Refinance Home

Loan @8.35%*

Lower EMIs,

Higher Savings!!

Are you making regular EMI payments on your home loan? It’s time for a reward. Transfer your outstanding home loan to a new bank and lock in the lowest possible interest rate of 8.35% per annum. New EMIs begin at Rs.758 per lakh. Check your eligibility and obtain fast approval for this exciting deal.

Let's find the best Personal

loan for you

Let’s find the best

HLBT for you.

Currently, the best home loan balance transfer interest rate is 8.35% per annum. While refinancing your outstanding housing loan balance, you can take advantage of additional perks such as home loan top-up, lower EMIs, and extended tenure. Check your eligibility for immediate approval on a home loan balance transfer.

Get Lowest Rate

With a home loan balance transfer, you can get the finest refinancing offer at the lowest interest rate. Currently, the lowest house loan balance transfer starts at 8.35% per annum.

Trim down EMIs

A lower interest rate allows your current EMIs to be decreased. After resetting a Rs 50 lakh loan at 8.35% for 20 years, a 30-point interest rate drop can reduce your EMI by Rs 1000 and the total interest payable by Rs 2 lakhs.

Avail Top Up

Enjoy increased repayment flexibility with a home loan balance transfer top up and/or overdraft based on your need. Check your eligibility for housing loan refinancing and reset home loan conditions based on your monthly budget.

Get Lowest Rate

With a home loan balance transfer, you can get the finest refinancing offer at the lowest interest rate. Currently, the lowest house loan balance transfer starts at 8.35% per annum.

Trim down EMIs

A lower interest rate allows your current EMIs to be decreased. After resetting a Rs 50 lakh loan at 8.35% for 20 years, a 30-point interest rate drop can reduce your EMI by Rs 1000 and the total interest payable by Rs 2 lakhs.

Avail Top Up

Enjoy increased repayment flexibility with a home loan balance transfer top up and/or overdraft based on your need. Check your eligibility for housing loan refinancing and reset home loan conditions based on your monthly budget.

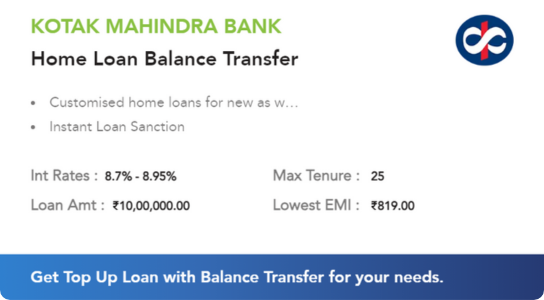

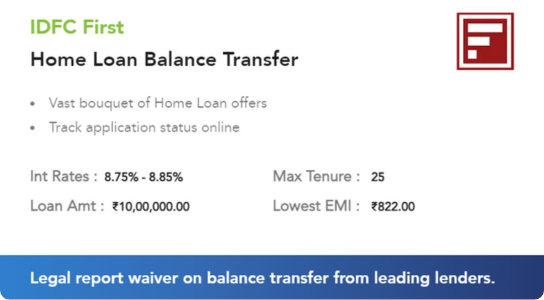

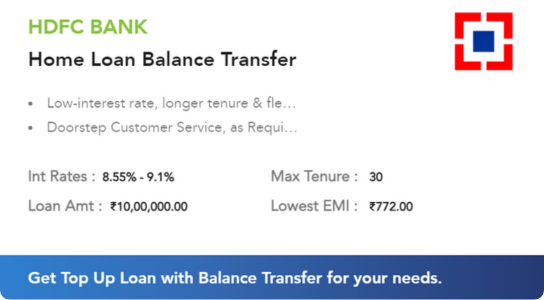

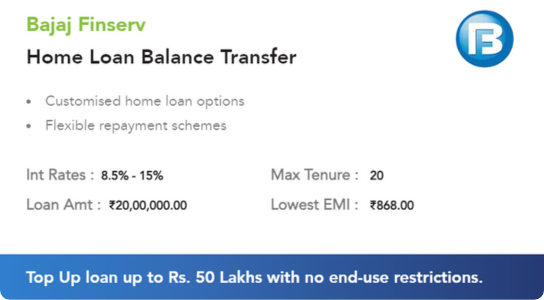

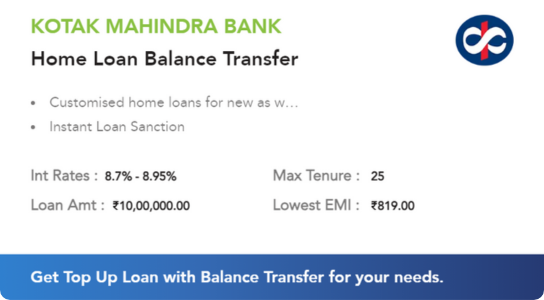

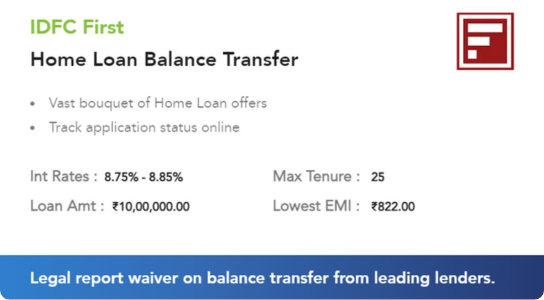

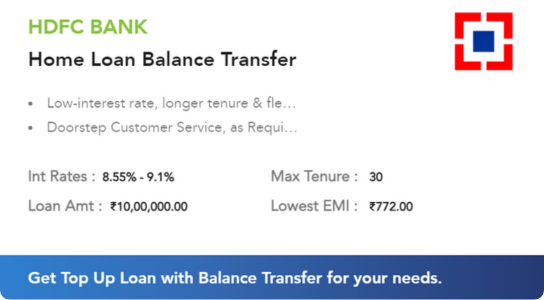

Popular Home Loans Balance Transfer

Popular Home Loans Balance Transfer

View and improve your

credit score - for free.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

View and improve your

credit score - for free.

✔ Recognise the quality of your score.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

The best offers from India's most

trusted banks

The best offers

from India’s

most

trusted banks

Home Loan Balance Transfer starts at 8.35% per annum for all profiles.

Apply for a Home Loan Balance Transfer online today and get a cheaper interest rate starting at 8.35% per annum. Receive better terms and services. During the balance transfer process, you can also apply for an instant top-up loan.

Home Loan Balance Transfer starts at 8.35% per annum for all profiles.

Apply for a Home Loan Balance Transfer online today and get a cheaper interest rate starting at 8.35% per annum. Receive better terms and services. During the balance transfer process, you can also apply for an instant top-up loan.

Financial Tools

Financial Tools

Related Blogs

Related Blogs

Refinance Home Loan @8.35%* Lower EMIs, Higher Savings!!

Are you making regular EMI payments on your home loan? It’s time for a reward. Transfer your outstanding home loan to a new bank and lock in the lowest possible interest rate of 8.35% per annum. New EMIs begin at Rs.758 per lakh. Check your eligibility and obtain fast approval for this exciting deal.

Let’s find the best HLBT for you.

Currently, the best home loan balance transfer interest rate is 8.35% per annum. While refinancing your outstanding housing loan balance, you can take advantage of additional perks such as home loan top-up, lower EMIs, and extended tenure. Check your eligibility for immediate approval on a home loan balance transfer.

Get Lowest Rate

With a home loan balance transfer, you can get the finest refinancing offer at the lowest interest rate. Currently, the lowest house loan balance transfer starts at 8.35% per annum.

Trim down EMIs

A lower interest rate allows your current EMIs to be decreased. After resetting a Rs 50 lakh loan at 8.35% for 20 years, a 30-point interest rate drop can reduce your EMI by Rs 1000 and the total interest payable by Rs 2 lakhs.

Avail Top Up

Enjoy increased repayment flexibility with a home loan balance transfer top up and/or overdraft based on your need. Check your eligibility for housing loan refinancing and reset home loan conditions based on your monthly budget.

Popular Home Loans Balance Transfer

View and improve your

credit score - for free.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

The best offers from India's most

trusted banks

Apply for Lowest Home Loan Online @ Rs. 758/Lakh* EMI

Apply for an immediate home loan online with interest rates starting as low as 8.35% per year. Pay an EMI of only Rs. 758 per lakh. The loan has a variable repayment period of up to 30 years. Apply today with minimal documentation. Check your eligibility and obtain fast approval here.

Financial Tools

From Our Blog

Learn More About Home Loans Balance Transfer

Domestic Advance Adjust Exchange (HLBT) is renegotiating or exchanging of your existing Domestic Credit to a unused bank. Utilizing HLBT office you’ll be able exchange Domestic Credit Adjust to the modern bank and profit of benefits such as lower Domestic Advance intrigued rate, reasonable or corrected EMIs, increase/decrease credit residency and/or best up to 100% of Domestic Credit. Most banks promptly favor the adjust exchange applications at lower rates since it is productive and moo unsafe to welcome clients already having a great reimbursement history. Within the final one year most extreme Domestic Credit Adjust Exchange demands are made due to noteworthy redresses in Domestic Credit Intrigued rates. The Domestic Advances (connected to repo rates) are accessible at most reduced of 8.35% interest rate for 30 years. It is best to take Domestic Credit Exchange within the beginning a long time, when your intrigued risk is tall.

Let’s burrow profound into the method of Domestic Advance Adjust Exchange and get it how it works.

- The takeover of the extraordinary Domestic Advance adjust from the existing moneylender is treated as a new credit by the new moneylender.

- Similar to a modern advance, the loan specialist will survey soundness of pay, credit score, and KYC confirmation. A endorsed application for the adjust exchange ought to be submitted to the existing bank.

- The board advocate and the board valuer of the modern loan specialist will attempt investigation of property reports and property valuation.

- The exchange of adjust will be permitted by the existing loan specialist as it were after the credit has run for a least period as endorsed at the time of credit endorsement. Until at that point, the No Complaint Certificate (NOC) will not be issued by the bank.

- The unused moneylender will treat the adjust exchange like a new advance and thus preparing charges will be collected at the endorsed rate, which ranges from 0.5% to 1% of the credit sum.

- On exchange of the extraordinary adjust consequent EMI gets to be payable to the modern moneylender.

| Bank/NBFC | Minimum Interest Rates | Processing Fees |

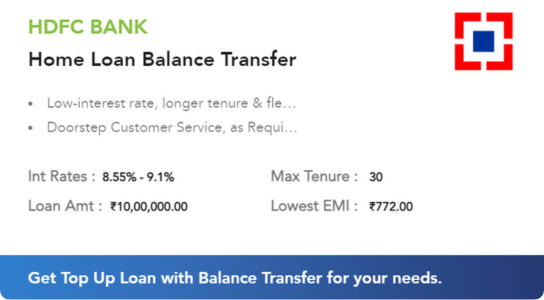

| HDFC Bank | 8.55% – 9.10% | 0.50% of the loan amount with a maximum of 3,000. |

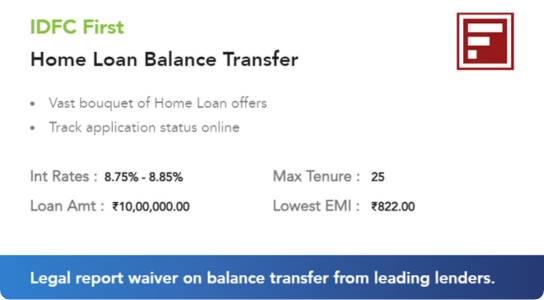

| IDFC First Bank | 8.75% | up to 0.50% of the loan amount |

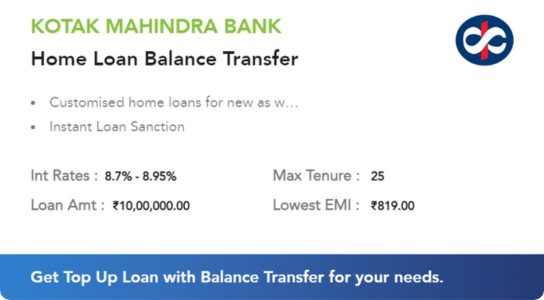

| Kotak Bank | 8.70% | up to 0.50% of the loan amount |

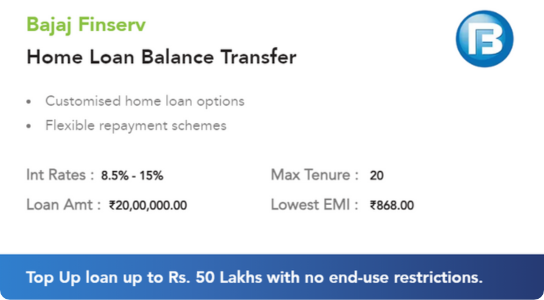

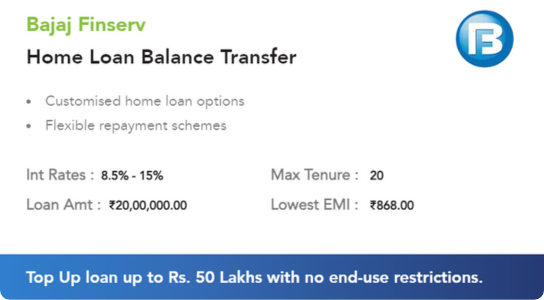

| Bajaj Finserv | 8.50% – 15.00% | Up to 0.50% – 7% |

| Home First Finance | 8.00% – 22.00% | Up to 0.50% – 7% |

| Bank of Baroda | 8.40% – 10.60% | 0.50% of the loan amount with a minimum of 7,500 and a maximum of 12,500. |

| SBI | 8.40% – 10.05% | 0.35% of the loan amount (minimum: Rs 10000 ; maximum: Rs 30000 ) GST as applicable |

| HSBC Bank | 8.45% | 0.50% of the loan amount with a maximum of 10,000. |

| Axis Bank | 8.75% – 9.10% | Up to 1% of the loan amount with a maximum of 10,000. |

| ICICI Bank | 9.00% – 10.05% | 0.50% of the loan amount. |

| Punjab National Bank | 8.40% – 10.25% | 0.50% of the loan amount. |

| Canara Bank | 8.40% to 11.75% | 0.50% of the loan amount. |

| Yes Bank | 9.40% – 10.25% | 2% on the loan amount with a maximum of 15,000. |

The eligibility criteria for the Home Loan Balance Transfer are similar to that of a home loan. The factors for eligibility can be listed as:

- Existing Loan: The applicant should be serving a Home Loan from RBI registered bank/ NBFC. The lender will also assess payment history of EMIs.

- Age: Applicants for HLBT should be between 21 to 60 years of age. The criteria may slightly vary for self employed individuals with age relaxation up till 65-70 years.

- Occupation: Salaried, self-employed, professionals as well as business owners can apply.

- Co-applicants: Up to 3 co-applicants can be added.

- Income: The minimum income should be Rs 15000. However the criteria will vary across the lenders.

- Experience: Even for HLBT, your business/ job continuity will matter. Experience of at least 2-3 years with the present employer and business vintage of 3 years with 2 years of profit-making period are considered.

- Credit Score: The credit score should be above 650. In case the CIBIL Score has declined from score assessed previously at the time of availing of existing Home Loan & is not as per lender’s credit policy, the balance transfer request can be rejected.

- Debt to income ratio of 40% to 50% should be complied with.

- LTV: Up to 90% of property value and as per lender’s credit policy.

A Home Loan Balance Transfer account is identical to a Home Loan account in terms of fees and charges. When you apply for a balance transfer, the bank will impose processing and administrative costs. Furthermore, punitive and prepayment charges will apply. Overall Home Loan Balance Transfer charges will vary depending on the lender’s policies.

Most banks and NBFCs follow the rates shown below:

- Processing fees will range between 0.5% and 2% of the loan amount.

- The penalty charge will be up to 2% of the outstanding balance per month.

- Foreclosure fees will be up to 4% of the pre-paid sum.

Home Loan Balance Transfer or refinancing switches your Home Loan to a new lender. You should take due diligence to ensure best saving and maximum benefits of transferring the loan. We have outlined step by step process to ease the loan transfer journey below-

How to transfer home loan from one bank to another?

- Pre-steps: First things first, make sure you have shortlisted the new lender for right reasons. Do your maths & calculate the savings.

- Contact existing lender: Submit an application/ form for Balance transfer and share reasons for the switch.

- Obtain NOC: After reviewing your application, the bank will share NOC or Consent Letter. The new lender will start the balance transfer only after your submit this document.

- Submit documents to the new lender. After obtaining NOC, submit all the necessary documents to the new lender. Besides KYC & property documents, the lender will also access documents validating Home Loan Balance such as interest statement and loan statement.

- Takeover: The new lender will take over the loan balance and repay the outstanding loan amount to the old lender. The bank will submit all property documents to new lender and confirm the same to you.

- Sign the agreement & pay processing fee & other charges. On approval of the take-over, obtain a sanction letter from the new lender and read the terms and conditions to ensure that there are no hidden charges.

The new lender will make a new home loan agreement including updated loan amount with top up (if requested), interest rate, schedule of EMIs, fees & charges. Sign the loan agreement and pay out applicable fees and charges.

The disbursal will be made by way of a cheque or draft or through RTGS directly into the existing Home Loan account.

rom next month, the EMIs will be due to the new lender as per the newly framed agreement.

There are no one-size-fits-all products. So choose the Best Home Loan Transfer option based on your individual requirements. If the new lender’s offer meets any of the following requirements, it is likely to be an ideal fit for you:

- Lower rate of intrigued- In most extreme cases, individuals choose adjust exchange for lower intrigued rate. You’ll consider arranging with the existing bank for renegotiating your advance or want a modern moneylender who is willing to offer a lower rate. Make beyond any doubt the contrast in rate after the switch is at slightest 50 bps. The higher is the contrast, higher will be the sparing.

- Better post disbursal benefit- On the off chance that your existing bank has unbending terms and you’re looking for superior client benefit and ease of credit reimbursement, make beyond any doubt you studied unused lender’s terms carefully other than perusing client reviews.

- Lower EMIs- Examine the modern EMI arrange and calculate the sparing. Make beyond any doubt you are doing not increment generally intrigued burden on your Home Advance.

- Best Up- In the event that beat is what you’re searching for, do investigate the top-up choice along with your current loan specialist. Compare the offer with a new lender and as it were make a choice after a astute comparison.

- Reimbursement adaptability- There’s no dispossession charge on Domestic Credit prepayment. In any case some of the time, there can be lock-in or constrain on the sum that can be pre-paid for gratis. So make beyond any doubt you carefully evaluate what kind of reimbursement adaptability you’re seeking for from the modern bank.

Choose the lender after careful consideration. The preceding checklist will assist you. The top banks for best Home Loan Balance Transfer are HDFC Bank, Axis Bank, Kotak Mahindra, ICICI Bank, and SBI Bank.

| Loan amount | Old rates | New Rates | Old EMI | New EMI | You Save / Month |

| 5 Lakh | 8.60% | 8.50% | Rs. 6,226 | Rs. 6,199 | Rs. 27 |

| 9 Lakh | 8.60% | 8.50% | Rs. 11,207 | Rs. 11,159 | Rs. 48 |

| 12 Lakh | 8.60% | 8.50% | Rs. 14,943 | Rs. 14,878 | Rs. 65 |

| 15 Lakh | 8.60% | 8.50% | Rs. 18,678 | Rs. 18,598 | Rs. 80 |

| 20 Lakh | 8.60% | 8.50% | Rs. 24,904 | Rs. 24,797 | Rs. 107 |

| 25 Lakh | 8.60% | 8.50% | Rs. 31,130 | Rs. 30,996 | Rs. 134 |

Decide on adjust exchange in taking after circumstances:

1. When intrigued rates are falling & you’re qualified to induce lower rate by exchanging your Domestic Credit Scheme. Eg. from MCLR to repo connected Domestic Credit.

2. After you have a budgetary crunch, and/or you need to profit of a Beat Up and/ or need to adjust EMIs or Tenor as per your current cash flows.

3. Once you are seeking out for a few particular highlights which your display bank isn’t advertising.

In any case in any case, don’t disregard to compare Domestic Advance Adjust Exchange offers from diverse moneylenders. Compare Domestic Advance Intrigued Rates and connected expenses such as preparing expenses, dispossession charges, corrective charges etc. You’ll be able effectively compare the credits online on our site. Online Domestic Credit Adjust Exchange prepare is quick, dependable and bother free.

| KYC | Identity Proof : (any of the following)

|

Address Proof: (any of the following)

| |

| Income Proof – Financial Documents | Salaried Employees:

Statement of A/c for the past 1 year where your salary is credited Self-employed persons-

Partnership deed in case of partnership firms (if the applicant is one of the partners or the firm itself) Certificate of Incorporation for limited companies (if the applicant is one of the directors or the company itself) |

| Other Documents: |

|

| Property Documents: |

|

A Home Loan Balance Transfer (HLBT) account is similar to a conventional Home Loan Account. You merely change your lender; other duties, including as interest rate payments and EMI burdens, will remain under the new terms. First, discuss the HLBT application with your present lender and acquire a NOC. Submit a Consent letter to the new lender to commence the balance transfer. The new lender will take over the loan and property documentation. The Home Loan Balance Transfer process is straightforward, quick, and cost-effective.

When you receive a lower-interest-rate home loan offer from another lender, you should apply for a balance transfer. The gap in interest rates should be at least 60-100 basis points for significant savings. It is generally advantageous for MCLR-linked loans to convert to repo-linked loans, particularly in a decreasing rate environment. However, if you currently have a repo-linked house loan, your lending rate will be adjusted to reflect the benchmark rate over the next three months. If your credit score has improved and lenders are prepared to offer you better rates, you should consider a balance transfer. Other benefits include altered EMI plans, repayment flexibility, post-disbursement services, and so on.

Currently, Kotak Mahindra Bank has the lowest Home Loan Transfer rate in India. However, interest rates are not the sole consideration for selecting a lender. Before deciding on a lender, compare processing fees, penalties, late payment fees, and post-disbursement services. The top lenders for home loan balance transfers are SBI, HDFC, Axis, and ICICI Bank. The top NBFCs for HLBT in India are Bajaj Finserv, Tata Capital, and HDFC Housing.

No, a guarantor is not necessary when applying for a home loan transfer. In a mortgage, home loan, or LAP, the property in question acts as loan collateral, therefore the bank does not require a guarantor.

There is no limit on balance transfers. However, the final terms always vary based on the bank’s credit policy. The amount of the loan transfer will be approved based on your income, previous repayment history, credit score, and LTV.

The Home Loan Transfer Process may take between one and two weeks to complete. Because the transfer includes communication with two distinct lenders, the procedure will take longer than obtaining a new home loan. You should utilise a professional lending agency such as LoansWala to receive the quickest turnaround time and the best deal.

A person who chooses balance transfer can undoubtedly qualify for PMAY, as long as he or she has not previously used the scheme’s benefits. The PMAY stipend will only be extended once in a lifetime.

You must provide basic KYC documents such as your name and address, as well as proof of income and property. A fast list might include: Aadhar card, passport/voter ID/driver’s licence, latest three months’ salary slips, previous months’ bank statements indicating salary credits, Form 16 and IT returns, property documents, outstanding balance letter and no objection certificate from previous lender.