Business Loan EMI Calculator

Any type of business requires a steady flow of cash to fund its working capital, day-to-day operations, or facility growth. Some firms can have consistent cash inflows, while others have irregular cash inflows. The majority of businesses borrow money from banks or Non-Banking Financial Companies (NBFCs) in order to continue or expand their operations. The term “Business Loan” refers to money borrowed from financial organisations at acceptable rates.

Calculator Information

The Equipment Finance Calculator calculates the type of repayment required, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate. The Product selected determines the default interest rate for personal loan product. The Equipment Finance Calculator also calculates the time saved to pay off the loan and the amount of interest saved based on an additional input from the customer. This is if repayments are increased by the entered amount of extra contribution per repayment period. This feature is only enabled for the products that support an extra repayment. The calculations are done at the repayment frequency entered, in respect of the original loan parameters entered, namely amount, annual interest rate and term in years.Calculator Assumptions

Length of Month

All months are assumed to be of equal length. In reality, many loans accrue on a daily basis leading to a varying number of days interest dependent on the number of days in the particular month.Number of Weeks or Fortnights in a Year

One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.Rounding of Amount of Each Repayment

In practice, repayments are rounded to at least the nearer cent. However the calculator uses the unrounded repayment to derive the amount of interest payable at points along the graph and in total over the full term of the loan. This assumption allows for a smooth graph and equal repayment amounts. Note that the final repayment after the increase in repayment amount.Rounding of Time Saved

The time saved is presented as a number of years and months, fortnights or weeks, based on the repayment frequency selected. It assumes the potential partial last repayment when calculating the savings.Amount of Interest Saved

This amount can only be approximated from the amount of time saved and based on the original loan details.Calculator Disclaimer

The results from this calculator should be used as an indication only. Results do not represent either quotes or pre-qualifications for the product. Individual institutions apply different formulas. Information such as interest rates quoted and default figures used in the assumptions are subject to change.

Feel free to use our Equipment Finance Calculator

Sorry

This video does not exist.

| Period | Payment | Interest | Balance |

|---|

Calculator Disclaimer

The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.

Table of Contents

ToggleWhat is a business loan EMI calculator?

The Business Loan EMI Calculator is a mathematical computation that indicates how much a borrower must pay the lender each month for their Business Loan. For example: Assume you borrowed $1,000,000 for a two-year period at a 14% annual interest rate. The Business Loan EMI Calculator will show the EMI as 4,801.29. So, until the conclusion of the 24-month term, the borrower must pay 4,801.29*24 = 1,15,230 plus any necessary loan processing fees.

The Business Loan EMI calculator is based on the following formula:

Now the calculation for the EMI of this will be: EMI = P x R x (1+R)^N]/[(1+R)^N-1]

Where

- P = is the amount borrowed,

- R = is the interest rate per month (a 14% per annum interest translates to (14/12) % per month), and

- N = is the number of monthly installments.

Benefits of using the EMI calculator

Using an EMI calculator for a business loan EMI Calculator or Commercial Loan The EMI calculator has various benefits:

- Accuracy: EMI calculators do exact calculations. This accuracy is critical for financial planning, as it ensures that you know exactly how much money you need to set aside each month for loan repayment.

Time-Saving: Manual EMI calculations can be time-consuming and complicated, particularly if you are unfamiliar with the formula. An EMI calculator makes this procedure easier, providing results instantaneously. - Simple Comparisons: You can simply adjust variables such as loan amount, interest rate, and tenure to compare different loan scenarios. This allows you to make more educated selections regarding which loan offer is appropriate for your circumstances.

- Budget Planning: Knowing your monthly EMI in advance helps you plan your budget more effectively. You can evaluate how the loan repayment fits into your overall financial strategy and modify other spending accordingly.

- Understanding Interest Impact: EMI calculators can help you understand the impact of interest rates on your loan. You can examine how different interest rates effect your monthly payments.

- Flexibility: Experiment with different loan amounts, tenures, and interest rates to find the optimal payback schedule for your financial circumstances.

- Informed Decision-Making: By offering a comprehensive image of your future financial commitments, EMI calculators help you make smarter decisions about loan borrowing and repayment options.

- Convenience: EMI calculators are easily accessible online, allowing you to make calculations at any time without the need for specialised equipment or financial knowledge.

How to use the business loan EMI calculator for monthly EMIs

To effectively use a Business Loan EMI Calculator for calculating monthly EMIs, you must first understand the method and the required inputs. This tool makes it easier to calculate your monthly financial responsibilities for a business loan. Here are the steps to use an EMI calculator for business loans:

- Input Loan Amount:Enter the total amount of loan you wish to borrow.

- Interest Rate Input:Input the annual interest rate charged by the lender.

- Loan Tenure: Specify the duration over which you plan to repay the loan, typically in months or years.

- Calculate EMI:The calculator uses the formula

- EMI:[P x R x (1+R)^N]/[(1+R)^N-1]

where P is the loan amount, r is the monthly interest rate, and n is the number of installments, to compute the monthly EMI.

How to calculate EMI for business loan?

Calculating the business loan EMI involves a specific formula. Here’s how you can do it: EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

where,

- P = Loan amount

- R = Monthly interest rate

- N = Tenure of the loan in months

Steps to Calculate Business Loan EMI

Determine the Loan Amount (P): This is the total amount you wish to borrow.

Calculate the Monthly Interest Rate (r):

- The interest rate provided by lenders is usually an annual rate.

- Convert it to a monthly rate by dividing it by 12.

- Convert the percentage to a decimal for calculation purposes (e.g., 12% becomes 0.12 and then divide by 12).

Determine the Tenure in Months (n):

- If the tenure is given in years, convert it to months (1 year = 12 months).

Apply the Formula:

- Substitute the values of P, R, and N into the formula.

- Perform the calculation to find the EMI.

Example of a business loan EMI calculation

For instance, if you have a loan amount of ₹500,000 at an annual interest rate of 12% for a tenure of 5 years (60 months), the EMI can be calculated as follows:

- Monthly interest rate = 12% / 12 = 1% or 0.01

- Number of installments (n) = 60

According to the EMI calculation formula EMI = [P x R x (1+R)^N]/[(1+R)^N-1], the required business loan EMI will be Rs. 11,122.

Why do you need to calculate EMI for business loans?

Businesses revolve around unpredictability, and there is no guarantee of consistent cash flows. A customer may pay their bills in a single day or over a period of months. As a result, a business owner must have a comprehensive understanding of their fixed expenses in order to devise an effective strategy for repaying loans. Calculating the EMI in advance allows one to estimate one’s payback capability and choose the loan amount and tenure that best suits one’s financial situation.

The factors that affect the EMI on a business loan

Several factors have a substantial impact on the EMI for a business loan, mostly because they affect the interest rate imposed by lenders. Understanding these elements can help firms better predict their loan costs.

- Nature of Business: The sort of business has a significant impact on loan conditions. Lenders examine the nature of the business, determining if it is profitable or losing money, and whether its operations fall into any high-risk areas. Businesses that are considered steady and lucrative frequently receive more favourable interest rates, resulting in reduced EMIs.

- CIBIL Score: The CIBIL score, a crucial indicator of creditworthiness, has a considerable impact on borrowing rates. values vary from 300 to 900, with values above 750 being considered healthy. A better CIBIL score can result in lower interest rates, which reduces the EMI, but a lower score can result in higher rates or possibly loan refusal.

- Business Experience: Established enterprises are frequently viewed as less risky, resulting in reduced financing rates. New or less established enterprises may experience higher rates due to perceived increased risk of default or nonpayment. This experience also influences the kind of credit packages offered to a business.

- Lenders analyse a company’s annual turnover when determining interest rates. A high turnover rate can indicate financial health and stability, potentially resulting in reduced interest rates and EMIs. Conversely, lesser turnover may result in higher interest rates.

- Revenue and Profit: Lenders examine monthly, quarterly, and annual revenue numbers. These numbers allow them to analyse the company’s ability to repay the loan. Poor revenue performance may result in higher interest rates.

- Payback History: A company’s previous loan payback history is an important element. A solid repayment history can lead to lower interest rates, whereas a poor track record can result in higher rates, regardless of credit score.

- Good relationships with financial institutions can be advantageous. Long-term, dependable customers may be provided lower interest rates because of their established track record with the lender.

In summary, the EMI for a business loan is determined by a number of factors including the company’s financial health, credit history, and relationship with lenders. Understanding these characteristics might help firms obtain better loan conditions and manage their debts more effectively.

Amortization Table

| Year | Opening Balance | Amount paid by customer (EMI*12) | Interest paid during the year | Principal paid during the year | Closing Balance |

|---|---|---|---|---|---|

| 1 | ₹4000000 | ₹8597560 | ₹3294528 | ₹5303032 | ₹34696968 |

| 2 | ₹34696968 | ₹10317072 | ₹3312446 | ₹7004626 | ₹27692341 |

| 3 | ₹27692341 | ₹10317072 | ₹2540512 | ₹7776560 | ₹19915781 |

| 4 | ₹4756944 | ₹10317072 | ₹1683508 | ₹8633564 | ₹11282217 |

| 5 | ₹11282217 | ₹10317072 | ₹732059 | ₹9585013 | ₹1697204 |

| 6 | ₹1697204 | ₹1719512 | ₹22308 | ₹1697204 | 0 |

| Year | Opening Balance | Interest paid during the year | Closing Balance |

|---|---|---|---|

| 1 | ₹4000000 | ₹3294528 | ₹34696968 |

| 2 | ₹34696968 | ₹3312446 | ₹27692341 |

| 3 | ₹27692341 | ₹2540512 | ₹19915781 |

| 4 | ₹19915781 | ₹1683508 | ₹11282217 |

| 5 | ₹11282217 | ₹732059 | ₹1697204 |

| 6 | ₹1697204 | ₹22308 | ₹0 |

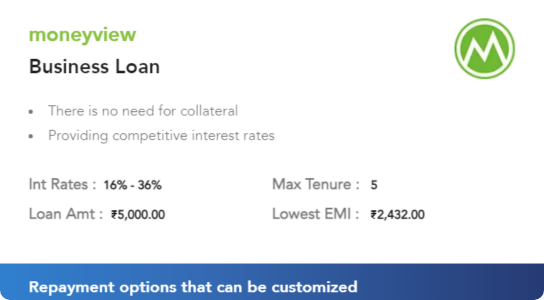

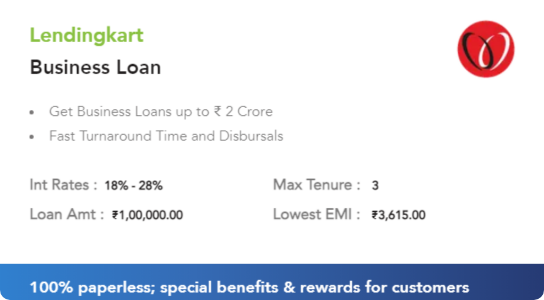

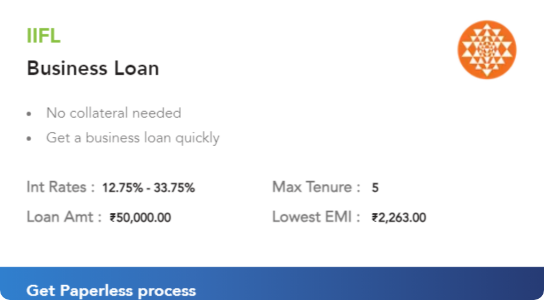

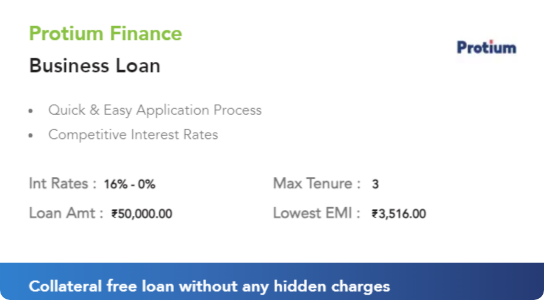

Best Deals

From Our Blog

Business Loan EMI Calculator FAQs

Calculating the EMI for a company loan before to taking it out is critical for various reasons:

- Budgeting: It aids in financial planning and budgeting, ensuring that loan repayments are reasonable.

- Loan Comparison: This feature allows you to evaluate several loan offers and select the most cost-effective choice.

- Cash Flow Management: Helps manage cash flow successfully by understanding future financial commitments.

To utilise a Business Loan EMI Calculator, you normally require:

- Loan Amount (Principal): The total amount of money you want to borrow.

- Interest Rate: The annual interest rate on the loan.

- Loan Tenure: The time period over which you intend to repay the loan, typically measured in months or years.

A Business Loan The EMI Calculator is an online application that calculates the EMI for a business loan. This calculator makes calculating the monthly loan payment easier by allowing you to enter the principal amount, interest rate, and loan tenure.

You can calculate the EMI of your Business Loan through the “Business Loan EMI Calculator” available on our website. You can also use a combination of the loan amount, tenure, the interest rate to know the EMI online quickly.

The EMI calculator helps you to know how much interest you are expected to pay with respect to your loan tenure. The longer the loan tenure, more the interest rates one will have to pay for the same.

To ensure payment consistency, it is highly advised that the EMI be calculated in advance. When you take out a loan, you assure the bank that you will pay back the agreed-upon amount each month. As a result, before taking out a loan, one should carefully manage their finances, taking into account their monthly spending, income, and other aspects to minimise payment inconsistencies.

LoansWala calculator calculates different banks’ EMIs based on the information you submit. You can also evaluate other banks based on their interest rates and EMI options and select the best one.

If we take the rate of interest at 12% for a tenure of 5 yrs (60 months) then the business loan EMI will be Rs. 1,11,222.

Bank of Baroda Business Loan

Bank of India Business Loan

Deutsche Bank Business Loan

Federal Bank Business Loan

HDFC Bank Business Loan

IDFC First Bank Business Loan

Indian Bank Business Loan

Kotak Mahindra Bank Business Loan

RBL Bank Business Loan

SBI Business Loan

Yes Bank Business Loan

CGTMSE Scheme

PMEGP Loan

PSB Loans in 59 Minutes

Saksham Yuva Yojana

SBI E Mudra Loan

Mudra Loan

Documents Required for Mudra Loans

Mudra Loan Eligibility

Aditya Birla Capital Business Loan

Bajaj Finserv Business Loan

Faircent Business Loan

SMFG India Business Loan

IIFL Finance Business Loan

KreditBee Business Loan

Lendingkart Business Loan

Moneyview Business Loan

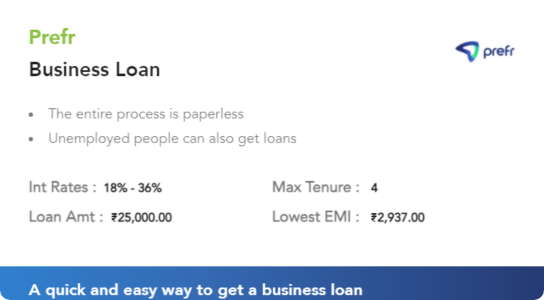

Prefr Credit Business Loan

Protium Finance Business Loan

Tata Capital Business Loan

Ziploan Business Loan

Business Loan Documents Required

Business Loan Eligibility

Business Loan EMI Calculator

Business Loan Interest Rates

Business Loans for Women

MSME Loan

Startup Business Loan

Unsecured Business Loans

Working Capital Loan