Loan Against Property EMI Calculator

Calculate your EMI with the Loan Against Property EMI Calculator to better organise your budget. The LAP calculator is an online application that is free to use by everyone. The instrument produces correct results without any difficulty.

Calculator Information

The Equipment Finance Calculator calculates the type of repayment required, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate. The Product selected determines the default interest rate for personal loan product. The Equipment Finance Calculator also calculates the time saved to pay off the loan and the amount of interest saved based on an additional input from the customer. This is if repayments are increased by the entered amount of extra contribution per repayment period. This feature is only enabled for the products that support an extra repayment. The calculations are done at the repayment frequency entered, in respect of the original loan parameters entered, namely amount, annual interest rate and term in years.Calculator Assumptions

Length of Month

All months are assumed to be of equal length. In reality, many loans accrue on a daily basis leading to a varying number of days interest dependent on the number of days in the particular month.Number of Weeks or Fortnights in a Year

One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.Rounding of Amount of Each Repayment

In practice, repayments are rounded to at least the nearer cent. However the calculator uses the unrounded repayment to derive the amount of interest payable at points along the graph and in total over the full term of the loan. This assumption allows for a smooth graph and equal repayment amounts. Note that the final repayment after the increase in repayment amount.Rounding of Time Saved

The time saved is presented as a number of years and months, fortnights or weeks, based on the repayment frequency selected. It assumes the potential partial last repayment when calculating the savings.Amount of Interest Saved

This amount can only be approximated from the amount of time saved and based on the original loan details.Calculator Disclaimer

The results from this calculator should be used as an indication only. Results do not represent either quotes or pre-qualifications for the product. Individual institutions apply different formulas. Information such as interest rates quoted and default figures used in the assumptions are subject to change.

Feel free to use our Equipment Finance Calculator

Sorry

This video does not exist.

| Period | Payment | Interest | Balance |

|---|

Calculator Disclaimer

The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.

Loan Against Property EMI Calculator Online

A Loan Against Property The EMI Calculator is an online tool for calculating mortgage loan payments. As you enter loan against property (LAP) information such as amount, rate of interest, and term, the calculator will automatically produce monthly installments and a loan amortisation schedule. You can easily utilise a free Loan EMI Calculator 24 hours a day, seven days a week on lender and aggregator websites and applications. Using an EMI Calculator allows you to make informed borrowing decisions.

Table of Contents

ToggleLoan Against Property EMI Calculation

Currently, the lowest Loan Against Property EMI is Rs. 1,008 per lakh at 8.90% per annum. Leading lenders, including SBI, HDFC, ICICI Bank, IDBI First Bank, IndusInd Bank, Tata Capital, and Bajaj Finserv, provide the greatest LAP offers.

Let’s use LoansWala LAP EMI Calculator to calculate the EMI and amortisation schedule for a Loan Against Property using the following parameters:

Loan Amount: Rs 1,00,000

Loan Tenure: 15 years

Rate of Interest: 8.90%

As you fill these details, EMI Calculator will share following results:

Total Payment: Rs 1,81,499

Total Interest: Rs 81,499

EMI: Rs 1,008

You will also get following LAP Amortization schedule.

| Year | Opening Balance | EMI*12 | Interest (p.a) | Principal (p.a) | Closing Balance |

|---|---|---|---|---|---|

| 1 | Rs. 1,00,000 | Rs. 12,100 | Rs. 8,766 | Rs. 3,334 | Rs. 96,666 |

| 2 | Rs. 96,666 | Rs. 12,100 | Rs. 8,457 | Rs. 3,643 | Rs. 93,023 |

| 3 | Rs. 93,023 | Rs. 12,100 | Rs. 8,119 | Rs. 3,981 | Rs. 89,043 |

| 4 | Rs. 89,043 | Rs. 12,100 | Rs. 7,750 | Rs. 4,350 | Rs. 84,693 |

| 5 | Rs. 84,693 | Rs. 12,100 | Rs. 7,347 | Rs. 4,753 | Rs. 79,940 |

| 6 | Rs. 79,940 | Rs. 12,100 | Rs. 6,906 | Rs. 5,194 | Rs. 74,746 |

| 7 | Rs. 74,746 | Rs. 12,100 | Rs. 6,425 | Rs. 5,675 | Rs. 69,071 |

| 8 | Rs. 69,071 | Rs. 12,100 | Rs. 5,898 | Rs. 6,202 | Rs. 62,870 |

| 9 | Rs. 62,870 | Rs. 12,100 | Rs. 5,323 | Rs. 6,777 | Rs. 56,093 |

| 10 | Rs. 56,093 | Rs. 12,100 | Rs. 4,695 | Rs. 7,405 | Rs. 48,688 |

| 11 | Rs. 48,688 | Rs. 12,100 | Rs. 4,008 | Rs. 8,091 | Rs. 40,597 |

| 12 | Rs. 40,597 | Rs. 12,100 | Rs. 3,258 | Rs. 8,842 | Rs. 31,755 |

| 13 | Rs. 31,755 | Rs. 12,100 | Rs. 2,438 | Rs. 9,662 | Rs. 22,094 |

| 14 | Rs. 22,094 | Rs. 12,100 | Rs. 1,543 | Rs. 10,557 | Rs. 11,536 |

| 15 | Rs. 11,536 | Rs. 12,100 | Rs. 564 | Rs. 11,536 | Rs. 0 |

How LAP EMI is Calculated?

A Loan Against Property is repaid in Equated Monthly Installments (EMIs). The interest component is calculated using the declining balance approach, thus interest payments decrease with loan tenure. You can easily calculate loan EMI using an online calculator. Simply enter the loan amount, period, and interest rate, and you will receive a quick EMI and payback schedule. By evaluating different rates and tenures, you can determine an affordable EMI plan based on your repayment capacity.

Formula for calculating EMI is:

EMI = [P x R x (1+R) ^ N] / [ (1+R) ^ N-1]

Where,

P = Principal amount

R = Rate of Interest

N = Tenure in months

Loan Against Property Interest Rate Calculator

A Loan Against Property The EMI calculator is an online tool that allows you to effortlessly determine the monthly instalments you must pay towards the loan against the property amount. This tool provides reliable results based on certain inputs, such as loan amount, interest rate, and loan tenure. The calculator aids in better financial planning and determining payback capability.

Factors Affecting LAP EMI Calculation

Following factors will affect the EMI of your mortgage loan:

- The primary amount is the loan amount you borrowed from a bank or financial organisation. The EMI is calculated as the interest % on this amount. As you return the EMI, the main amount decreases, which reduces your interest liability.

- Term: The term of an LAP might range from 10 to 15 years, depending on the lender’s credit policy. Furthermore, the applicant’s current and retirement ages have an impact on loan tenure. Longer tenures result in reduced EMIs.

- Every borrower wants to lock in the best interest rate possible. However, the offer rate is determined by the type of property being mortgaged, the borrower’s profile, and their credit score. The rate will also vary based on the lender’s credit policy. The rate may be floating or fixed.

Why Use a Loan Against Property Calculator?

A Loan EMI Calculator simplifies the EMI computation process. Simply enter the loan amount, tenure, and interest rate to automatically calculate the EMI and amortisation plan in a couple of seconds. It is now fully hassle-free for the applicant to analyse loan affordability. EMI Calculator allows you to compare the EMI load for various tenures and amounts and make an informed borrowing decision. As a long-term financial commitment, it is always essential that you understand your payback obligations before applying for a loan.

Benefits of Using a Loan Against Property Calculator

- A free tool for determining EMI and loan amortisation schedules.

- Eliminates the need for manual mathematical calculations.

- Easily calculate your EMI.

- The tool is simple to use and freely available online.

- The calculator is accessible to all users. No technical knowledge is required.

- No limit on consumption.

- Change tenure and rate combinations to get an inexpensive EMI that fits your budget.

- Conveniently compare LAP offerings.

How to Use LoansWala Loan Against Property Calculator?

It is 100% free and absolutely easy to calculate LAP EMI using LoansWala Loan Against Property Calculator. Here are the steps to follow:

- Go to LoansWala official website.

- Under Financial Tools, select EMI Calculator.

- Enter loan details such as amount, tenure and rate of interest.

- Hit ‘Calculate’ button to get EMI.

- You will get loan EMI, overall interest payment and amortization schedule.

Product Overview: What is Loan Against Property?

A Loan Against Property (LAP) is a secured loan made against a self-owned residential or commercial property. The borrower commits property to the bank or NBFC in exchange for the loan amount. The loan amount is determined as a proportion of the property’s market value. This ratio is known as loan-to-value (LTV) for mortgages. The loan can be obtained as a term loan, an overdraft facility, or a demand loan. LAPs, like personal loans, have no restrictions on their end usage. You can obtain a property loan for personal, business, or other purposes. The effective rate of interest is calculated based on the loan amount, borrower eligibility, credit score, and other factors.

Currently, the lowest LAP interest rate starts at 8.90% per annum for a maximum of fifteen years.

Types of Property Eligible for LAP/ Mortgage Loan

A Loan Against Property (LAP) is a secured loan made against a self-owned residential or commercial property. The borrower commits property to the bank or NBFC in exchange for the loan amount. The loan amount is determined as a proportion of the property’s market value. This ratio is known as loan-to-value (LTV) for mortgages. The loan can be obtained as a term loan, an overdraft facility, or a demand loan. LAPs, like personal loans, have no restrictions on their end usage. You can obtain a property loan for personal, business, or other purposes. The effective rate of interest is calculated based on the loan amount, borrower eligibility, credit score, and other factors.

Currently, the lowest LAP interest rate starts at 8.90% per annum for a maximum of fifteen years.

| Feature | Description |

|---|---|

| Interest rate | 8.90% p.a. onwards |

| Tenure | Flexible, up to 15 years |

| Purpose |

|

| Processing fee |

|

| Prepayment charges | NIL for floating rate loans |

| Stamp duty/other charges | As applicable |

| Documents Required |

|

Types of Loan Against Property

1. Loan Against Property- Term Loan

- Purpose: Term LAP for personal, business, educational, medical & other purposes.

- Amount of loan: You can avail loan up to 70 % of the property’ market value.

- Margin: A margin for LAP ranges from 30 – 50 %.

- Interest: LAP Interest rates start from 8.90% p.a.

- Tenure: Maximum tenure for LAP will go up to 15 years.

- Security: Self-owned residential, commercial or industrial property

- Processing fee: up to 1 %.

2. Lease Rental Discounting

- Lease Rental Discounting is offered against rental properties. The loan is approved on submission of rental receipts.

- Purpose: Same as Loan Against Property Term Loan.

- Amount of loan: Up to 60% of property value.

- Margin: The margin vary from 30-50%.

- Tenure: Tenure ranges up to 10 years.

3. Overdraft Facility Against Property

- Overdraft facilities against property are sanctioned against residential, commercial or industrial property for multiple purposes. The OD is sanctioned for 1 year and can be renewed next year as per eligibility.

- Purpose: This dropping overdraft facility can be used for working capital requirements.

- Repayment: The interest applies to the amount consumed and needs to be paid as per statement each month.

- Margin: A margin of 40% to 55% is stipulated.

- Processing charge: Processing fees are usually low and start from 0.5% of the loan amount.

Amortization Table

| Year | Opening Balance | Amount paid by customer (EMI*12) | Interest paid during the year | Principal paid during the year | Closing Balance |

|---|---|---|---|---|---|

| 1 | ₹5000000 | ₹504163 | ₹366294 | ₹137869 | ₹4862131 |

| 2 | ₹4862131 | ₹604996 | ₹425526 | ₹179470 | ₹4682661 |

| 3 | ₹4682661 | ₹604996 | ₹408885 | ₹196111 | ₹4486551 |

| 4 | ₹4486551 | ₹604996 | ₹390702 | ₹214294 | ₹4272256 |

| 5 | ₹4272256 | ₹604996 | ₹370832 | ₹234164 | ₹4038092 |

| 6 | ₹4038092 | ₹604996 | ₹349120 | ₹255876 | ₹3782216 |

| 7 | ₹3782216 | ₹604996 | ₹325394 | ₹279601 | ₹3502615 |

| 8 | ₹3502615 | ₹604996 | ₹299469 | ₹305527 | ₹3197088 |

| 9 | ₹3197088 | ₹604996 | ₹271140 | ₹333856 | ₹2863232 |

| 10 | ₹2863232 | ₹604996 | ₹240185 | ₹364811 | ₹2498421 |

| 11 | ₹2498421 | ₹604996 | ₹206359 | ₹398637 | ₹2099784 |

| 12 | ₹2099784 | ₹604996 | ₹169396 | ₹435599 | ₹1664185 |

| 13 | ₹1664185 | ₹604996 | ₹129007 | ₹475989 | ₹1188196 |

| 14 | ₹1188196 | ₹604996 | ₹84872 | ₹520124 | ₹668072 |

| 15 | ₹668072 | ₹604996 | ₹36646 | ₹568350 | ₹99722 |

| 16 | ₹99722 | ₹100833 | ₹1111 | ₹99722 | ₹0 |

| Year | Opening Balance | Interest paid during the year | Closing Balance |

|---|---|---|---|

| 1 | ₹5000000 | ₹366294 | ₹4862131 |

| 2 | ₹4862131 | ₹425526 | ₹4682661 |

| 3 | ₹4682661 | ₹408885 | ₹4486551 |

| 4 | ₹4486551 | ₹390702 | ₹4272256 |

| 5 | ₹4272256 | ₹370832 | ₹4038092 |

| 6 | ₹4038092 | ₹349120 | ₹3782216 |

| 7 | ₹3782216 | ₹325394 | ₹3502615 |

| 8 | ₹3502615 | ₹299469 | ₹3197088 |

| 9 | ₹3197088 | ₹271140 | ₹2863232 |

| 10 | ₹2863232 | ₹240185 | ₹2498421 |

| 11 | ₹2498421 | ₹206359 | ₹2099784 |

| 12 | ₹2099784 | ₹169396 | ₹1664185 |

| 13 | ₹1664185 | ₹129007 | ₹1188196 |

| 14 | ₹1188196 | ₹84872 | ₹668072 |

| 15 | ₹668072 | ₹36646 | ₹99722 |

| 16 | ₹99722 | ₹1111 | ₹0 |

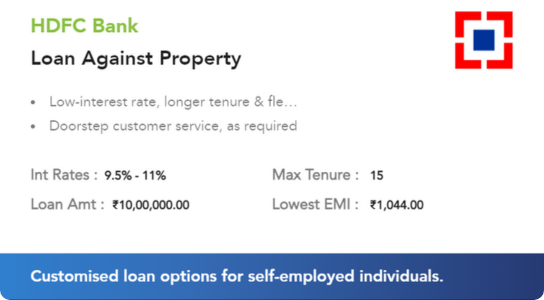

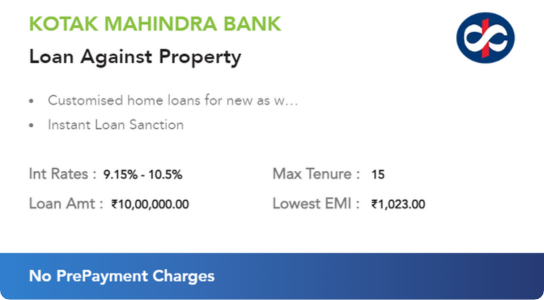

Best Deals

From Our Blog

FAQs

Yes, Loan Against Property can be obtained by businesses or groups for commonly owned commercial buildings. To be qualified for the loan, you must verify ownership of the property as well as present proof of the company’s business and profits.

The bank and the EMI calculator both use the identical formula to calculate the EMI. You should ensure that the components, i.e., loan tenure, interest rate, and loan amount, considered by the bank and the calculator, are all the same. Don’t forget to include professional costs in the loan amount when calculating the EMI. If this is done, the EMI provided by the bank and the EMI determined by the calculator will be the same.

The loan amount obtained through Loan Against Property has no constraints on how it is used. It can thus be used for renovations if necessary.

Calculating the EMI manually might be difficult due to the number of sophisticated calculations involved. The Loan Against Property Calculator will do the calculations quickly and provide you with an extremely precise answer.

Yes, the LoansWala Loan Against Property Calculator is a 100% free service available to everyone with a basic internet connection.

The sort of loan you should take depends on your needs and the type of property you own. For example, if you possess a present property (commercial or residential), you should consider a Loan Against Property. If you have a rental property from which you have been receiving rent on a regular basis, you may be eligible for a Lease Rental Discount. If you require regular, frequent funding, you could use an overdraft facility.

Apply for Home Loan

SBI Home Loan

HDFC Home Loan

Bandhan Bank Home Loan

PNB Home Loan

SBI Loan Against Property

LAP without Income Proof and ITR

Home First Loan Against Property

HDFC Loan Against Property

Yes Bank Loan Against Property

Loan Against Property Eligibility

SBI Loan Against Property Eligibility

HDFC Loan Against Property Eligibility

PNB Loan Against Property Eligibility

SBI Bank Loan Against Property Interest Rates

HDFC Loan Against Property Interest Rates

ICICI Loan Against Property Interest Rates

PNB Loan Against Property Interest Rates

SBI Loan Against Property

LAP without Income Proof and ITR

Home First Loan Against Property

HDFC Loan Against Property

Yes Bank Loan Against Property

SBI Bank Loan Against Property Interest Rates

HDFC Loan Against Property Interest Rates

ICICI Loan Against Property Interest Rates

PNB Loan Against Property Interest Rates

Loan Against Property Eligibility

SBI Loan Against Property Eligibility

HDFC Loan Against Property Eligibility

PNB Loan Against Property Eligibility

Apply for Home Loan

SBI Home Loan

HDFC Home Loan

Bandhan Bank Home Loan

PNB Home Loan