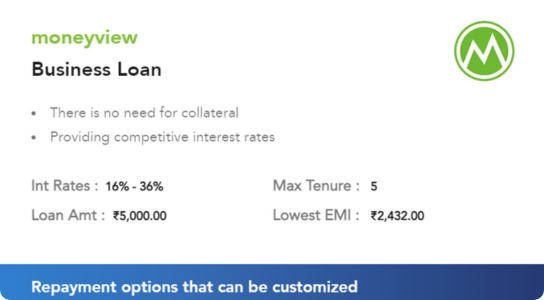

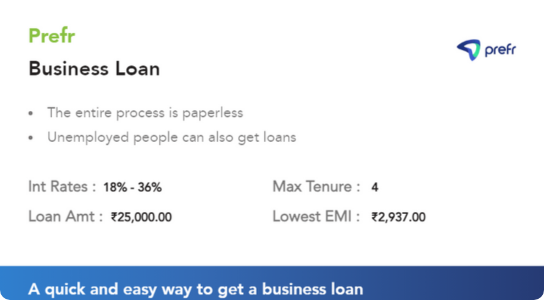

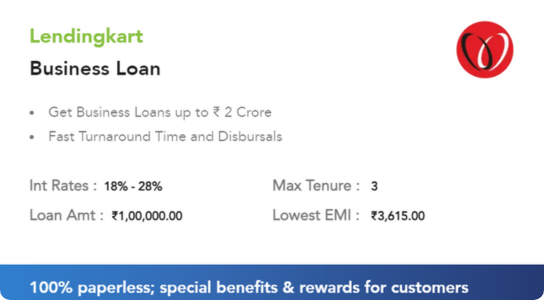

Popular Business Loans

Popular Business Loans

View and improve your

credit score - for free.

✔ Recognise the quality of your score.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

View and improve your

credit score - for free.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

Trending Business Loans

Trending Business Loans

The best offers

from India’s

most

trusted banks

The best offers from India's most

trusted banks

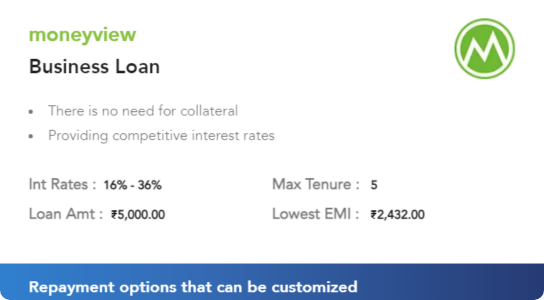

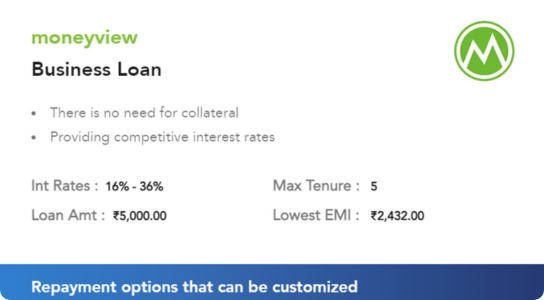

Business Loan Offers

Get a Kotak Mahindra Bank Business Loan up to Rs. 2 crore online with interest rates starting at 16% per annum.

Business Loan Offers

Get a Kotak Mahindra Bank Business Loan up to Rs. 2 crore online with interest rates starting at 16% per annum.

Financial Tools

Financial Tools

Business Growth Loan

Apply for quick business loans of up to 2 crore at competitive interest rates for manufacturing, trading, and services. Special plans are available for female entrepreneurs, new start-ups, and existing small businesses. Use an online calculator to determine your eligibility for a business loan and the applicable interest rate.

Get high business loan eligibility

Before asking for a loan, create a business strategy, know your credit score, determine the loan amount, conduct market research on accessible business loan options, and have the papers ready.

Common documents required

Proof of address and picture identity of promoters, business proof, income proof, partnership deed for a partnership firm, articles of association, memorandum of association, board resolution, PAN card, and so on.

Get high business loan eligibility

Applicants should be between the ages of 21 and 65, with a minimum company vintage of three years. The minimum business turnover and yearly turnover specified in the ITR will be required. For at least the previous year, the business should have been profitable.

Here find the best

personal loan offers

for you!

You’re just a few steps away from getting the best business loan near you. LoansWala representative will contact you with the finest cash loan offer once you submit your contact name, email address, and mobile number.

Popular Business Loans

View and improve your

credit score - for free.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

Trending Business Loans

The best offers from India's most

trusted banks

Business Loan Offers

Get a Kotak Mahindra Bank Business Loan up to Rs. 2 crore online with interest rates starting at 16% per annum.

Financial Tools

From Our Blog

Learn More About Business Loans

| Rate of interest | Competitive interest rates |

| Loan amount | Up to Rs. 500 Crores |

| Repayment tenure | Up to 20 years |

| Processing fee | Up to 3.5% of the loan amount |

| Minimum business vintage | 3 years |

| Prepayment charges | Up to 6% |

| Age required | 21 to 65 years |

| Name of Lender | Rate of Interest (per annum) | Processing Fee | Maximum Loan Limit |

| Bank of Baroda | As per the policy of the bank | As per the policy of the bank | Rs. 200 Crores |

| HDFC Bank | 11.90% – 21.35% | 0.99% – 2.50% | Rs. 50 Lakhs |

| Axis Bank | 9% – 18.50% | Up to 2% + taxes | Rs. 50 Lakhs |

| SBI | Competitive rate linked to EBLR & MCLR | 0% to 1% | Rs. 500 Crores |

| Kotak Mahindra Bank | Competitive interest rates | Up to 2% | Rs. 75 Lakhs |

| ICICI Bank | 10% – 11.10% | Up to 2% + taxes | Rs. 2 Crores |

| IDFC FIRST Bank | Competitive interest rates | Up to 3.5% | Rs. 7 Crores |

- Purpose: To meet the financial needs of a business, such as the purchase of new plant and machinery, the renewal of existing plant and machinery, the construction of infrastructure, and the expansion of business.

- Take your business to a higher level. Additionally, working capital financing will be extended to cover the company’s day-to-day operating costs.

- Loan Amount: Loan limits vary depending on the project for which financing is required.

- Interest Rates: Interest rates vary from lender to lender depending on the loan amount, the project for which the loan is sought, the industry, sector and customer profile.

- Security: security varies by loan amount and industry.

- Normally, no collateral is required for his loans up to Rs 200 crore to the MSME sector.

- The loan is secured by a credit guarantee system.

- Typically, when financing is for working capital, primary security is provided by pledging stocks and bonds.

- A pledge of assets created by a bank loan if the loan is an investment.

- Residential/Commercial Security Required.

- Agricultural assets are not accepted unless the loan is for agricultural and related activities.

- Repayments: working capital loans are short-term loans of 6 to 12 months that renew annually. The repayment period for temporary loans is 3 to 8 years, and up to 20 years for construction of commercial facilities.

- Processing Fee: The Processing Fee also varies depending on the type of activity and line of business, but is typically up to 3. 5% depending on the bank/financial institution.

- Prepayment Fees: Some lenders do not charge prepayment fees, while others charge 0-6% of the outstanding balance.

The types of business loans are as follows.

Working Capital Loan Available to any businessman engaged in the service industry, manufacturing industry, retail industry, wholesale industry, or import/export industry.

This plan is typically selected when a company is experiencing a liquidity shortage due to irregular cash flows and needs funds to cover the company’s ongoing operating costs, or when there is a sudden increase in business volume will be done.Working capital financing can be provided through lines of credit, overdrafts, packaging credits, postal credits, or non-fund-based lines of credit such as bank guarantees and letters of credit.

This is a revolving payment system that you can use whenever you need it. Once the company’s cash flow improves, you can replenish the spent amount with deposits.The biggest advantage of this type of loan is that interest is charged only on the amount used and the period of use.

Interest rates are primarily based on a company’s credit rating. Working capital loans have a term of 6 to 12 months and are renewed after an annual review. The most important collateral for working capital financing is the shares and bonds of the company/company. Collateral may be required through a mortgage or commercial loan. This varies depending on the financial institution and loan amount.

Term Loans These loans are primarily provided for capital investments of a long-term nature. This could include building a factory site, improving infrastructure, or upgrading existing structures. Since the loan amount for this facility is large, it will be repaid in one lump sum. The repayment period will also be longer, from 7 years to 20 years. Interest rates vary depending on the company profile, credit rating, loan amount and term.

The primary collateral is the asset created by the loan, and the collateral is a residential/commercial loan. To apply for this type of loan, you must provide detailed project and procedural rules for the use of the loan amount.

Invoice Financing This is a very advantageous way of arranging financing for your business. The period from invoice issue to final payment may take 60-90 days. During this period, companies may face a liquidity crisis and need funds for day-to-day business operations.

Banks/financial institutions provide financing on such invoices to customers with whom they have a long-term relationship and have availed satisfactory credit facilities. Up to 80% of the invoice amount will be provided as working capital and the remaining 20% will be provided upon receipt of final payment. For invoice financing, fees and interest will apply according to the lender’s guidelines.

Equipment financing is popular in the manufacturing industry. All manufacturing companies require essential equipment to produce their products. This equipment is financed by a bank/financial institution. We can finance office equipment, healthcare equipment, medical equipment, construction equipment, and more. In some cases, the amount raised can exceed 100 million yen. Funding is related to the project. Since the amounts are generally high, the interest rates are very competitive.The repayment period is 3 to 7 years. Assets resulting from a loan carry collateral, and residential and commercial real estate requires collateral on a case-by-case basis.

PMMY

Pradhan Mantri Mudra Yojana was set up to promote entrepreneurship in the MSME sector and create employment for the youth of the country. Loans are provided to both service and production sectors. The loan amount ranges from Rs 50,000 to Rs 10 million depending on the industry.

Stand Up India is set up to facilitate new business creation by candidates belonging to Scheduled Castes/Scheduled Tribes and to encourage women entrepreneurship.Entrepreneurs belonging to Scheduled Castes/Scheduled Tribes or women entrepreneurs must hold majority stake in the enterprise/company to be eligible for funding under this scheme.

The general eligibility criteria for business loans are:

- The age range of the applicant or business founder she must be between 21 and 65 years old.

- Sole traders/partnership companies and sole traders, self-employed persons/professionals engaged in manufacturing, services or trade.

- At least her three fiscal years.

- Minimum business turnover and minimum annual turnover as per ITR is required.

- The level of requirements varies from lender to lender.

- The company must have been profitable for at least one year.

The following are the common documents required for a Business Loan:

- Proof of address of the promoters: Aadhaar Card, Voter’s ID Card, Driving Licence, Utility Bills, etc.

- Photo ID proof of the promoters: PAN Card, Passport, Voter’s ID Card, Driving Licence, etc.

- Proof of business: GST Registration, Trade Licence, Registration under Shop Act, Drug Licence, etc.

- Income proof: Balance Sheet and Profit & Loss Account audited by an Auditor with Auditor’s report.

- Other documents:

- Partnership Deed in the case of Partnership Firm.

- Articles of Association, Memorandum of Association, and Board Resolution as per the format provided by the lender in the case of a Company.

- PAN Card of Partnership Firm/Company.

- National and State Permit if finance is availed for a commercial vehicle.

Business loans involve various types of charges, like documentation charges, cheque dishonour charges, repayment mode swap charges, charges for duplicate NOC, cancellation charges, and so on. Following are three main charges types that are common for each lender:

- Processing charges: Up to 3.5% of the loan amount + GST.

- Foreclosure charges: Up to 6% of the outstanding loan amount.

Delayed payment penalty: 2% onwards over & above the normal rate of interest on the overdue amount for the overdue period.

- Prepare a business charter that details your business plan for the next few years.

- Before approaching a lender, check the creditworthiness of the promoter and the company.

- Determine the amount, as knowing the exact loan amount is also an essential requirement.

- Do a little market research to understand the different options available for business loans in the market.

- Choose the option that suits your needs and also check the loan interest rate and other associated fees.

- Look for a lender that doesn’t require complicated approval processes.

- Research and prepare the required documents before applying for a business loan.

Before approaching a lender, it is critical to understand both the promoters’ and the company’s credit scores. Credit scores reflect your repayment history. If both the company and the promoters have good credit, it will be considerably easier to obtain a business loan.

The eligibility examination for a business loan is based on the following variations:

- The credit score of the company/promoters is required. A good credit score demonstrates the company’s or promoters’ financial discipline, which influences the financing decision.

- The company’s financial statements include the balance sheet and profit and loss account. Financial statements for the previous three years, as well as predicted financial statements for the coming year, will provide a concise overview of the company’s income creation and performance.

- The DSCR represents the company’s repayment capacity. The ideal DSCR ranges between 1 and 1.5.

Yes. Following a specified lock-in time, a part-payment option will be available. However, the lender will determine how many times a part-payment can be made. In addition, part-payment charges ranging from 2% to 4% will be levied on the amount paid.

- Prepare a business charter that details your business plan for the next few years.

- Before approaching a lender, check the creditworthiness of the promoter and the company.

- Determine the amount, as knowing the exact loan amount is also an essential requirement.

- Do a little market research to understand the different options available for business loans in the market.

- Choose the option that suits your needs and also check the loan interest rate and other associated fees.

- Look for a lender that doesn’t require complicated approval processes.

- Research and prepare the required documents before applying for a business loan.

Before approaching a lender, it is critical to understand both the promoters’ and the company’s credit scores. Credit scores reflect your repayment history. If both the company and the promoters have good credit, it will be considerably easier to obtain a business loan.

The eligibility examination for a business loan is based on the following variations:

- The credit score of the company/promoters is required. A good credit score demonstrates the company’s or promoters’ financial discipline, which influences the financing decision.

- The company’s financial statements include the balance sheet and profit and loss account. Financial statements for the previous three years, as well as predicted financial statements for the coming year, will provide a concise overview of the company’s income creation and performance.

- The DSCR represents the company’s repayment capacity. The ideal DSCR ranges between 1 and 1.5.

Yes. Following a specified lock-in time, a part-payment option will be available. However, the lender will determine how many times a part-payment can be made. In addition, part-payment charges ranging from 2% to 4% will be levied on the amount paid.

Business Loans should be paid in Equated Monthly Instalments (EMIs) for which auto-debit instructions have to be given.

Yes. Some banks do provide a dropline overdraft facility against the security of the immovable property.

For working capital financing, repayment will be on demand. It is typically valid for 6 to 12 months, with the option to renew on an annual basis. The payback duration for term loans ranges from three to twenty years, depending on the project for which the funds are borrowed.