EMI Calculator for Home Loan

Home loans might help you eventually acquire your dream home. They provide you with the lump sum money, which is to be repaid in installments over the loan’s term. The Home Loan EMI calculator calculates the amount you must repay to the bank or lending institution each month. Let’s look at the Home Loan EMI calculator formula and discover how to calculate Home Loan EMI.

Calculator Information

The Equipment Finance Calculator calculates the type of repayment required, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate. The Product selected determines the default interest rate for personal loan product. The Equipment Finance Calculator also calculates the time saved to pay off the loan and the amount of interest saved based on an additional input from the customer. This is if repayments are increased by the entered amount of extra contribution per repayment period. This feature is only enabled for the products that support an extra repayment. The calculations are done at the repayment frequency entered, in respect of the original loan parameters entered, namely amount, annual interest rate and term in years.Calculator Assumptions

Length of Month

All months are assumed to be of equal length. In reality, many loans accrue on a daily basis leading to a varying number of days interest dependent on the number of days in the particular month.Number of Weeks or Fortnights in a Year

One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.Rounding of Amount of Each Repayment

In practice, repayments are rounded to at least the nearer cent. However the calculator uses the unrounded repayment to derive the amount of interest payable at points along the graph and in total over the full term of the loan. This assumption allows for a smooth graph and equal repayment amounts. Note that the final repayment after the increase in repayment amount.Rounding of Time Saved

The time saved is presented as a number of years and months, fortnights or weeks, based on the repayment frequency selected. It assumes the potential partial last repayment when calculating the savings.Amount of Interest Saved

This amount can only be approximated from the amount of time saved and based on the original loan details.Calculator Disclaimer

The results from this calculator should be used as an indication only. Results do not represent either quotes or pre-qualifications for the product. Individual institutions apply different formulas. Information such as interest rates quoted and default figures used in the assumptions are subject to change.

Feel free to use our Equipment Finance Calculator

Sorry

This video does not exist.

| Period | Payment | Interest | Balance |

|---|

Calculator Disclaimer

The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.

What is a Home Loan EMI Calculator?

The home loan EMI calculator is an important financial tool. It is useful for determining the Equated Monthly Installment (EMI) of a house loan. This provides the borrower with a clear indication of the monthly outflows required to repay the loan, which is incredibly useful for budgeting. The Home Loan EMI calculator formula E = P x r x (1 + r) n / ((1 + r) n – 1) creates the answer using three parameters: principal loan amount, interest rate, and loan term (months). Given the intricacy of the Home Loan EMI calculator formula, it is advisable to use the Home Loan EMI calculator online.

Table of Contents

ToggleWhat is EMI?

EMI stands for Equated Monthly Rate (EMI). When a borrower applies for a mortgage, the principal is approved at an interest rate calculated by the lender. The principal amount withdrawn and the cumulative amount of interest accrued on it must be repaid within the agreed loan term.

This repayment will be made monthly.

The amount paid is called Equivalent Monthly Installment (EMI).

Home Loan EMI is calculated using the online Home Loan EMI Calculator.

The home loan EMI formula requires three inputs: principal amount, interest rate, and loan period (in months).

EMI corresponding to the input value is generated instantly.

Users can modify any or all input values to achieve the ideal EMI value.

Home Loan EMI Calculator can help you reduce your home loan EMI by: Principal Reduction Interest Reduction Choosing a Longer Loan Term The EMI value consists of two components. Principal portion and interest portion. So, in addition to EMI calculation, the home loan EMI calculator also helps you understand the total cost of the loan.

How to Calculate Home Loan EMI using EMI Calculator?

- Start searching for Home Loan EMI Calculator in Google search bar.

- Open the Home Loan EMI Calculator online.

- Enter the loan principal amount.

- Enter the interest rate at which the financial institution offers mortgage loans.

- Enter the number of months you want to repay the loan.

| Loan Amount | Rate of Interest | Loan Term | EMI Value |

|---|---|---|---|

| Rs. 10 Lakhs Home Loan EMI | 8.50% | 20 years | Rs. 8,678 |

| Rs. 15 Lakhs Home Loan EMI | 8.50% | 20 years | Rs. 13,017 |

| Rs. 20 Lakhs Home Loan EMI | 8.50% | 20 years | Rs. 17,356 |

| Rs. 25 Lakhs Home Loan EMI | 8.50% | 20 years | Rs. 21,696 |

| Principal Amount | Total EMI | Total Interest | Total Payments |

|---|---|---|---|

| Rs. 10,00,000 | Rs. 8,678 | Rs. 10,82,776 | Rs. 20,82,776 |

| Rs. 15,00,000 | Rs. 13,017 | Rs. 16,24,164 | Rs. 31,24,164 |

| Rs. 20,00,000 | Rs. 17,356 | Rs. 21,65,332 | Rs. 41,65,332 |

| Rs. 25,00,000 | Rs. 21,696 | Rs. 27,06,939 | Rs. 52,06,939 |

How to Reduce your Home Loan EMI?

Therefore, there are many ways to reduce your home loan EMI.

- Choose a lower principal amount – The principal amount directly affects the EMI value of the home loan. To reduce EMI, consider lower amount of equity while applying for home loan.

- Choose the lowest interest rate – The higher the home loan interest rate, the higher the EMI value. The interest portion is the cost of the loan. So, to keep both your loan cost and EMI low, choose the loan company that offers the lowest home loan interest rate.

- Extension of loan term – Home loan term and EMI are inversely related to each other. As soon as the loan tenure increases, the EMI value decreases and vice versa.

- Transfer of home loan balance to another lender – Transferring the balance of your ongoing home loan to another lender offering a lower interest rate may reduce the EMI value. Balance transfer also allows the borrower to extend the loan tenure and reduce the EMI.

- Loan Advance – Loan advance is adjusted to the principal amount, thereby reducing the EMI.

- Switching from a fixed interest rate to a variable interest rate – Unlike a fixed interest rate, a variable interest rate fluctuates according to economic fluctuations. These are linked to interest rates based on MCLR (Marginal Lending Rate). As the MCLR rate decreases, the EMI value decreases.

Factors Affecting Home loan EMI

The home loan EMI calculator uses the formula E = P x r x (1 + r) n / ((1 + r) n – 1) to calculate the EMI. As you can see, the home loan EMI formula consists of three variables: P, r, and n. P is the principal amount, r is the interest rate charged annually by the lender, and n is the loan term (in months).

Therefore, the value of EMI depends on the values of these three factors. Additional information: AnyRoR Gujarat Land Records can also be checked. However, each factor has a different impact on the PMI value. Let us understand the impact of each variable on the value of EMI:

Principal Amount: The approved and sanctioned home loan amount is the principal amount. When a borrower applies for a higher principal amount, the corresponding EMI also increases. To keep your EMIs low and within your budget, apply for a smaller amount of home loan as well.

Loan term: The term of the loan is the number of years in which you repay the mortgage. The home loan EMI calculator requires this number as the number of months. As the loan tenure increases, the EMI value decreases. The Rs.20 million home loan EMI calculator shows the following results:

Interest rate: interest rate is the interest rate charge on the mortgage loan. This is the interest rate on a loan at the time a lender grants a loan and a borrower accepts a mortgage. Even small differences in home loan interest rates have a huge impact on the EMI and overall cost of the home loan. Good credit, a stable job and income, and a healthy banking relationship can help a borrower negotiate a lower interest rate. The Rs. 20 million home loan EMI calculator shows the following results.

How is Home Loan Interest Calculated?

The interest rate of a home loan depends on the loan interest rate set by the Reserve Bank of India.

Finance companies use this as a base rate and add operating costs to determine the interest rate at which they will offer you a mortgage.

The interest rate at which a lender offers a home loan varies depending on the MCLR interest rate.

This is the interest rate below which banks cannot lend.

Borrowers with good credit, who meet the eligibility criteria, and who have a strong, long-term relationship with their bank can qualify for the lowest interest rates.

Interest on a mortgage is calculated as a percentage of the principal amount.

Mortgage interest is calculated using the declining balance method.

On each repayment of EMI, the equity portion of the EMI resolution is set off against the principal amount.

This reduces the outstanding principal amount.

LoansWala Home Loan EMI Calculator lets you know the EMI amount along with the total interest and total payments on the home loan principal at a given interest rate.

What is the Home Loan Amortization Schedule?

A home loan repayment plan is a home loan repayment plan. This is a tabular format that shows the breakdown of his two components (principal part and interest part) of the home loan EMI calculator.

The mortgage repayment schedule includes the following details:

- EMI Installment Number – Each EMI installment has a unique serial number. Each installment number includes distribution details, due date, and beginning and ending principal balances.

- Due Date – This is the date on which the EMI installment becomes due.

- Beginning Principal Balance – This is the principal amount of the mortgage balance at the beginning of the month. Building loan interest is calculated based on this amount.

- Installment Amount – This is the value of the EMI amount to be paid.

The calculation is done using a home loan EMI calculator.

- Principal component – The portion of the EMI that is used to repay the principal loan.

- Interest Component – The portion of an EMI that is used to repay the interest component of a home loan.

- Final Capital – This is the outstanding principal amount after paying the EMIs for the month.

The final mortgage amount for one month is displayed as the starting mortgage amount for the next month.

Amortization Table

| Year | Opening Balance | Amount paid by customer (EMI*12) | Interest paid during the year | Principal paid during the year | Closing Balance |

|---|---|---|---|---|---|

| 1 | ₹5000000 | ₹499190 | ₹435013 | ₹64177 | ₹4935823 |

| 2 | ₹4935823 | ₹599028 | ₹514259 | ₹84769 | ₹4851054 |

| 3 | ₹4851054 | ₹599028 | ₹504917 | ₹94111 | ₹4756944 |

| 4 | ₹4756944 | ₹599028 | ₹494546 | ₹104482 | ₹4652461 |

| 5 | ₹4652461 | ₹599028 | ₹483031 | ₹115996 | ₹4536465 |

| 6 | ₹4536465 | ₹599028 | ₹470248 | ₹128780 | ₹4407685 |

| 7 | ₹4407685 | ₹599028 | ₹456056 | ₹142972 | ₹4264714 |

| 8 | ₹4264714 | ₹599028 | ₹440300 | ₹158728 | ₹4105986 |

| 9 | ₹4105986 | ₹599028 | ₹422808 | ₹176220 | ₹3929766 |

| 10 | ₹3929766 | ₹599028 | ₹403388 | ₹195640 | ₹3734126 |

| 11 | ₹3734126 | ₹599028 | ₹381828 | ₹217200 | ₹3516926 |

| 12 | ₹3516926 | ₹599028 | ₹357892 | ₹241136 | ₹3275790 |

| 13 | ₹3275790 | ₹599028 | ₹331318 | ₹267710 | ₹3008079 |

| 14 | ₹3008079 | ₹599028 | ₹301815 | ₹297213 | ₹2710866 |

| 15 | ₹2710866 | ₹599028 | ₹269061 | ₹329967 | ₹2380899 |

| 16 | ₹2380899 | ₹599028 | ₹232697 | ₹366330 | ₹2014569 |

| 17 | ₹2014569 | ₹599028 | ₹192327 | ₹406701 | ₹1607868 |

| 18 | ₹1607868 | ₹599028 | ₹147507 | ₹451521 | ₹1156346 |

| 19 | ₹1156346 | ₹599028 | ₹97748 | ₹501280 | ₹655066 |

| 20 | ₹655066 | ₹599028 | ₹42505 | ₹556523 | ₹98543 |

| 21 | ₹98543 | ₹99838 | ₹1295 | ₹98543 | ₹0 |

| Year | Opening Balance | Interest paid during the year | Closing Balance |

|---|---|---|---|

| 1 | ₹5000000 | ₹435013 | ₹4935823 |

| 2 | ₹4935823 | ₹514259 | ₹4851054 |

| 3 | ₹4851054 | ₹504917 | ₹4756944 |

| 4 | ₹4756944 | ₹494546 | ₹4652461 |

| 5 | ₹4652461 | ₹483031 | ₹4536465 |

| 6 | ₹4536465 | ₹470248 | ₹4407685 |

| 7 | ₹4407685 | ₹456056 | ₹4264714 |

| 8 | ₹4264714 | ₹440300 | ₹4105986 |

| 9 | ₹4105986 | ₹422808 | ₹3929766 |

| 10 | ₹3929766 | ₹403388 | ₹3734126 |

| 11 | ₹3734126 | ₹381828 | ₹3516926 |

| 12 | ₹3516926 | ₹357892 | ₹3275790 |

| 13 | ₹3275790 | ₹331318 | ₹3008079 |

| 14 | ₹3008079 | ₹301815 | ₹2710866 |

| 15 | ₹2710866 | ₹269061 | ₹2380899 |

| 16 | ₹2380899 | ₹232697 | ₹2014569 |

| 17 | ₹2014569 | ₹192327 | ₹1607868 |

| 18 | ₹1607868 | ₹147507 | ₹1156346 |

| 19 | ₹1156346 | ₹97748 | ₹655066 |

| 20 | ₹655066 | ₹42505 | ₹98543 |

| 21 | ₹98543 | ₹1295 | ₹0 |

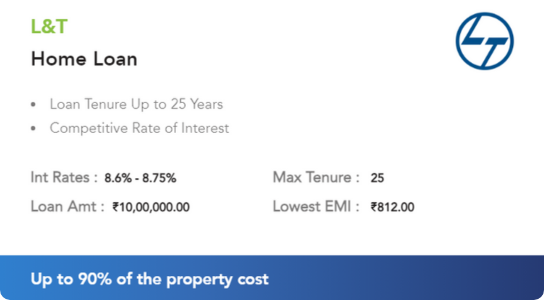

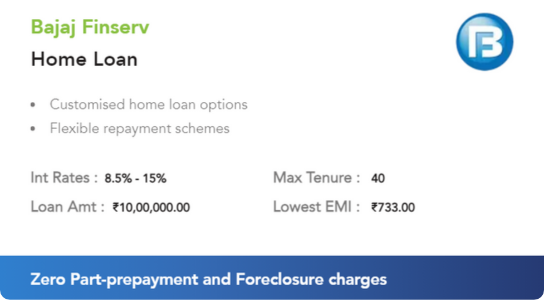

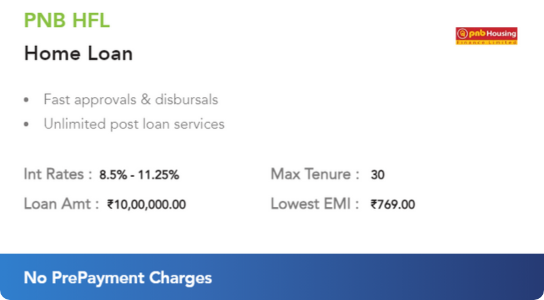

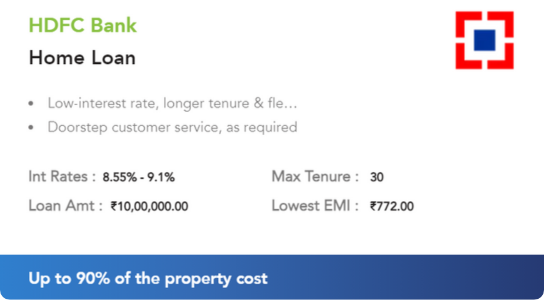

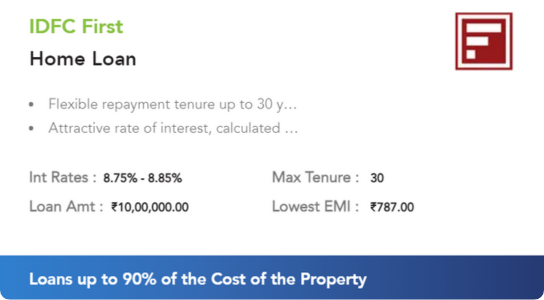

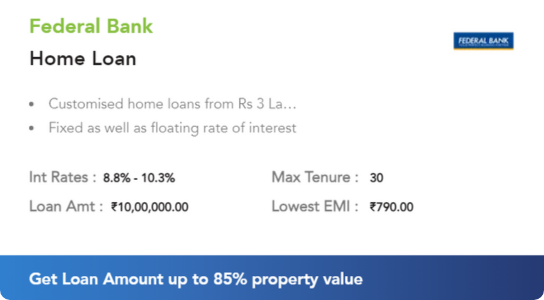

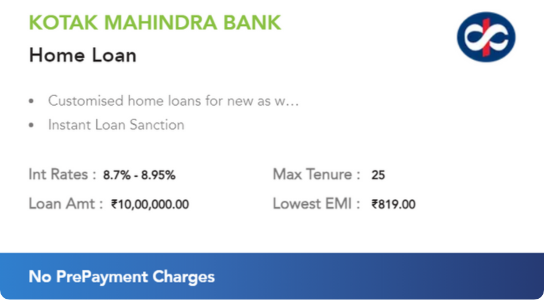

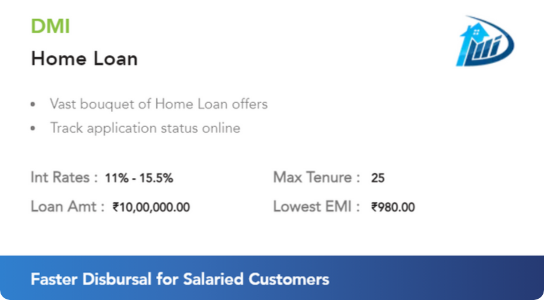

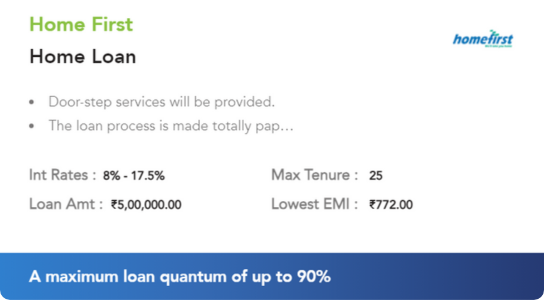

Best Deals

From Our Blog

FAQS

Home loan interest is computed as a percentage of the principle. It is computed using a decreasing balance basis. Each EMI repayment includes a principle component that partially pays off the home loan principal. This lowers the outstanding principle amount. The subsequent interest computation uses the outstanding principal amount as the entire loan amount.

The home loan EMI calculator works on the Home Loan EMI calculator formula E = P x r x (1 + r) n / ((1 + r) n – 1). Here P = principal loan amount, r = rate of interest, n = loan period in months.

For an Rs. 20 lakh home loan taken at a rate of interest of 8.35% p.a. for a 30 year loan period, the EMI amount will be Rs. 15,378.

For an Rs. 25 lakh home loan taken at a rate of interest of 8.35% p.a. for a 30 year loan period, the EMI amount will be Rs. 19,223.

For an Rs. 15 lakh home loan taken at a rate of interest of 8.35% p.a. for a 30 year loan period, the EMI amount will be Rs. 11,354.

Apply for Home Loan

SBI Home Loan

HDFC Home Loan

Ummeed Housing Finance

Bandhan Bank Home Loan

Home Loan Interest Rates

Best Home Loan Interest Rates

SBI Home Loan Interest Rates

HDFC Home Loan Interest Rates

Bank of Baroda Home Loan Interest Rates

Apply for Home Loan

SBI Home Loan

HDFC Home Loan

Ummeed Housing Finance

Bandhan Bank Home Loan

Home Loan Interest Rates

Best Home Loan Interest Rates

SBI Home Loan Interest Rates

HDFC Home Loan Interest Rates

Bank of Baroda Home Loan Interest Rates

Home Loan Eligibility

SBI Home Loan Eligibility

HDFC Home Loan Eligibility

Bank of India Home Loan Eligibility

Bank of Baroda Home Loan Eligibility

Home Loan EMI Calculator

Kotak Home Loan EMI Calculator

LIC Home Loan EMI Calculator

SBI Home Loan EMI Calculator

HDFC Home Loan EMI Calculator

Home Loan Eligibility

SBI Home Loan Eligibility

HDFC Home Loan Eligibility

Bank of India Home Loan Eligibility

Bank of Baroda Home Loan Eligibility

Home Loan EMI Calculator

Kotak Home Loan EMI Calculator

LIC Home Loan EMI Calculator

SBI Home Loan EMI Calculator

HDFC Home Loan EMI Calculator

Home Loan Balance Transfer Interest Rates

Pradhan Mantri Awas Yojana

How to Apply for PMAY

DDA Housing Scheme 2023

Home Loan in Delhi NCR

SBI Home Loan Customer Care

LIC Home Loan Customer Care

HDFC Home Loan Customer Care

ICICI Bank Home Loan Customer Care

Indiabulls Home Loan Customer Care

DHFL Home Loan Customer Care

Home Loan Balance Transfer Interest Rates

Pradhan Mantri Awas Yojana

How to Apply for PMAY

DDA Housing Scheme 2023

Home Loan in Delhi NCR

SBI Home Loan Customer Care

LIC Home Loan Customer Care

HDFC Home Loan Customer Care

ICICI Bank Home Loan Customer Care

Indiabulls Home Loan Customer Care

DHFL Home Loan Customer Care