Online EMI Calculator

Whether it’s a home loan, a vehicle loan, or a personal loan, the EMI calculator can help you figure how much you’ll have to pay each month to cover the total loan. The loan EMI calculator helps the borrower arrange their monthly finances more effectively. Let’s look at how to calculate loan EMIs using an online EMI calculator.

Calculator Information

The Equipment Finance Calculator calculates the type of repayment required, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate. The Product selected determines the default interest rate for personal loan product. The Equipment Finance Calculator also calculates the time saved to pay off the loan and the amount of interest saved based on an additional input from the customer. This is if repayments are increased by the entered amount of extra contribution per repayment period. This feature is only enabled for the products that support an extra repayment. The calculations are done at the repayment frequency entered, in respect of the original loan parameters entered, namely amount, annual interest rate and term in years.Calculator Assumptions

Length of Month

All months are assumed to be of equal length. In reality, many loans accrue on a daily basis leading to a varying number of days interest dependent on the number of days in the particular month.Number of Weeks or Fortnights in a Year

One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.Rounding of Amount of Each Repayment

In practice, repayments are rounded to at least the nearer cent. However the calculator uses the unrounded repayment to derive the amount of interest payable at points along the graph and in total over the full term of the loan. This assumption allows for a smooth graph and equal repayment amounts. Note that the final repayment after the increase in repayment amount.Rounding of Time Saved

The time saved is presented as a number of years and months, fortnights or weeks, based on the repayment frequency selected. It assumes the potential partial last repayment when calculating the savings.Amount of Interest Saved

This amount can only be approximated from the amount of time saved and based on the original loan details.Calculator Disclaimer

The results from this calculator should be used as an indication only. Results do not represent either quotes or pre-qualifications for the product. Individual institutions apply different formulas. Information such as interest rates quoted and default figures used in the assumptions are subject to change.

Feel free to use our Equipment Finance Calculator

Sorry

This video does not exist.

| Period | Payment | Interest | Balance |

|---|

Calculator Disclaimer

The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.

What is an EMI Calculator?

The loan The EMI calculator is a financial instrument that calculates the monthly installment of the loan repayment that the borrower will make each month. The mathematical EMI calculator formula is: E = P x r x (1 + r)n / (1 + r)n – 1. It takes three parameters to generate output: P (principal loan amount), r (interest rate), and n (loan period in months). Undoubtedly, the EMI calculator formula appears sophisticated and complicated; hence, using an EMI calculator online not only simplifies the work but also produces accurate and error-free results.

Table of Contents

ToggleWhat is EMI?

A loan is a financial contract.It takes place between the lender and the borrower.The borrower benefits from the cash flow in the form of a lump sum, while the lender charges interest and certain fees on the loan proceeds, increasing the lender’s income.

Borrowers can profitably use the loan amount for their desired purpose and repay the proceeds in convenient monthly installments.This is where a monthly EMI calculator comes in handy.This allows the borrower to calculate the EMI (equal monthly installments) amount to repay the loan.

EMI is calculated based on his three variables namely principal amount, interest rate and loan period whereas EMI value consists of his two parts namely principal part and interest part. Therefore, the Monthly EMI Calculator also helps you to separate the principal amount and the interest paid. Therefore, the EMI calculator will help you calculate the total cost of the loan.

The EMI of a fixed rate loan remains the same throughout the loan term, but the principal and interest ratio of the EMI value keeps changing during repayment.Keep in mind that during the first few years of loan repayment, the interest portion will be higher than the principal.The EMI amount is paid to the lender on a predetermined date every month through the repayment mode selected at the time of loan application.

How to Calculate EMI using EMI Calculator?

The EMI calculator formula uses three variables – principal amount, rate of interest, and loan tenure, to calculate the amount of EMI.

When the value of each parameter is entered in the EMI calculator formula E = P x r x ( 1 + r )n / ( ( 1 + r )n – 1 ), the resultant EMI value is generated. The task is done best using an EMI calculator online.

How to calculate EMI?

- Search for ‘EMI calculator’ in the Google Search bar.

- Open the EMI calculator online

- Enter the value for P i.e. the value of the loan you wish to avail

- Enter the value of r i.e. the rate of interest offered by the lender

- Enter the value for n i.e. the duration of the loan in months

- Submit the values

The EMI value corresponding to the entered values will be generated by the EMI calculator, instantly.

How to Reduce your EMI?

As mentioned above, EMI is the amount that is repaid every month over the life of the loan. So, while applying for a loan, you should decide on the EMI value carefully. EMI values can be reduced in various ways.These include:

- Lower the principal amount – The loan amount directly affects the EMI value. The higher the loan amount applied for, the higher the corresponding EMI value. So, if you want to reduce your EMI, lower the loan amount you apply for.

- Choose a lower interest rate – Like the loan amount, the interest rate also has a direct impact on the EMI value. The interest rate corresponds to the cost of the loan. Therefore, borrowers should always choose a lender that offers loans at the lowest interest rates. This not only reduces your monthly EMI but also reduces the overall cost of your loan.

- Increase Loan Term – Increasing the loan term reduces the EMI value. Therefore, loan tenure and EMI are inversely related to each other.

- Balance Transfer – EMI generated using EMI formula is paid monthly. EMIs can be further reduced by transferring the loan balance from one lender to another. During the conversion process, the new lender recalculates the EMI using the EMI calculator using the new parameters such as loan amount, interest rate, and loan term.

- Loan Prepayment – Borrowers can effectively use windfall profits to repay their loans. Early repayment of the loan helps reduce EMIs as the advance amount is adjusted against the principal amount.

- Transition from Fixed Rate to Floating Rate – The EMI value of a loan availed at fixed rate remains the same throughout the loan period. You can reduce this amount by changing from a fixed rate to a variable rate. Floating interest rates are linked to the MCLR-based interest rate (marginal cost of lending interest), so you can benefit from a reduction in the MCLR interest rate.

Factors Affecting EMI

EMI is calculated using a formula.The principal amount, the interest rate charged annually and the loan tenure in months are mandatory inputs in the EMI calculator. In other words, the EMI value is determined by these three factors.

Interestingly, however, each factor affects the EMI value differently.While the loan amount and the interest rate at which the loan is availed have a direct impact on the EMI value, the loan term has an indirect impact on the EMI value.

Let us understand this in detail:

Principal Amount: The loan amount for which the borrower wants to apply is the principal amount.When the principal increases, the corresponding EMI value also increases and vice versa. Therefore, if the borrower wants to reduce the EMI, consider applying for a lower principal amount.

Loan Term: The number of years in which the loan is repaid is the loan term. The EMI calculator requires you to enter the loan period in months. So if you want to take out a loan for 5 years, the number of months would be 60 (5 x 12). As the loan tenure increases, the EMI value decreases. However, it is important to note at this point that the longer the loan term, the higher the loan amount. Therefore, you should choose a loan period that will give you the ideal EMI according to your repayment capacity. It should not be too high or too low.

Interest rate: interest rate is the interest rate at which a financial company offers a loan. This is the cost of the loan. When interest rates increase, the total cost of the loan and monthly EMI increases. Therefore, you should carefully compare interest rates from different lenders. If the borrower has good credit, a stable income, and a faithful banking history, you may be able to further negotiate the interest rate.

How is Home Loan Interest Calculated?

The EMI of a loan can be calculated using an online EMI calculator. The EMI calculator requires the values of three parameters to determine the loan EMI. Loan amount, interest rate, and loan period. When you consider a home loan, you will notice that the loan amount is high and the loan term is long. Therefore, to keep the EMI value low, home loan interest rates should be kept at the lowest level.

Borrowers can choose between fixed and variable interest rates. In contrast to fixed interest rates, variable interest rates are linked to her MCLR rate (marginal cost of lending interest). This allows the borrower to benefit from the downtrend fluctuations in the economic scenario but may have to bear additional costs incurred due to increase in MCLR interest rate.

The mortgage interest rate offered to the borrower is calculated as follows:

- MCLR Interest Rate – This is the minimum interest rate fixed by her RBI below which lenders cannot extend loans to borrowers. Therefore, the mortgage interest rate is directly affected by the loan interest rate.

- Credit Score – Borrowers who have a good credit history, meet the lending company’s eligibility criteria, and have a loyal banking relationship with the lending company will be offered a home loan at the lowest interest rate offered by that company.

- Lender Reputation – Like the borrower’s reputation, the lender’s reputation is equally important when calculating mortgage interest rates. Lenders, especially banks, have a huge supply of funds and a large market position, attracting more customers through cheap offers. These institutions benefit from economies of scale through their wide range of operations, which they pass on in the form of the lowest interest rates on mortgages.

What is the Home Loan Amortization Schedule?

A mortgage payment schedule is a tabular representation that lists loan payments over the life of the loan. This shows the breakdown of the loan EMI and separates the principal and interest parts. The mortgage repayment schedule includes the following information:

- Installment Number – Each EMI installment has a unique serial number. The payment details associated with the installment number will be displayed next to it.

- Due Date – This is the date on which the EMI installment becomes due.

- Starting Capital – This is the total outstanding principal at the beginning of the month. The starting principal balance is used to calculate interest.

- Installment Amount – This is the EMI amount paid against the home loan. Calculations are done using an EMI calculator.

- Main Component – EMI resolution. Shows the portion that will be used to repay the main loan.

- Interest Component – Dissolution of EMI. Refers to the portion that is used to repay interest on a mortgage.

- Final Capital – This is the remaining principal amount that remains outstanding after paying the EMIs for the month. The ending capital amount of one month becomes the beginning capital amount of the next month.

Amortization Table

| Year | Opening Balance | Amount paid by customer (EMI*12) | Interest paid during the year | Principal paid during the year | Closing Balance |

|---|---|---|---|---|---|

| 1 | ₹5000000 | ₹499190 | ₹435013 | ₹64177 | ₹4935823 |

| 2 | ₹4935823 | ₹599028 | ₹514259 | ₹84769 | ₹4851054 |

| 3 | ₹4851054 | ₹599028 | ₹504917 | ₹94111 | ₹4756944 |

| 4 | ₹4756944 | ₹599028 | ₹494546 | ₹104482 | ₹4652461 |

| 5 | ₹4652461 | ₹599028 | ₹483031 | ₹115996 | ₹4536465 |

| 6 | ₹4536465 | ₹599028 | ₹470248 | ₹128780 | ₹4407685 |

| 7 | ₹4407685 | ₹599028 | ₹456056 | ₹142972 | ₹4264714 |

| 8 | ₹4264714 | ₹599028 | ₹440300 | ₹158728 | ₹4105986 |

| 9 | ₹4105986 | ₹599028 | ₹422808 | ₹176220 | ₹3929766 |

| 10 | ₹3929766 | ₹599028 | ₹403388 | ₹195640 | ₹3734126 |

| 11 | ₹3734126 | ₹599028 | ₹381828 | ₹217200 | ₹3516926 |

| 12 | ₹3516926 | ₹599028 | ₹357892 | ₹241136 | ₹3275790 |

| 13 | ₹3275790 | ₹599028 | ₹331318 | ₹267710 | ₹3008079 |

| 14 | ₹3008079 | ₹599028 | ₹301815 | ₹297213 | ₹2710866 |

| 15 | ₹2710866 | ₹599028 | ₹269061 | ₹329967 | ₹2380899 |

| 16 | ₹2380899 | ₹599028 | ₹232697 | ₹366330 | ₹2014569 |

| 17 | ₹2014569 | ₹599028 | ₹192327 | ₹406701 | ₹1607868 |

| 18 | ₹1607868 | ₹599028 | ₹147507 | ₹451521 | ₹1156346 |

| 19 | ₹1156346 | ₹599028 | ₹97748 | ₹501280 | ₹655066 |

| 20 | ₹655066 | ₹599028 | ₹42505 | ₹556523 | ₹98543 |

| 21 | ₹98543 | ₹99838 | ₹1295 | ₹98543 | ₹0 |

| Year | Opening Balance | Interest paid during the year | Closing Balance |

|---|---|---|---|

| 1 | ₹5000000 | ₹435013 | ₹4935823 |

| 2 | ₹4935823 | ₹514259 | ₹4851054 |

| 3 | ₹4851054 | ₹504917 | ₹4756944 |

| 4 | ₹4756944 | ₹494546 | ₹4652461 |

| 5 | ₹4652461 | ₹483031 | ₹4536465 |

| 6 | ₹4536465 | ₹470248 | ₹4407685 |

| 7 | ₹4407685 | ₹456056 | ₹4264714 |

| 8 | ₹4264714 | ₹440300 | ₹4105986 |

| 9 | ₹4105986 | ₹422808 | ₹3929766 |

| 10 | ₹3929766 | ₹403388 | ₹3734126 |

| 11 | ₹3734126 | ₹381828 | ₹3516926 |

| 12 | ₹3516926 | ₹357892 | ₹3275790 |

| 13 | ₹3275790 | ₹331318 | ₹3008079 |

| 14 | ₹3008079 | ₹301815 | ₹2710866 |

| 15 | ₹2710866 | ₹269061 | ₹2380899 |

| 16 | ₹2380899 | ₹232697 | ₹2014569 |

| 17 | ₹2014569 | ₹192327 | ₹1607868 |

| 18 | ₹1607868 | ₹147507 | ₹1156346 |

| 19 | ₹1156346 | ₹97748 | ₹655066 |

| 20 | ₹655066 | ₹42505 | ₹98543 |

| 21 | ₹98543 | ₹1295 | ₹0 |

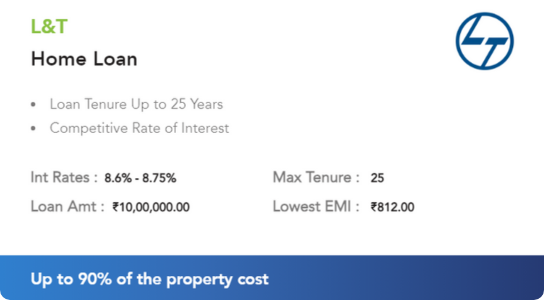

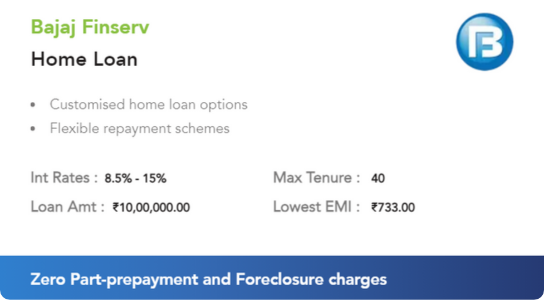

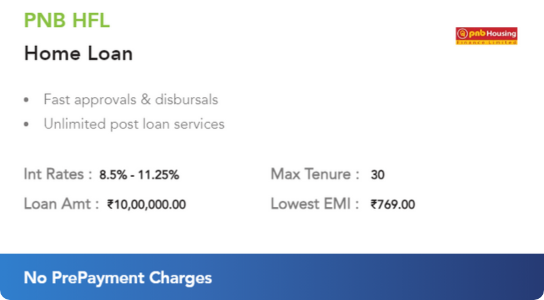

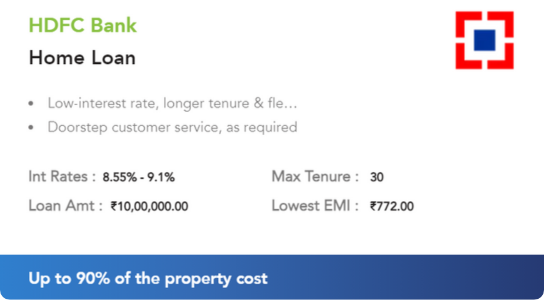

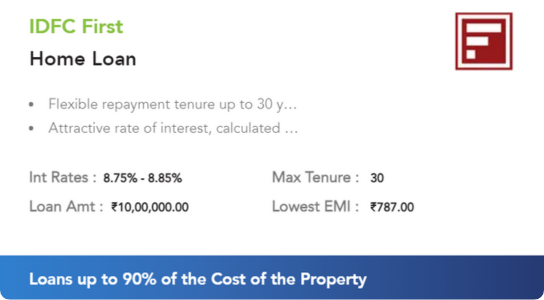

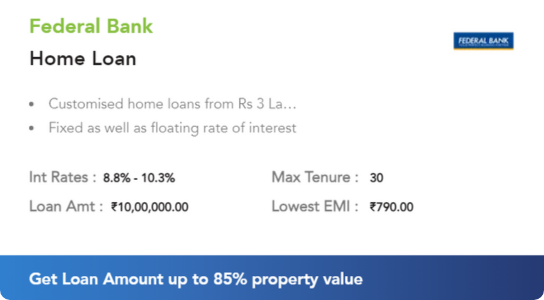

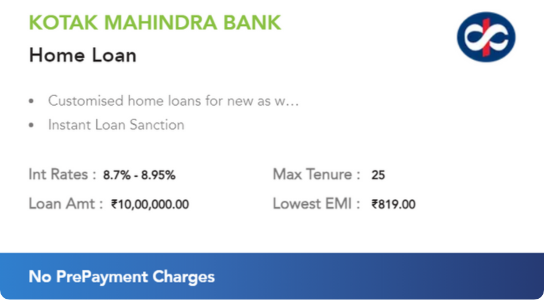

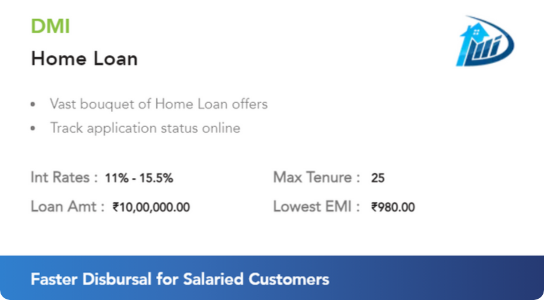

Best Deals

From Our Blog

FAQS

The EMI calculator delivers results depending on inputs. The EMI estimated by the EMI calculator will match the actual bank EMI if the correct inputs are provided, such as the actual rate of interest paid by the bank, the actual principal loan that the bank will authorise, and the actual loan period for which the loan will be obtained. If there is any difference between the actual data and the EMI value computed by the EMI calculator, it will not match the actual bank EMI.

Yes, the EMI calculator can be used to generate the EMI value for all types of loans like home loans, personal loans, car loans, education loans, etc.

The EMI calculator formula E = P x r x (1 + r )n / ( ( 1 + r )n – 1 ) is the same for all EMI calculators. However, there are different EMI calculators available for a home loan, car loan, and personal loan. This is primarily because of the restriction in the maximum loan amount that is allowed as input.

When using the EMI calculator, to reduce your EMI:

- Enter a smaller principal amount

- Enter a lower rate of interest

- Enter a longer loan tenure

To calculate EMI using the EMI calculator you will require 3 inputs – the loan amount you wish to avail, the rate of interest at which the lending company will offer a loan, and the period for which you wish to take the loan.

Syndicate Bank Balance Check Number

Bank of India Balance Check Number

SBI Balance Check Toll-Free Number

Bank of Baroda Balance Check Number

Andhra Bank Balance Check Number

HDFC Bank Balance Check Number

SBI Credit Card

HDFC Bank Credit Card

PNB Credit Card

Yes Bank Credit Card

HSBC Credit Card

Syndicate Bank Balance Check Number

Bank of India Balance Check Number

SBI Balance Check Toll-Free Number

Bank of Baroda Balance Check Number

Andhra Bank Balance Check Number

HDFC Bank Balance Check Number

CTC Full Form

Apply For Loan Against Property

SBI Loan Against Property

HDFC Bank Loan Against Property

Loan Against Property Interest Rates

HDFC LAP Interest Rates

Check Free CIBIL score

CIBIL score calculation

CIBIL score range

Check CIBIL score by pan card

CIBIL score for home loan

EPF

EPF Passbook

UAN Activation

Unified Member Portal

EPF Claim Status