Loan Against

Property to fulfil

your dreams

A mortgage or secured loan obtained after pledging real estate as security is known as a loan against property, or LAP. The interest rate is set at 9% per annum. For a maximum of 15 years, you can get LAP up to 80% of the value of the property.

Let's find the best Personal

loan for you

Loan Against

Property Offers

Starting @9% p.a.

You are only a few clicks away from the finest deal on a loan against property. Share your name, mobile number, and email address to receive personalised property loan offers in your area. Compare and select based on your personal needs without any obligation.

Easy approval & sanction

Loans against property are secured loans with simple eligibility requirements. You can apply for high-ticket LAPs for school, business, or personal purposes, and get financing up to Rs. 15 crore with minimal difficulty.

Attractive interest rates

The interest rate on a loan against property begins at 8.90% per year. You get a larger loan amount at a lower EMI. Unlike personal loans, property loans are less expensive and provide greater repayment flexibility with a longer term choice.

Flexible tenure & EMI

A loan against property provides the most liquidity value for your property. You can get financing for up to 15 years. A long-term property loan offers cheaper EMIs and easier payback.

Easy approval & sanction

Loans against property are secured loans with simple eligibility requirements. You can apply for high-ticket LAPs for school, business, or personal purposes, and get financing up to Rs. 15 crore with minimal difficulty.

Attractive interest rates

The interest rate on a loan against property begins at 8.90% per year. You get a larger loan amount at a lower EMI. Unlike personal loans, property loans are less expensive and provide greater repayment flexibility with a longer term choice.

Flexible tenure & EMI

A loan against property provides the most liquidity value for your property. You can get financing for up to 15 years. A long-term property loan offers cheaper EMIs and easier payback.

Popular Loan Against Property

Popular Loan Against Property

View and improve your

credit score - for free.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

View and improve your

credit score - for free.

✔ Recognise the quality of your score.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

The best offers

from India’s

most

trusted banks

The best offers from India's most

trusted banks

Pre-Approved Loan Against Property @9% p.a

Salaried and self-employed individuals can apply for loans against property worth up to Rs. 5 crore both online and offline. The LAP can be utilised for business expansion, long-term working capital, debt consolidation, equipment purchases, medical emergencies, education/marriage of children, vacations, and much more. Higher loan amounts are accessible to a specific group of customers.

Pre-Approved Loan Against Property @9% p.a

Salaried and self-employed individuals can apply for loans against property worth up to Rs. 5 crore both online and offline. The LAP can be utilised for business expansion, long-term working capital, debt consolidation, equipment purchases, medical emergencies, education/marriage of children, vacations, and much more. Higher loan amounts are accessible to a specific group of customers.

Financial Tools

Financial Tools

Related Blogs

Related Blogs

Loan Against Property to fulfil your dreams

A mortgage or secured loan obtained after pledging real estate as security is known as a loan against property, or LAP. The interest rate is set at 9% per annum. For a maximum of 15 years, you can get LAP up to 80% of the value of the property.

Loan Against

Property Offers

Starting @9% p.a.

You are only a few clicks away from the finest deal on a loan against property. Share your name, mobile number, and email address to receive personalised property loan offers in your area. Compare and select based on your personal needs without any obligation.

Easy approval & sanction

Loans against property are secured loans with simple eligibility requirements. You can apply for high-ticket LAPs for school, business, or personal purposes, and get financing up to Rs. 15 crore with minimal difficulty.

Attractive interest rates

The interest rate on a loan against property begins at 8.90% per year. You get a larger loan amount at a lower EMI. Unlike personal loans, property loans are less expensive and provide greater repayment flexibility with a longer term choice.

Flexible tenure & EMI

A loan against property provides the most liquidity value for your property. You can get financing for up to 15 years. A long-term property loan offers cheaper EMIs and easier payback.

Popular Loan Against Property

View and improve your

credit score - for free.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

The best offers from India's most

trusted banks

Pre-Approved Loan Against Property @9% p.a

Salaried and self-employed individuals can apply for loans against property worth up to Rs. 5 crore both online and offline. The LAP can be utilised for business expansion, long-term working capital, debt consolidation, equipment purchases, medical emergencies, education/marriage of children, vacations, and much more. Higher loan amounts are accessible to a specific group of customers.

Financial Tools

From Our Blog

Learn More About Loan against Property

A Loan against Property (LAP) can be obtained against the mortgage of a self-owned property for either personal or business purposes. The property serves as security for the loan supplied by the lender. The margin for a loan against property typically runs between 50 and 90% of the property’s value (also known as LTV or loan-to-value).

- Simple to urge: LAP may be a secured loan making it less demanding for moneylenders to offer cash to the borrower because it is sponsored by collateral.

- Longer residency: More often than not banks endorse a LAP between Rs. 3 Lakhs to Rs. 100 Crores. It is the as it were credit office other than the Lodging Advance that permits banks to stipulate reimbursement period of up to 20 a long time.

- Lower intrigued rate: In comparison to Individual Advances, a LAP advance contains a lower rate of intrigued. The reason is the security advertised to the banks.

- Lower EMI: Once you have longer residency and a lower intrigued rate, the EMIs are bound to be lower.

- Adaptability: Different banks have adaptable advance items in this category, counting term credits, overdraft offices, switch contract, etc.

- Sorts: LAP can have different sorts, such as advance against residential/commercial property, advance against lease receivables, switch contract, and so on.

- Tax benefits: You get benefits charge benefits on the off chance that you profit a advance against property for domestic redesign purposes. More often than not, clients go for domestic remodel credits in case they need to carry out repairs to the same property to be mortgaged to the bank. You might carry out repairs to your domestic but profit a contract loan by selling another property. Beneath such circumstances, you have got to demonstrate that the conclusion utilize of the advance is for carrying out remodels to the property you dwell in.

Each lender has their own eligibility criteria for availing LAP. Below are some common criteria to be eligible for a mortgage loan:

- Age: Minimum 21 years and maximum 65 years.

- Profession: Both self-employed individuals and salaried persons with a regular source of income are eligible for a Loan Against Property.

- Joint applications: Co-applicants are permissible. Lenders can accept the income of the co-applicants for arriving at the eligibility.

- Ownership:

- The applicant should have unencumbered property in their name. The property can be residential, commercial, or industrial.

- Agricultural land is not acceptable as security for the loan.

- Many banks stipulate that the property should either be vacant or self-occupied.

- Some of the banks do not consider a property that is let out on rent or lease to third parties.

- Some lending institutions sanction loan against vacant residential plots

- Margin: The margin requirement for Loan Against Property can be 10% to 50% of the market value of the property.

- Current obligations: The take-home pay norms come into effect. Usually, one should have a take-home pay of 50% after accounting for all the EMIs including the proposed one for the Loan against Property. Hence, it is imperative for the borrowers to declare their current obligations.

- Credit history: The lending banks are members of CIBIL (Credit Information Bureau (India) Limited). They can pull out the records from CIBIL to determine your credit score. Usually, a credit score in the range of 600 and above is acceptable.

- Forthright expenses: Numerous banks take after the method of collecting forthright expenses for handling the application. They alter the expenses with the preparing expense in case they favor the credit. Keep in mind, typically a non-refundable expense. It is ordinarily within the run of Rs. 3,000 to Rs. 5,000.

- Preparing expenses: The customary preparing expenses are within the extend of 0.50-1.00%.

- Valuation charges: Ordinarily, these charges are included within the preparing expenses. But, a few banks charge it as a isolated substance. These charges are payable to the valuation build who decides the esteem of the property and submits the valuation report to the bank.

- Lawful scrutiny charges: Comparative to the valuation charges, a few banks incorporate these charges within the preparing expenses. At times, you’ve got to cause these charges independently. It is payable to the advocate who conducts the legitimate look of the property and submits the Legal Scrutiny Report.

- Contract enrollment charges: A few states in India don’t require the enlistment of the evenhanded contract. It is obligatory in states like Tamil Nadu. You have got to cause these charges (0.5% of the credit sum subject to a most extreme of Rs. 25,000 as stamp obligation and Rs. 5,100 as impartial contract enrollment charges).

- Prepayment charges: A few banks charge prepayment charges to the tune of 2% to 5% of the exceptional advance It depends from bank to bank.

- Protections: Protections of the property to be sold to the bank is obligatory. Too, some banks have tie-ups with protections companies who showcase their items like advance protections, health insurance, and individual mishap scope. These are discretionary charges.

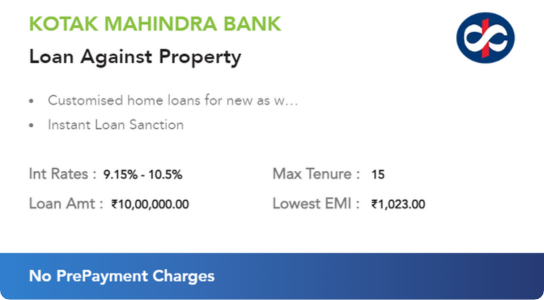

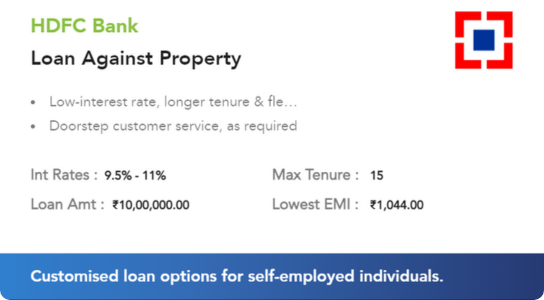

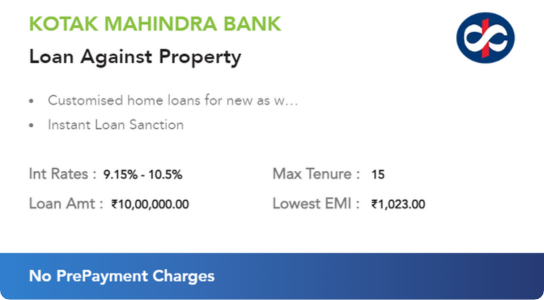

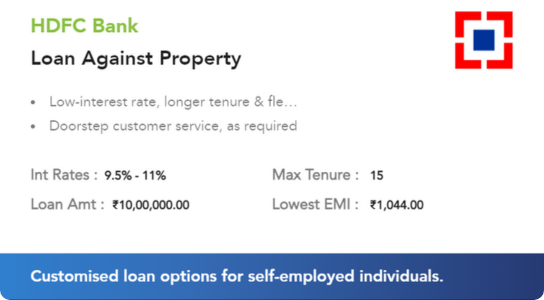

| Bank Name | Interest Rate | Processing Fees |

|---|---|---|

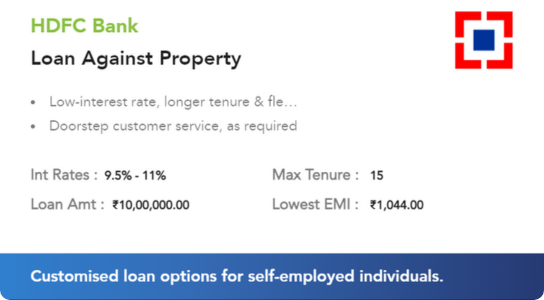

| HDFC Bank | 9.50% – 11.00% | Up to 1.50% of loan amount + taxes |

| IDFC First | 9.00% – 20.00% | Up to 3% of Loan Amount |

| HSBC Bank | 9.75% | 1% of loan amount + GST |

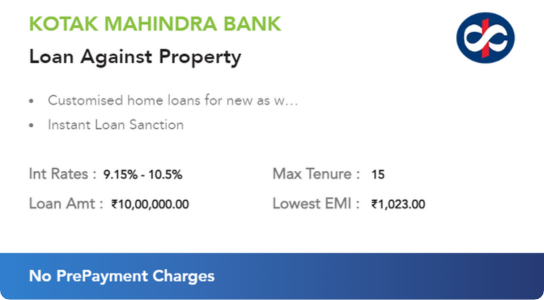

| Kotak Mahindra Bank | 9.15% – 10.50% | 1% of loan amount + GST |

| PNB Housing | 9.25% – 12.45% | 2% of loan amount + GST |

| State Bank of India | 10% – 11.55% | Up to 1% of loan amount |

| Federal Bank | 12.60% | 0.50% of loan amount |

| Home First | 12.80% – 18.50% | Rs 2,500 + GST |

| Bank of India | 11.25% | Up to 0.50% of loan amount |

| Bank of Baroda | 10.85% – 16.50% | Up to 1% of loan amount |

| IDBI Bank | 9.50% – 11.45% | 1% of loan amount |

| Central Bank of India | 13.75% | Up to 1% of loan amount |

| Bank of Maharashtra | 10.95% – 11.95% | 1% of loan amount + GST |

| Jammu & Kashmir Bank | 11.45% | Up to 1% of loan amount + GST |

| South Indian Bank | 13.15% – 14.40% | 1% of loan amount |

| YES Bank | 8.85% | Up to 1% of loan amount + GST |

- Visit the official site of the loan specialist to fill within the online credit application shape or fill it right away through our site.

- On completion of this mortgage credit handle, you’ll be able to select the offer that suits your necessities. You ought to keep your application frame and documents prepared. We have a uncommon group to help you in this respect at no additional taken a toll.

- The loan specialist has the duty of verifying the KYC and salary confirmation reports. The moneylender would like to examine the property and have a discourse with the borrower to get first-hand data around the borrower’s business, business, income, and speculations.

- Banks have advocates on their board to carry out a legitimate rummage around for the last 30 a long time to guarantee the property is free from any encumbrances which the borrower has the clear title to it. It may be a prerequisite for the impartial contract to be substantial and official on the borrower.

- The evaluation of the property is the another step taking after which the banks assess the advance application for the qualification sum.

- On the endorsement of the credit, the bank sends you the endorse letter that you just ought to go through and concur to the terms and conditions. LoansWala helps you in this respect.

- At long last, you have got to execute the evenhanded mortgage and enlist it (if registration is obligatory – It isn’t so in a few states).

- We assist you with the payment prepare as well.

- Conduct thorough market research on the top mortgage loan companies in India.

- Compare the top lenders’ interest rates, fees, features, documentation requirements, eligibility, and other criteria.

- Assess your eligibility, CIBIL score, and payback capacity.

- Choose a reputable lender who can provide the greatest loan against property package that fits your budget.

- Approach the lender and apply for a loan against property.

Types of loan against property can be classified based on the purpose for which you avail the loan.

- Business Expansion Loans: Business entities can avail this facility for acquiring new machinery, purchase of plant, meeting working capital requirements, and invest in new technology or business. The lending banks require collateral in the form of property, residential, commercial, or industrial. Depending on the nature of the property available as collateral, the lending banks calculate the loan eligibility. For commercial properties, the LTV is around 55- 65%. In the case of industrial properties, the LTV reduces to 40-55% whereas the LTV in the case of residential property is in the range of 65-70%.

- Working Capital Overdraft Facility: Banks sanction overdraft facilities against the property for meeting the day-to-day working capital requirements. Under such circumstances, the property is accepted as collateral. Lending banks estimate the amount of finance required based on the following figures:

- Property value and nature of the property

- Actual working capital requirement calculated as per the internal policies of the bank, usually the Projected Annual Turnover method.

- Personal Expenses: Individuals can also avail Loan against the Property for personal expenses such as medical expenses, educational expenses, marriages, travel, as well as for purchasing consumer durables.

- Home Renovation: Usually, people do not avail this loan for renovating homes as there are separate schemes available at comparatively lower LAP interest rates. However, there can be circumstances when the borrower might have to resort to avail a Loan against Property for home renovation.

- Lease Rental Discounting: Some banks offer loans against the future rent receivables, especially in metropolitan and urban areas. One should note that the property that fetches the rent should also be mortgaged in favour of the bank. Banks usually finance in the range of 75% to 90% of the future lease/rent receivables. The tenure of such loans is shorter and should end before the expiry of the lease or the rental

You can use the LoansWala EMI Calculator to determine your Loan Against Property EMI. To perform the EMI calculation, simply open our LAP EMI Calculator and enter the relevant information to obtain the result. Along with the EMI, you will receive a comprehensive chart outlining the breakdown of principal and interest repayment throughout the course of the loan.

| Document Type | Documents Acceptable |

| Identity Proof |

|

| Address Proof |

|

| Income/Financial Documents |

|

| Property Documents |

|

| Other Documents |

|

The nicest feature about a loan against property is that you can prepay it before the end of the repayment period if you choose. According to RBI regulations, if the loan is based on floating mortgage interest rates, no prepayment charges apply. Other lenders may charge prepayment fees ranging from 2% to 5% of the outstanding loan balance. It varies from bank to bank.

There are many different forms of mortgage loans in the sector, including mortgages, commercial mortgages, and industrial mortgages. Every bank has its own product and interest rate. It is laborious to compare the goods offered by several banks.

LoansWala can assist you in this respect. We collect information from multiple sources and present it on a single screen, allowing you to compare a variety of products. It enables you to make an informed decision. We assist you with various areas of the transaction, such as demographics, income, repayment capacity, and so forth.

LoansWala provides access to:

- Select the lowest interest rate from the comparison screen.

- Low processing fees: Banks usually charge processing fees ranging from 0.50 to 1%. Processing fees can account for a substantial portion of your spending due to the large quantity involved.

- LoansWala’s credit team simplifies documentation procedures.

- Loan to Value Ratio (LTV) varies by bank. LoansWala allows you to examine numerous margin rates and select the one that best suits your needs.

- Borrowers often neglect prepayment terms, which are hidden charges. It might range from 2 to 5%. LoansWala allows you to evaluate the prepayment clauses of numerous banks and select the best option.

- Transaction charges: LAP needs an equitable mortgage of property. It can cost you a lot of money, including advocacy fees, evaluation fees, stamp duty on mortgage registration, and so on. Some banks include the advocate and evaluation fees in their processing fee structure, while others charge separately. LoansWala assists you in making this decision and obtaining the best possible deal for you.

LoansWala’s specialists, with over 28 years of expertise in the field of Loan against Property, can assist you in assessing your demographics and personal profile.

- Examine your prior repayment history.

- Understand banker jargon like Legal Scrutiny Report (LSR) and their policies regarding loans against property.

- Read the fine print that many people neglect.

- Industrial properties, including factories, warehouses, and processing units.

- Commercial properties, including malls, complexes, shops, office buildings, and hotel buildings.

- Residential properties, including residential homes, apartments, flats, and individual houses.

- Schools, hospitals, cinema halls and other properties .

- It can also be provided against non-agricultural land.

- LAP is also offered against unbuilt/under construction property if it falls under the list of approved builders of banks/ NBFCs.

ICICI, IDFC Bank, Kotak Bank, HDFC, SBI, Federal bank are some of the banks which are offering great deals on loan against property.

A mortgage loan is a loan provided by banks and other financial institutions against the mortgage of property or other assets for personal as well as business purposes.

You can apply for a mortgage loan through LoansWala, through the lender’s website, visiting the nearest branch of the loan provider or by calling on their customer care number.

A Reverse Mortgage Loan is a credit facility which provides an additional income source to senior citizens of India, who have a self-owned or self-occupied home in India. It is a financial arrangement designed for senior citizens to fulfil their funding needs.

Most lenders a maximum repayment tenure of 15 to 25 years for LAP.

You can get as much as 90% of property’s market value as a loan against your property, depending on your property’s value.

You can get as much as 90% of property’s market value as a loan against your property, depending on your property’s value.

Yes, NRIs as well as PIOs can get LAP in India if they are salaried, work for a reputed organization in selected countries and own a residential/commercial property in India.

A home loan is availed for the purchase/construction/renovation/repair of a residential house property whereas LAP is availed to fulfill any personal or business requirement just like a personal loan.

Individuals with a minimum CIBIL score of 600 or above acain avail LAP.

- Elaborate your income to the lender.

- Maintain a high average monthly balance in your savings bank account.

- Opt for a lower loan-to-value (LTV).

- You can also consider Peer-to-Peer lending alternatives.

- Apply with a co-applicant.

- Fill in the application form and submit it along with the required documents.

- Lenders will verify all the details.

- The property to be mortgaged will be evaluated by the lender.

- After evaluation and your eligibility check, your application will be approved if you are eligible.

- You will receive the loan agreement.

- If you agree with all the terms and sign the document, the loan amount will be transferred to your account within a few days.

Yes. Being a secured loan, your application can be approved with a low credit score as well. You can also co-apply for the loan with your earning spouse or other co-applicants.

Apply for Home Loan

SBI Home Loan

HDFC Home Loan

Bandhan Bank Home Loan

PNB Home Loan

SBI Loan Against Property

LAP without Income Proof and ITR

Home First Loan Against Property

HDFC Loan Against Property

Yes Bank Loan Against Property

Loan Against Property Eligibility

SBI Loan Against Property Eligibility

HDFC Loan Against Property Eligibility

PNB Loan Against Property Eligibility

SBI Bank Loan Against Property Interest Rates

HDFC Loan Against Property Interest Rates

ICICI Loan Against Property Interest Rates

PNB Loan Against Property Interest Rates

SBI Loan Against Property

LAP without Income Proof and ITR

Home First Loan Against Property

HDFC Loan Against Property

Yes Bank Loan Against Property

SBI Bank Loan Against Property Interest Rates

HDFC Loan Against Property Interest Rates

ICICI Loan Against Property Interest Rates

PNB Loan Against Property Interest Rates

Loan Against Property Eligibility

SBI Loan Against Property Eligibility

HDFC Loan Against Property Eligibility

PNB Loan Against Property Eligibility

Apply for Home Loan

SBI Home Loan

HDFC Home Loan

Bandhan Bank Home Loan

PNB Home Loan