Compound Interest Rate Calculator

There are two types of interest: simple interest and compound interest. While simple interest is solely paid on the original amount, compound interest adds the previous month’s interest to the principal amount to create a new balance in your account. The interest for the following month is due on this new balance. Everything you need to know about compound interest is listed below.

Calculator Information

The Equipment Finance Calculator calculates the type of repayment required, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate. The Product selected determines the default interest rate for personal loan product. The Equipment Finance Calculator also calculates the time saved to pay off the loan and the amount of interest saved based on an additional input from the customer. This is if repayments are increased by the entered amount of extra contribution per repayment period. This feature is only enabled for the products that support an extra repayment. The calculations are done at the repayment frequency entered, in respect of the original loan parameters entered, namely amount, annual interest rate and term in years.Calculator Assumptions

Length of Month

All months are assumed to be of equal length. In reality, many loans accrue on a daily basis leading to a varying number of days interest dependent on the number of days in the particular month.Number of Weeks or Fortnights in a Year

One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.Rounding of Amount of Each Repayment

In practice, repayments are rounded to at least the nearer cent. However the calculator uses the unrounded repayment to derive the amount of interest payable at points along the graph and in total over the full term of the loan. This assumption allows for a smooth graph and equal repayment amounts. Note that the final repayment after the increase in repayment amount.Rounding of Time Saved

The time saved is presented as a number of years and months, fortnights or weeks, based on the repayment frequency selected. It assumes the potential partial last repayment when calculating the savings.Amount of Interest Saved

This amount can only be approximated from the amount of time saved and based on the original loan details.Calculator Disclaimer

The results from this calculator should be used as an indication only. Results do not represent either quotes or pre-qualifications for the product. Individual institutions apply different formulas. Information such as interest rates quoted and default figures used in the assumptions are subject to change.

Feel free to use our Equipment Finance Calculator

Sorry

This video does not exist.

| Period | Payment | Interest | Balance |

|---|

Calculator Disclaimer

The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.

What is Compound Interest?

Whether you save money in a bank or borrow money from a financial organisation, interest is charged. Savings yield interest, whereas borrowing requires you to pay interest.

Whether you save or borrow, you can expect one of two forms of interest: simple interest or compound interest. With simple interest, you just pay interest on the principal amount. However, compound interest adds the previous month’s interest to the principal amount to create a new balance in your account. The interest for the following month is due on this new balance.

Simply put, compound interest means ‘interest on interest’.

Table of Contents

ToggleWhat Are the Advantages and Disadvantages of Compound Interest?

Compound Interest V/S Simple Interest

| Simple Interest | Compound Interest |

|---|---|

| This interest is only levied on the principal amount or the loan amount. | The interest is levied on the loan amount as well as the interest that is added to it each month. |

| This is a small percentage of the principal amount as agreed between the lender and the borrower. | This is a percentage of the principal amount along with the simple interest that is earned upon the principal amount as agreed upon by the lender and borrower. |

| Wealth and repayment amount in case of loans increase steadily. | Whether it is savings or the repayment on your loan, the growth of the amount is faster because of compounding. |

| The returns with simple interest are lower. | You get higher returns with compound interest. |

| The principal amount does not change. | Interest is added to the principal, making it increase accordingly. |

| Simple interest is very easy to calculate as the formula is straightforward. | This is harder to calculate because of the compounding on the principal amount. |

How to Calculate Compound Interest?

You have the advantage of several online EMI calculators to help you calculate compound interest on savings and borrowings. However it is important for you to know how this value is determined to manage your wealth better.

Now, compound interest may be calculated either monthly or annually.

Calculating compound interest annually

- Add 1 to the rate of interest which is usually a decimal.

- To this value put the power of the tenure of your loan or the number of years you want to have your savings for.

- Multiply the result that you get with the principal amount or the current balance of your account.

- This will give you the new balance that you will have in your account.

The formula used for compound interest per month is:

Principal x (1+rate of interest) tenure

Calculating compound interest monthly

- Divide the interest rate by 12. This is because interest rates are usually expressed for the whole year.

- Add 1 to the number that you get to denote the compound interest.

- To the value that you get, put the power of the tenure of your loan.

- Multiply the result that you obtain with your principal amount or your current balance to get the new balance.

The formula for the compound interest calculated monthly is as follows:

Principal x (1+rate of interest / 12) tenure

Using a Compound Interest Calculator

You can simply calculate compound interest by utilising an online compound interest calculator. To calculate compound interest, simply input the interest rate offered on your savings account or imposed on your loan, the loan’s length or the time that you want to save for, and the principal amount.

These compound interest calculators also allow you to estimate the principal amount, interest rate, and duration of an investment or loan in advance. That way, you’ll know how much you need to invest to get a significant return or how long you need to invest it for. You can also determine the estimated repayment amount so that you can arrange your budget appropriately.

Facts About Compound Interest that you Should Know

Understanding compound interest is straightforward. Once you understand a few facts about compound interest, you will be able to use it effectively to boost your savings while also better managing your loan and other borrowing obligations.

Here are some facts regarding compound interest that you should be aware of if you want to make any major financial decisions in the future:

The benefits of compound interest can benefit everyone:

- If you invest wisely, you can take full advantage of compound interest, regardless of your current financial or employment situation. The only thing you need to know about compound interest is that as long as you can keep a portion of your earnings in your account, you can benefit from compound interest over a period of time.

- Compound interest has a downside: Compound interest can have a downside for most loans and bonds. When it comes to savings, you simply benefit from compound interest. However, the concept of compound interest when taking loans, especially credit cards, leads to higher repayments. As mentioned above, if you’re charged compound interest, the interest on your unpaid credit card balance can accumulate over a short period of time. It actually adds up faster than you might think.

- Even small savings per month can add up to big savings over This includes when you can’t add money to your savings balance because the interest is automatically added to the principal This also applies to all debts. The lower the repayment amount, the greater the burden, and you end up with more debt than you started with. When you save, keep your money for a longer period of time, and when you take out a loan, try to repay as much as possible with compound interest.

- Time is an important factor in compound interest: When compound interest is applied to savings, the longer the period of savings and compounding, the better. If your assets grow by 6% per year, using compound interest, they will double in about 12 years and quadruple in 12 years. In contrast, with loans and bonds, the faster you pay them off, the better.

- These open accounts tend to take advantage of compound interest.

- So if you continue to make minimum payments, you’re likely to end up in debt for much longer than you expected. The more often you save, the better the results. When saving, it is more effective to plan for compounding on a monthly or quarterly basis rather than annually.

- This means that your principal balance will steadily increase if you compound interest frequently.

- However, when it comes to loans, the less often you compound interest, the better.

- This is because the more frequently you compound interest, the more you pay back, and the more quickly you accumulate.

- Don’t be discouraged by low interest rates: Most banks don’t offer particularly high interest rates on savings accounts.

- Therefore, rather than keeping your money in a savings account, it seems better to use mutual funds and other investment options. Interest rates are high, minimum minimums are low, and participation is free.

- However, if you are unable to convert some of your assets into savings, you can also pay any amount on top of your debt.

- Compound interest can actually speed up your repayments: Let’s say you pay off the minimum amount of your credit card balance first and then increase that amount each month. Compound interest allows you to avoid paying large amounts over a long period of time, as long as you maintain stable and regular interest rate increases.

Amortization Table

| Year | Opening Balance | Amount paid by customer (EMI*12) | Interest paid during the year | Principal paid during the year | Closing Balance |

|---|---|---|---|---|---|

| 1 | ₹500000 | ₹106235 | ₹39191 | ₹67044 | ₹432956 |

| 2 | ₹432956 | ₹127482 | ₹39328 | ₹88154 | ₹344801 |

| 3 | ₹344801 | ₹127482 | ₹30097 | ₹97385 | ₹247416 |

| 4 | ₹247416 | ₹127482 | ₹19899 | ₹107583 | ₹139833 |

| 5 | ₹139833 | ₹127482 | ₹8634 | ₹118848 | ₹20984 |

| 6 | ₹20984 | ₹21247 | ₹263 | ₹20984 | ₹0 |

| Year | Opening Balance | Interest paid during the year | Closing Balance |

|---|---|---|---|

| 1 | ₹500000 | ₹39191 | ₹432956 |

| 2 | ₹432956 | ₹39328 | ₹344801 |

| 3 | ₹344801 | ₹30097 | ₹247416 |

| 4 | ₹247416 | ₹19899 | ₹139833 |

| 5 | ₹139833 | ₹8634 | ₹20984 |

| 6 | ₹20984 | ₹263 | ₹0 |

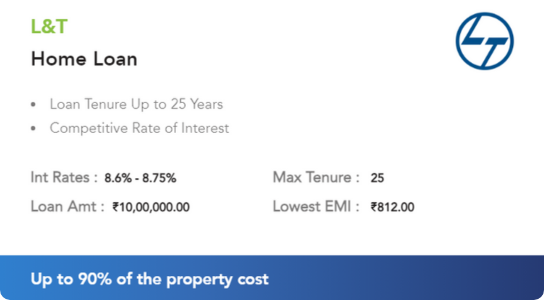

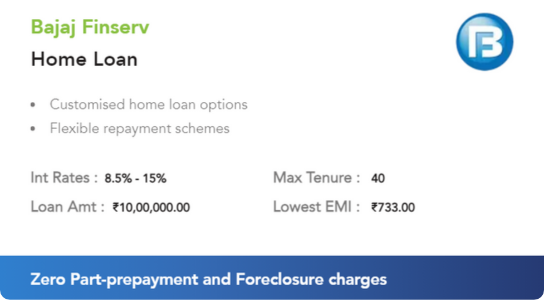

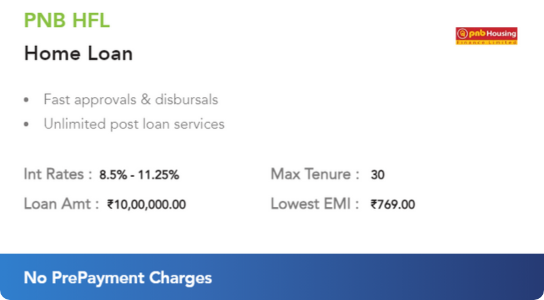

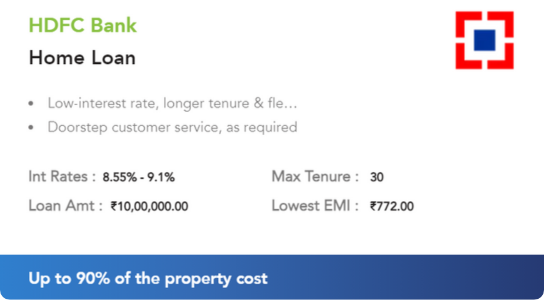

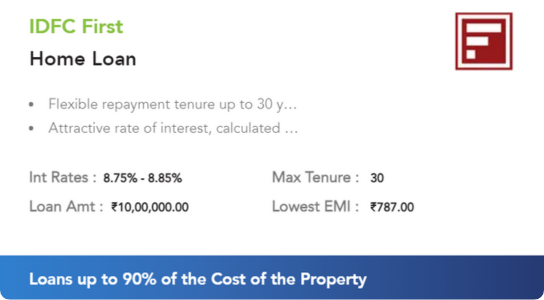

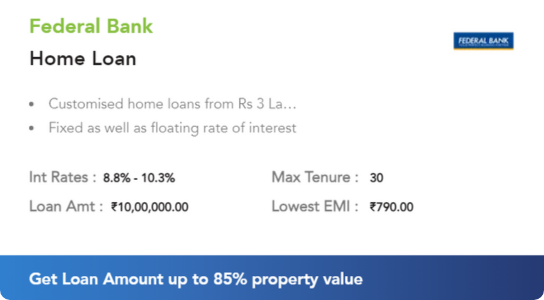

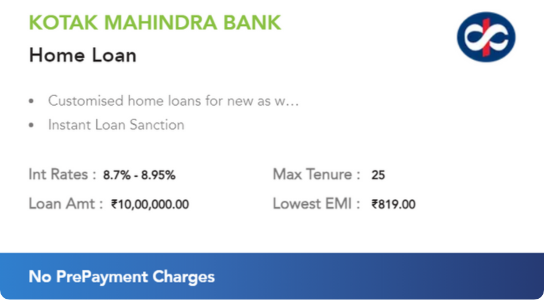

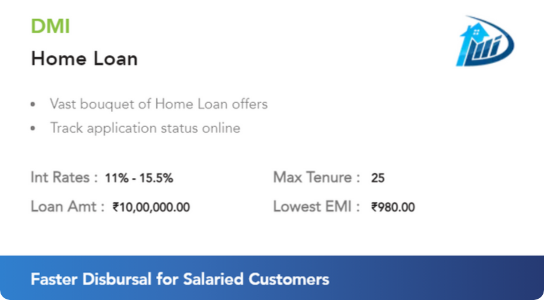

Best Deals

From Our Blog

Learn more about Compound Interest Calculator

To calculate how much you’ve saved through compound interest, you’ll need to know your account’s current amount. To calculate the amount you will have to repay for a loan, you must first know the principal amount or loan amount. All subsequent computations are dependent on the amount that you start with.

In the case of loans and borrowings, the interest rate remains constant during the term of the loan. When it comes to savings accounts, you can choose a high interest rate account for a limited period of time or just deposit your money in a savings account for as long as you want. The interest is paid for the time that you keep the account active. The longer you keep your account, the bigger the returns you will receive.

The interest rate on loans and other forms of borrowing fluctuates depending on a variety of factors. This includes the sort of loan you choose, your qualifying requirements, the bank you select, and so on. Even with savings accounts, interest rates vary depending on the bank and account type. If you choose a loan or a savings plan during an offer period, be sure you know how long it is valid before agreeing to the terms and conditions.

The interest on the loan is calculated monthly to allow for EMI repayment alternatives. If you have an outstanding balance on your credit card, the interest is calculated daily and due at the end of each month. When it comes to compound interest on savings accounts, it is computed daily and paid out at the end of each month or year. Of course, choosing monthly repayments is a good option because the principle amount increases each month and is compounded.

This inquiry is about compound interest on your savings accounts. You can choose to deposit any additional monies received in the form of a bonus or gift into your savings account each time. You might also choose to set aside a portion of your earnings into a savings account each month. The latter is a better option because you have a larger principal amount or balance to work with, resulting in higher returns.

You can use an online compound interest calculator to find out how much monthly payments you’ll need on your loan. You can also calculate the required investment period for the lowest repayments and highest returns. If you don’t know your interest rate, you can calculate it fairly accurately. Just enter the required data and the calculator will return accurate results.

As explained above, compound interest has its advantages and disadvantages. One way to avoid the negative effects of compound interest on your loan is to deposit a little more than the minimum balance each month. This is ideal for larger loans such as home loans and car loans.

However, for smaller debts, such as credit card bills, it’s best to pay off the entire amount at once to avoid compounding interest and high repayments. However, if that’s not possible, you can use the same idea as with larger loans to continually increase your monthly payments.

Syndicate Bank Balance Check Number

Bank of India Balance Check Number

SBI Balance Check Toll-Free Number

Bank of Baroda Balance Check Number

Andhra Bank Balance Check Number

HDFC Bank Balance Check Number

SBI Credit Card

HDFC Bank Credit Card

PNB Credit Card

Yes Bank Credit Card

HSBC Credit Card

Syndicate Bank Balance Check Number

Bank of India Balance Check Number

SBI Balance Check Toll-Free Number

Bank of Baroda Balance Check Number

Andhra Bank Balance Check Number

Apply For Loan Against Property

SBI Loan Against Property

HDFC Bank Loan Against Property

Loan Against Property Interest Rates

HDFC LAP Interest Rates

Check Free CIBIL score

CIBIL score calculation

CIBIL score range

Check CIBIL score by pan card

CIBIL score for home loan

EPF

EPF Passbook

UAN Activation

Unified Member Portal

EPF Claim Status