Personal Loan for a

Better Future.

Personal loans are suitable for funding higher education, business expansion, home improvements, weddings, travel, medical bills, and other needs. Navi presently offers the lowest personal loan interest rates, starting at 10.50%, with a fixed processing charge of 3.99%. Get immediate approval for inexpensive personal loans of up to 50 lakh for 5 years without pledging collateral or requiring a guarantor.

Let's find the best Personal

loan for you

Here find the best

personal loan offers

for you!

You are only a few steps away from receiving the greatest Personal loan offer in your area. As soon as you provide your contact information (name, email, and phone number), a LoansWala representative will call you with the greatest cash loan offer available.

Online Application

Compare personal loan options from over 100 lending partners and apply online in just a few minutes.

Check Eligibility

Personal Loan EMI Calculator will help you determine your eligibility for a personal loan.

Instant Disbursal

Upon successful approval, the loan amount will be disbursed directly to your account immediately.

Online Application

Compare personal loan options from over 100 lending partners and apply online in just a few minutes.

Check Eligibility

Personal Loan EMI Calculator will help you determine your eligibility for a personal loan.

Instant Disbursal

Upon successful approval, the loan amount will be disbursed directly to your account immediately.

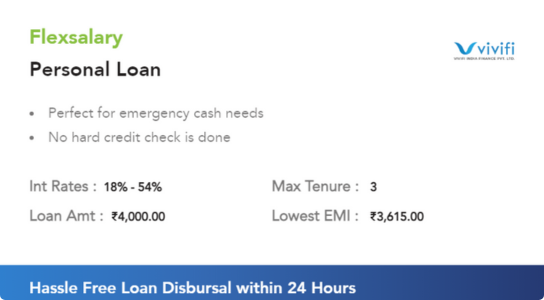

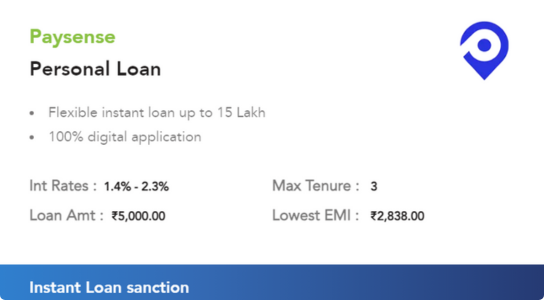

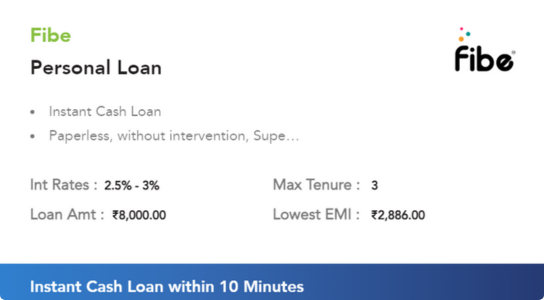

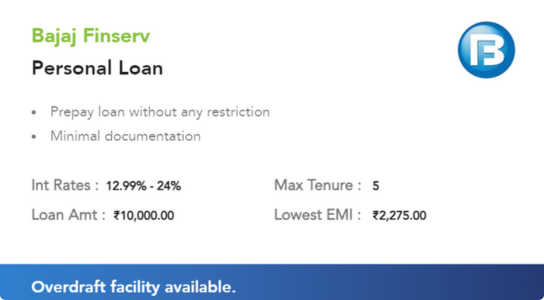

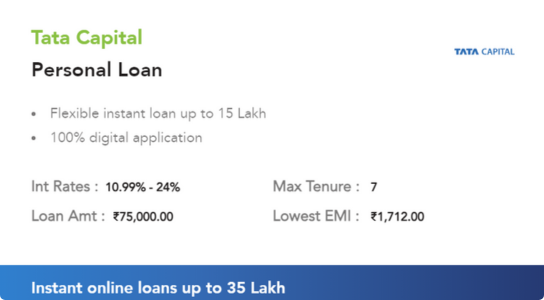

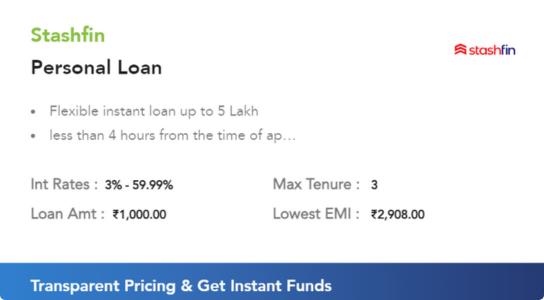

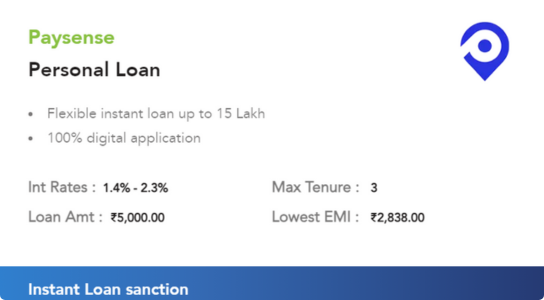

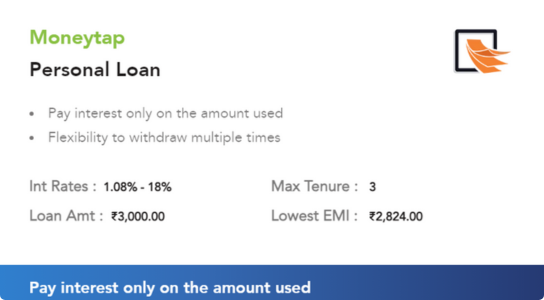

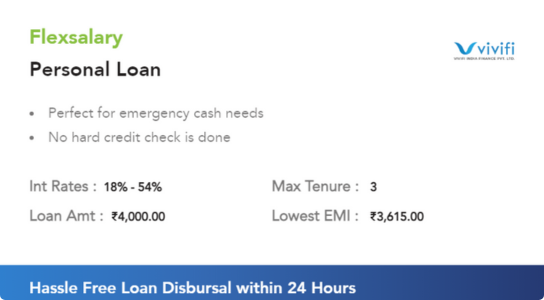

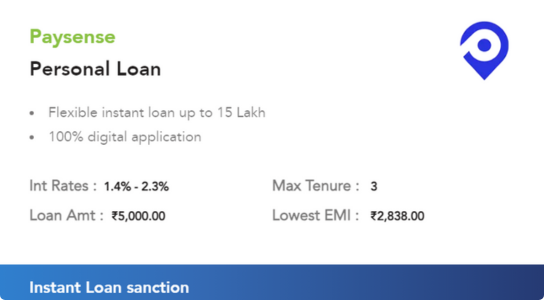

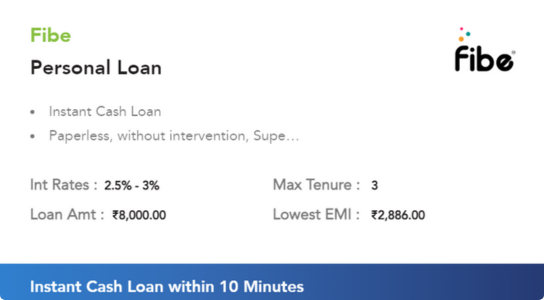

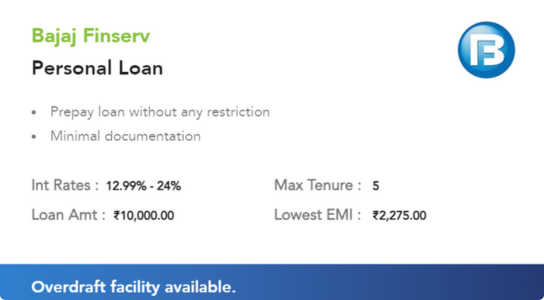

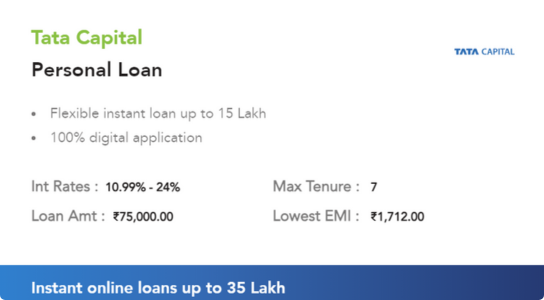

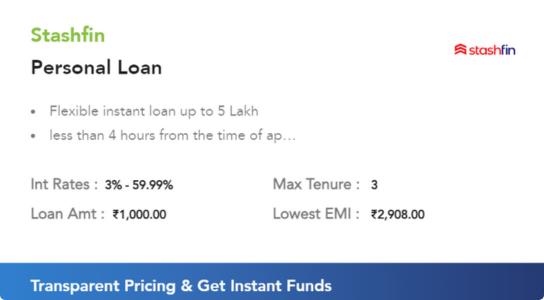

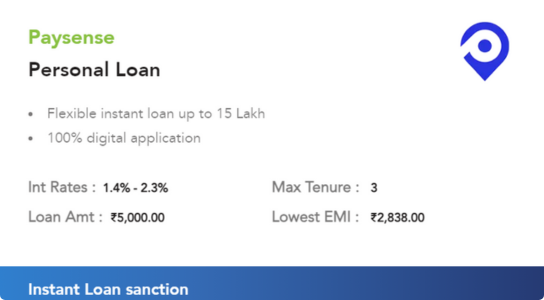

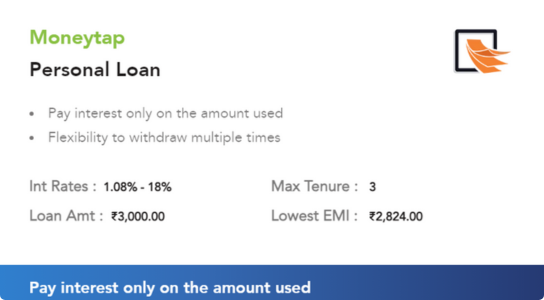

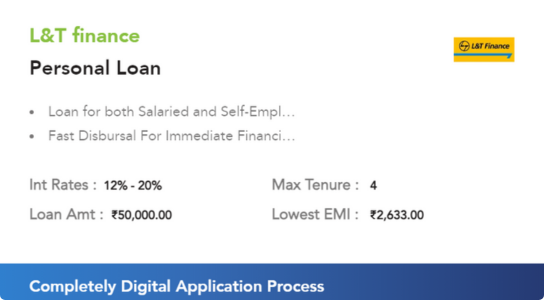

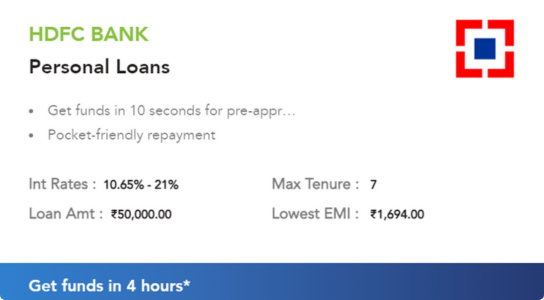

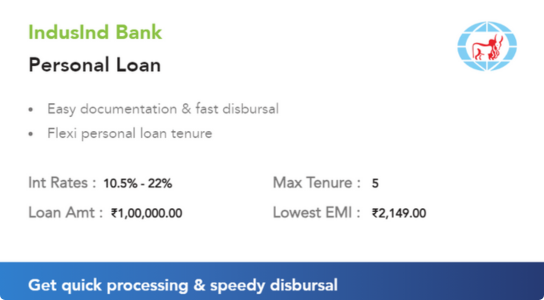

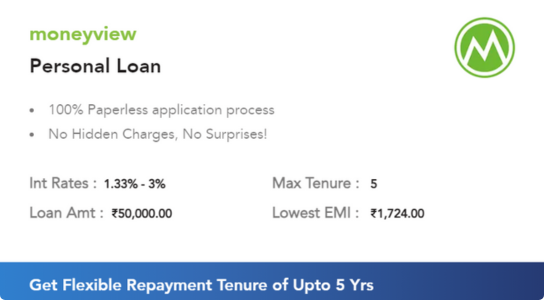

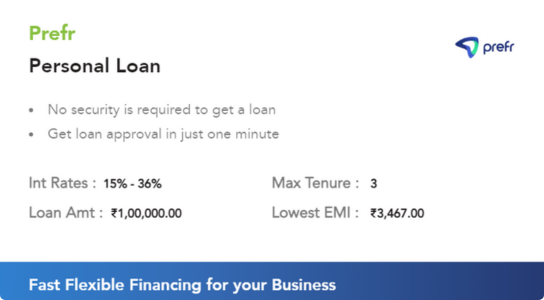

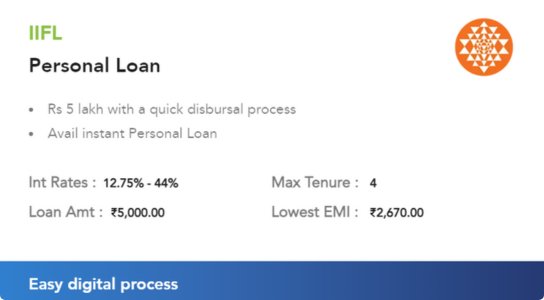

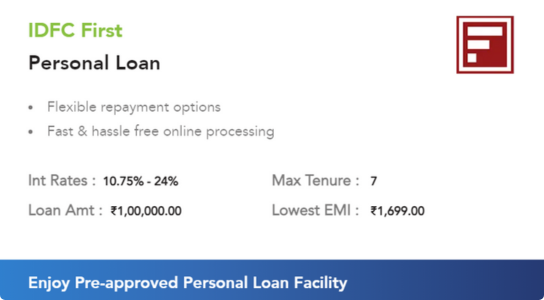

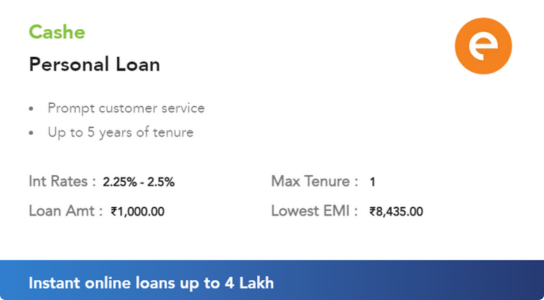

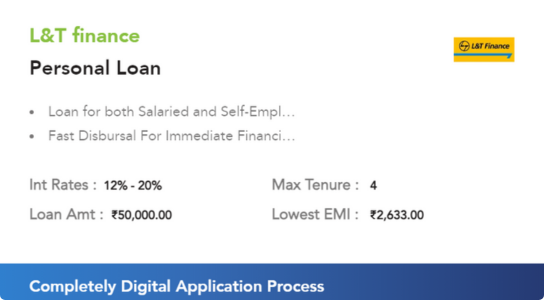

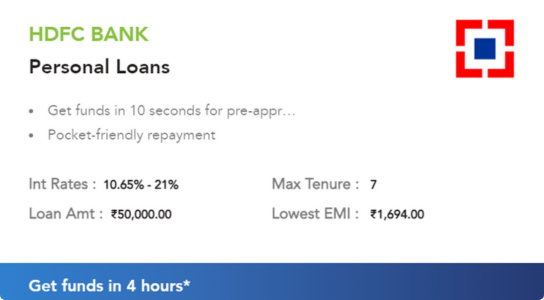

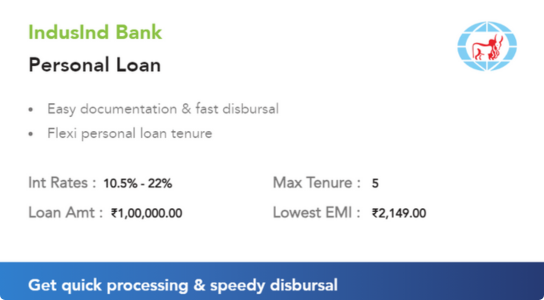

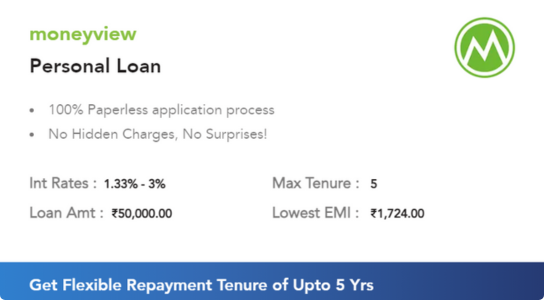

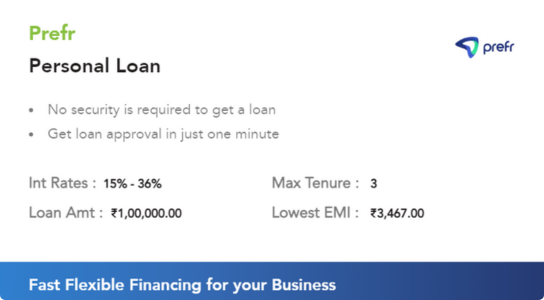

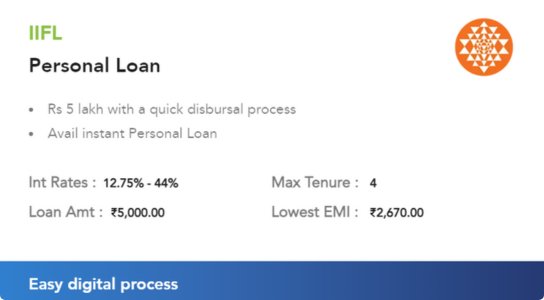

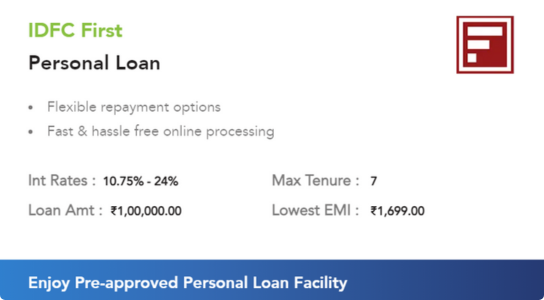

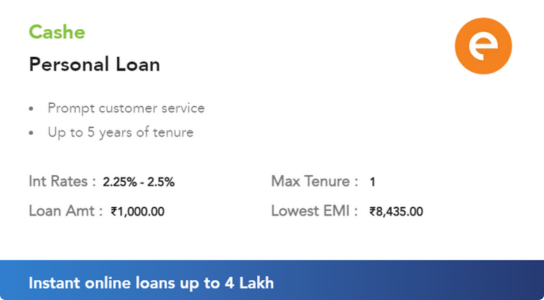

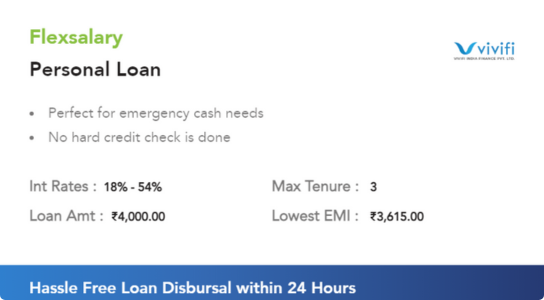

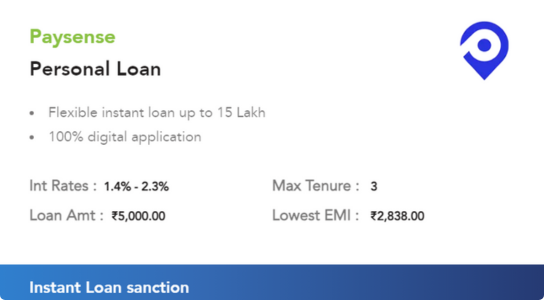

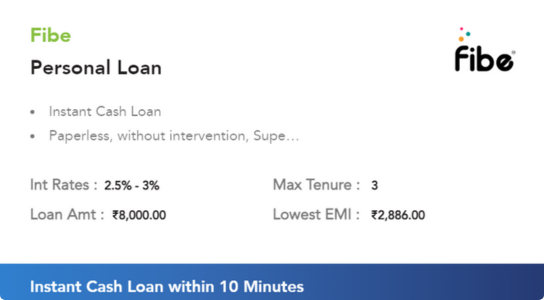

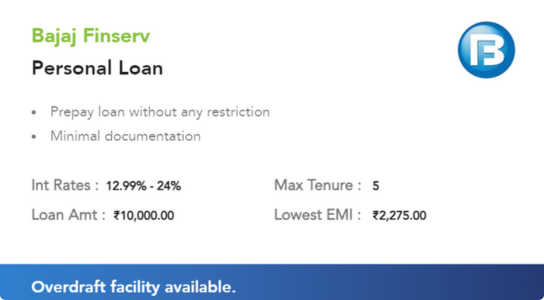

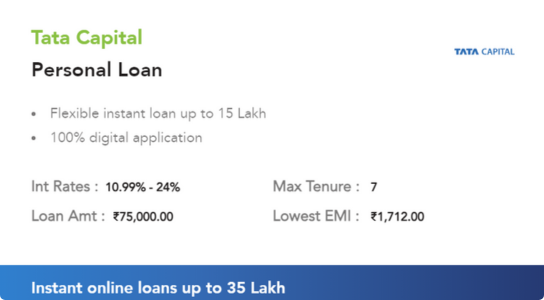

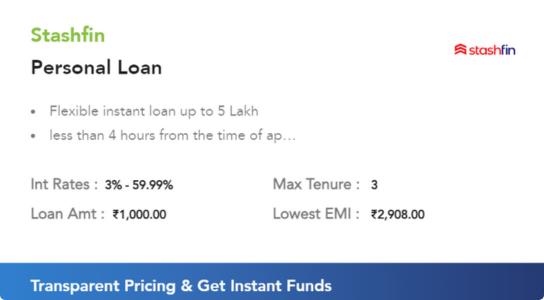

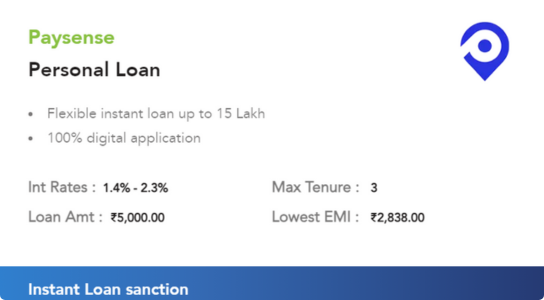

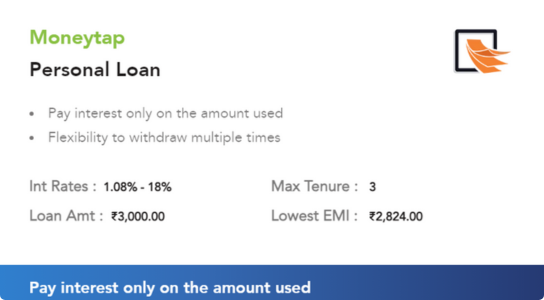

Personal Loan Offers

Personal Loan Offers

View and improve your

credit score - for free.

✔ Recognise the quality of your score.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

View and improve your

credit score - for free.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

Trending Loan Offers

Trending Loan Offers

The best offers

from India’s

most

trusted banks

The best offers from India's most

trusted banks

Apply Best Personal Loans offer beginning at 10.50%.

Get an IDFC First Bank personal loan ranging from Rs. 50000 to Rs. 40 Lakhs (Rs. 75 Lakhs as per eligibility standards) at the lowest interest rate of just 10.50% per annum, with a processing charge of 0.5% to 2.50% of the sanctioned limit + GST.

Apply Best Personal Loans offer beginning at 10.50%.

Get an IDFC First Bank personal loan ranging from Rs. 50000 to Rs. 40 Lakhs (Rs. 75 Lakhs as per eligibility standards) at the lowest interest rate of just 10.50% per annum, with a processing charge of 0.5% to 2.50% of the sanctioned limit + GST.

Financial Tools

Financial Tools

From Our Blog

From Our Blog

Personal Loan for a Better Future.

Personal loans are suitable for funding higher education, business expansion, home improvements, weddings, travel, medical bills, and other needs. Navi presently offers the lowest personal loan interest rates, starting at 10.50%, with a fixed processing charge of 3.99%. Get immediate approval for inexpensive personal loans of up to 50 lakh for 5 years without pledging collateral or requiring a guarantor.

Online Application

Compare personal loan options from over 100 lending partners and apply online in just a few minutes.

Check Eligibility

Personal Loan EMI Calculator will help you determine your eligibility for a personal loan.

Instant Disbursal

Upon successful approval, the loan amount will be disbursed directly to your account immediately.

Here find the best

personal loan offers

for you!

You are only a few steps away from receiving the greatest Personal loan offer in your area. As soon as you provide your contact information (name, email, and phone number), a LoansWala representative will call you with the greatest cash loan offer available.

Personal Loan Offers

View and improve your

credit score - for free.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

The best offers from India's most

trusted banks

Apply Best Personal Loans offer beginning at 10.50%.

Get an IDFC First Bank personal loan ranging from Rs. 50000 to Rs. 40 Lakhs (Rs. 75 Lakhs as per eligibility standards) at the lowest interest rate of just 10.50% per annum, with a processing charge of 0.5% to 2.50% of the sanctioned limit + GST.

Financial Tools

From Our Blog

Learn More About Personal Loans

- Current lowest personal loan interest rates start at 10.50% per year.

- Compare 100+ personal loan banks at LoansWala and select the best one.

- Check the fees and charges of all of India’s biggest banks that offer personal loans.

- Get a flexible repayment period ranging from 36 to 84 months.

- Submit an online loan application and receive immediate loan approval.

- Personal loans can be used for a variety of personal purposes, such as marriage, education, medical emergencies, shopping, and travel.

- Personal loans are unsecured, thus no collateral or security is required.

- You can obtain a personal loan using the top instant loan app in India or from online lending marketplaces.

A personal loan is the greatest way to gain access to finances in an emergency. Once you have met the appropriate Personal Eligibility Criteria, you can use this simple, unsecured loan to cover any need, such as a medical emergency, travel expenses, education fees, and more.

- Travel Loans: These personal loan programs are aimed at people who love to travel. This loan goes by many different names, including travel loans, vacation loans, and holiday loans. You can travel around the world with this loan and pay your bills with affordable EMIs. As an added benefit, you can also purchase travel insurance with this loan.

- Wedding Loan: Her wedding in India comes with a long list of expenses. It’s a unique experience for everyone, and many often need financial support to make it more memorable. For this reason, many lenders have started offering personal loans for weddings. These loans can be used by brides and grooms or their families to pay for wedding-related expenses such as venue reservations, catering, and honeymoon travel.

- Festival Credits: These credits are given to celebrate festivals, parties, and events. Festival Lawn helps you prepare for celebrations and hosting parties.

- Consumer Durable Loan: As the name suggests, this personal loan option is used to purchase appliances and durable goods.

- Retirement Loan: The Retirement Loan is available to retired employees to meet financial needs such as paying medical bills and daily expenses. In the case of pension loans, banks lend pensioners several times the pension received in the previous months before submitting the loan application.

- Home Improvement Loans: These loans are provided for renovation and repair purposes, purchasing new materials, and other home-related expenses.

- Education Loans:These loans can be used to pay for major educational expenses, such as your child’s college tuition or studying abroad.

- Computer and Mobile Phone Loans: Nowadays, many financiers are offering computer loans and mobile phone loans for the purchase of computers, laptops, and smartphones. Some lenders offer insurance on loans.

- Interest rates: personal loan interest rates start from 10.50% vary depending on credit score, income, etc.

- Loan Amount: You can get a loan from as low as 20,000 to 1 Rupee online. Depending on your needs and suitability.

- Loan Term: Personal Loans are available with terms starting from 12 months. The average term for a personal loan is 12 to 60 months, depending on the loan amount.

- Security: No collateral required as it is unsecured.

- Loan Processing Times: Personal Loan processing times are typically the fastest in the industry.

- Many banks approve online personal loans within 48 hours of submitting your online application.

- Fee: This varies by each bank. As a general rule, it is 3.5% of the loan amount.

- Prepayment Penalty: Banks charge a prepayment penalty if you repay your personal loan before the specified period. Fees range from 1% to 2% of the balance at the time of transaction completion.

| Name of the Bank | Interest Rate | EMI Payable Per year/ lakh | Processing Fees |

| Bank of Baroda | 10.10% | Rs.8815 | 2% of the loan amount |

| Bank of India | 10.25% | Rs.8789 | 2% of loan amount subject to a maximum of Rs.10000 |

| IDBI Bank Limited | 9.50-14% | Rs.8768 | 1% of loan amount subject to a maximum of Rs.2500 |

| PNB | 11.40% | Rs.8743 | 1% of the loan amount. |

| State Bank of India | 11.15% | Rs.8773 | Up to 1.5% of loan amount subject to a maximum of Rs.15000 |

| Union Bank of India | 9.30% – 13.40% | Rs.8741 | 0.50% of the loan amount |

| ICICI Bank | 10.75% -19% | Rs.8815 | Up to 2.25% of the loan amount |

| IndusInd Bank Ltd | 10.5% onwards | Rs.8838 | Up to 3% of the loan amount |

| IDFC First bank | 10.75% | Rs.8908 | Up to 2% of the loan amount |

| Kotak Mahindra Bank | 10.50% | Rs.8827 | Up to 2.5% of the loan amount |

| RBL Bank | 14%-23% | Rs.8979 | 4% of the loan amount |

- Click the Compare and Apply option.

- Fill out the required information in the registration form.

- Get the latest personal loan offers and choose from them.

- Apply for the credit plan of your choice.

- Fill out a quick form online.

- Submit the required personal loan documentation.

- A bank representative will contact you once your application form is received.

| Occupation | Salaried employees, self-employed professionals, self-employed non professionals, and business owners |

| Age | Minimum 21 years at loan application and maximum 60 years at loan maturity |

| Monthly income | 20,000 |

| Job/business continuity | 2 years continuous job or 3 years continuity in business |

| ITR | Last 2 years IT returns |

| Credit score | 700 & above |

- Credit Score: This is the most important approval factor. A credit score of 700 or above is usually considered a good score for a personal loan. The higher your credit score, the more likely you are to get a loan online.

- Income: 4,444 People with higher incomes are more likely to qualify for larger loans than those with lower incomes.

- Employment: Employees of listed companies, central government, state government and public sector are entitled to higher amounts.

- Job Continuity: Must be a long-term employee with your current organization. If you are self-employed, continuity of business and income is paramount.

- Borrower’s age: The minimum age is he is 21 years old. Banks have criteria for setting upper age limits. In most cases, the age at the end of the repayment period should not exceed 65 years.

- Loan Amount: Applying for a loan amount that you can afford is more suitable for your personal loan and more likely to be approved.

| KYC Documents |

|

| Income Documents – Salaried |

|

| Income Documents – Self-employed |

|

| Other Documents |

|

- Keep your credit score high: Your credit score represents your creditworthiness based on your past repayment history. Try to pay off your existing debts on time and regularly.

- Pay off your existing loan before applying for a new one. This will improve your credit score.

- To qualify for a personal loan, you need good credit (preferably 700 or above).

- Compare all offers before applying: Before applying for a loan, be sure to compare the interest rates, eligibility, and other features of all available personal loan options.

- This will give you access to the best personal loans with the lowest interest rates.

- Assess the total cost: Make sure you’ve evaluated the full cost of your personal loan, including interest, processing fees, upfront fees, etc., before closing the deal.

- Analyze your needs: Do not use personal loans for the following purposes: To make your wishes come true.

- Remember, all you have to pay back is the loan plus interest.

- Consider taking out a personal loan based on your needs rather than your wants.

- Assess your ability to repay: Before taking out a loan, assess how much you can repay.

- Make sure you have enough income to repay the EMIs every month for several years without incurring any financial burden.

- Don’t be fooled by fake offers: Gold isn’t all that glitters.

- Someone online may offer to give you a concession on the interest rate on your loan, but may trick you into other additional charges to make your instant loan more expensive.

- Avoid taking out personal loans for business purposes.

- Pay off your personal loans on time to avoid problems with your CIBIL score.

- Apply for a personal loan only if you have no other means of financing.

- Apply only for the loan amount you need immediately.

You may consider applying for a personal loan for a family wedding, educational fees, a vacation abroad, debt consolidation, house renovations, or any other reason.

| Occupation | Salaried employees, self-employed professionals, self-employed non professionals, and business owners |

| Age | Minimum 21 years at loan application and maximum 65 years at loan maturity |

| Monthly income | 20,000 |

| Job/business continuity | 2 years continuous job or 3 years continuity in business |

| ITR | Last 2 years IT returns |

| Credit score | 700 & above |

Pre-approved personal loans are fast loans provided by banks to select customers. These loans require minimal documentation and have no collateral or security.

Covid-19 personal loans were offered to help with covid-related financial difficulties until July 31, 2020. Many banks issued these loans. Unfortunately, they are no longer accessible in India.

- You may have several outstanding loans. One solution is to bring in a co-borrower. Your working spouse may join as a co-borrower. You might also try to lower your current liabilities by closing some loans.

- You may have a bad credit score. Check and thoroughly review your credit report. There could be mistakes in your report. If required, dispute them and take actions to correct your credit record. Remember that a Personal Loan requires a minimum credit score of 650 to 700.

- Foreclosure occurs when a borrower wishes to pay off all outstanding principal before the loan term ends. Part-prepayment occurs when the consumer does not close the entire loan but instead attempts to refund a portion of the outstanding balance.

- Banks often charge a prepayment penalty of 2% to 5% of the loan balance for attempting to prepay your loan. Some banks have a lock-in period during which you cannot foreclose the loan.

Generally, the least loan amount is around 50,000, with a maximum of 50 lakhs depending on your eligibility. Banks like to have personal discussions with borrowers before approving greater Personal Loan limits.

A credit score is a three-digit figure ranging between 300 and 900. It indicates a borrower’s creditworthiness. A higher credit score indicates a positive credit history and responsible repayment conduct. It also boosts the borrower’s chances of loan acceptance because lenders believe you can repay the loan.

Banks do not have any collateral to fall back on in the event of default. The banks’ only recourse is to bring a civil suit in court.

Each bank or NBFC provides different features and perks. To find the finest personal loan in India, you should analyse all current offers and select the one that best meets your needs.

If you have a good CIBIL score and necessary personal loan eligibility, you can apply for a personal loan on lending apps to get quick disbursal.

You can get loans of up to Rs.50 Lakhs. However, the maximum loan quantum depends on the lender and the eligibility factors that the borrower fulfills.

No. Personal loans are unsecured. So you are not required to furnish any security or collateral.

Apply For Personal loan

HDFC Bank Personal Loan

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

ICICI Bank Personal Loan

Apply For Personal loan

HDFC Bank Personal Loan

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

ICICI Bank Personal Loan

Personal Loan Interest Rates

HDFC Bank Personal Loan Interest Rates

IDFC First Bank Personal Loan Interest Rates

Bajaj Finserv Personal Loan Interest Rates

ICICI Bank Personal Loan Interest Rates

HDFC Bank Personal Loan EMI Calculator

IDFC First Bank Personal Loan EMI Calculator

Bajaj Finserv Personal Loan EMI Calculator

SBI Personal Loan EMI Calculator

HDFC Bank Personal Loan Eligibility

Bajaj Finserv Personal Loan Eligibility

Bank of Baroda Personal Loan Eligibility

Bank of India Personal Loan Eligibility

ICICI Personal Loan Eligibility

IDFC First Personal Loan Eligibility

HDFC Bank Personal Loan EMI Calculator

IDFC First Bank Personal Loan EMI Calculator

Bajaj Finserv Personal Loan EMI Calculator

SBI Personal Loan EMI Calculator

Best Loan Apps

Fibe Loan

Money View Loan

Moneytap Loan

Paysense Loan

Loan against LIC Policy

Loan on Credit Card

Loan on SBI Credit Card

Loan on HDFC Credit Card

Loan on ICICI Bank Credit Card

Line of Credit

Best Loan Apps

Fibe Loan

Money View Loan

Moneytap Loan

Paysense Loan

Loan against LIC Policy

Loan on Credit Card

Loan on SBI Credit Card

Loan on HDFC Credit Card

Loan on ICICI Bank Credit Card

Personal Loan Application Status

Bajaj Finserv Personal Loan Application Status

Kotak Personal Loan Application Status

Hdfc Personal Loan Application Status

SBI Personal Loan Application Status

Bajaj Finance Personal Loan Customer Care

Personal Loan Application Status

Bajaj Finserv Personal Loan Application Status

Kotak Personal Loan Application Status

Hdfc Personal Loan Application Status

SBI Personal Loan Application Status

Bajaj Finance Personal Loan Customer Care

SBI Personal Loan Customer Care

Indiabulls Personal Loan Customer Care

HDFC Personal Loan Customer Care

ICICI Personal Loan Customer Care