Gold Loans for

Urgent Cash

Needs

Apply for a fast gold loan by promising gold jewellery, ornaments, and coins to meet immediate cash needs. You can get a loan of up to Rs 1.5 crore at an interest rate of 7.50% per year for a period of 3 months to 3 years. There is a low EMI load, no end use restrictions, and no income eligibility limits.

Let's find the best Personal

loan for you

Let’s find the best

Gold Loan for you.

You are only a few steps away from receiving the greatest Gold loan offer in your city. Share your name, email address, and mobile number to receive a list of the finest gold loan schemes that meet your needs.

Faster Processing

Gold loans are completed more quickly than other sorts of bank loans. When the gold weight and purity are successfully verified, the payment is transferred to your bank account immediately. You can apply online.

No Income Proof and Credit Score

Gold loans are immediate, secured loans. Neither income evidence nor credit score qualifications are considered. These are emergency loans for difficult conditions such as unemployment, business failure, or unexpected cash shortages.

Low-Interest Rate

Gold loans are available at as low as 7.50% p.a. For shorter tenure, effective interest rate will be much lower @ 0.62 % per month. You can opt for No EMI or interest only EMI with bullet repayment.

Faster Processing

Gold loans are completed more quickly than other sorts of bank loans. When the gold weight and purity are successfully verified, the payment is transferred to your bank account immediately. You can apply online.

No Income Proof and Credit Score

Gold loans are immediate, secured loans. Neither income evidence nor credit score qualifications are considered. These are emergency loans for difficult conditions such as unemployment, business failure, or unexpected cash shortages.

Low-Interest Rate

Gold loans are available at as low as 7.50% p.a. For shorter tenure, effective interest rate will be much lower @ 0.62 % per month. You can opt for No EMI or interest only EMI with bullet repayment.

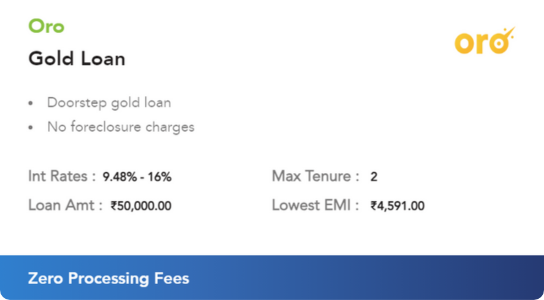

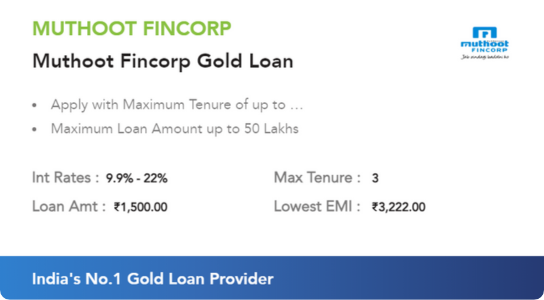

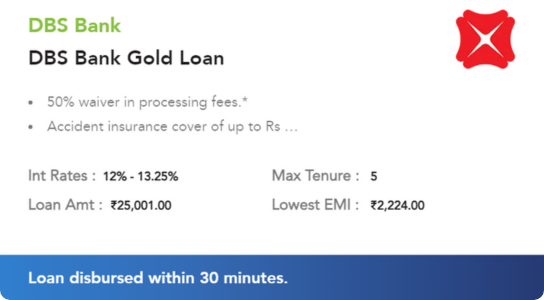

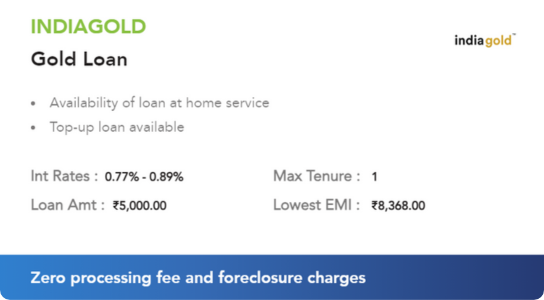

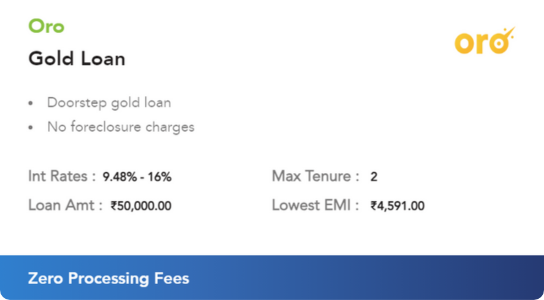

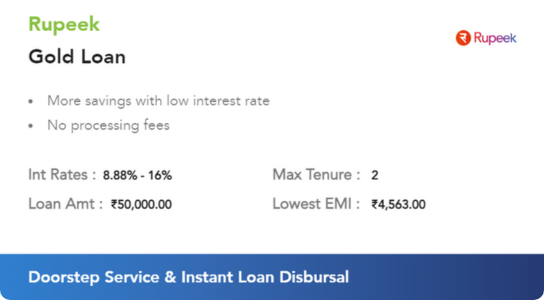

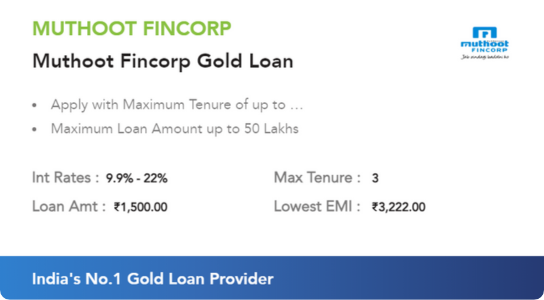

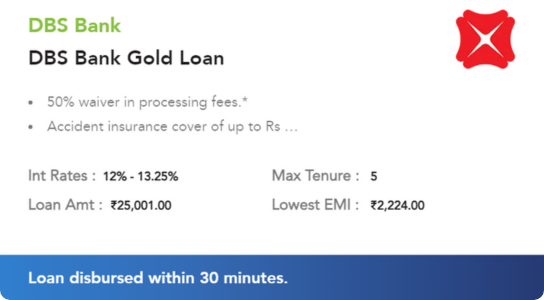

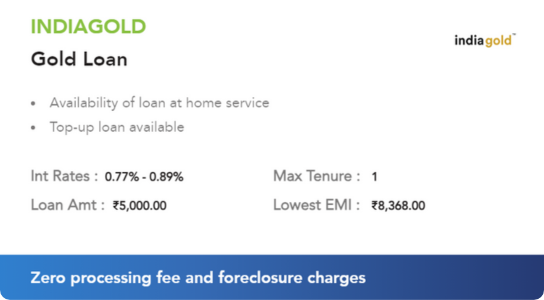

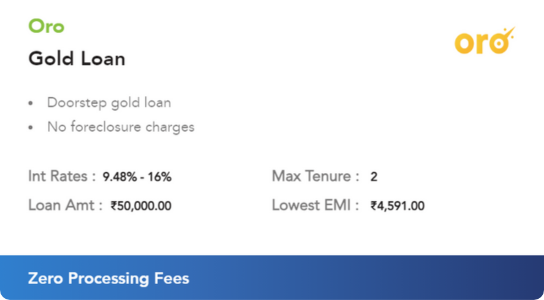

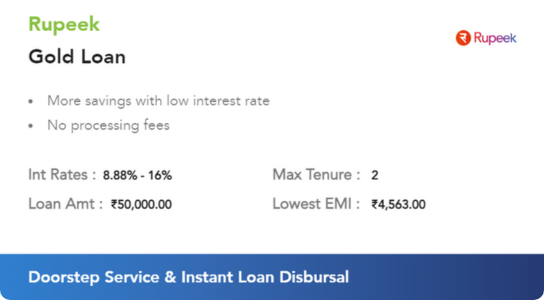

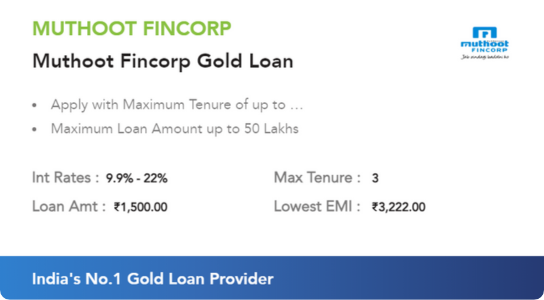

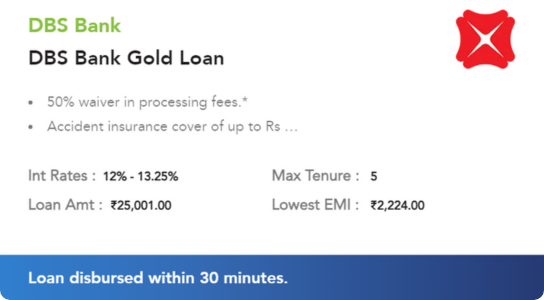

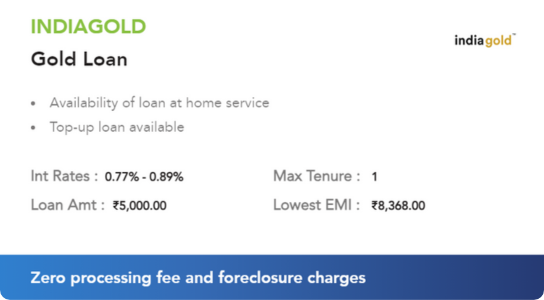

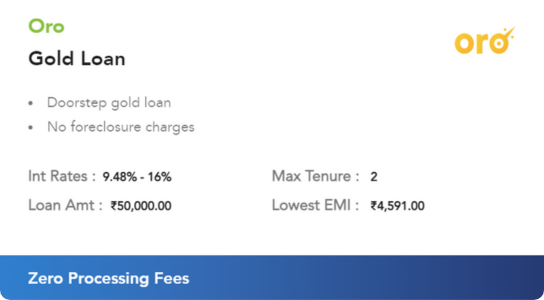

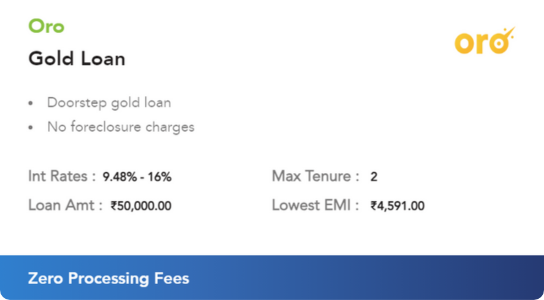

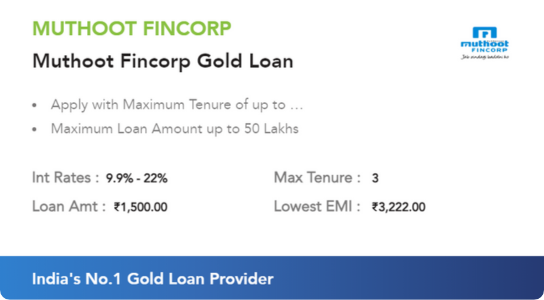

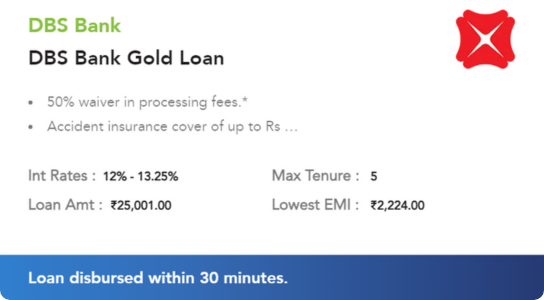

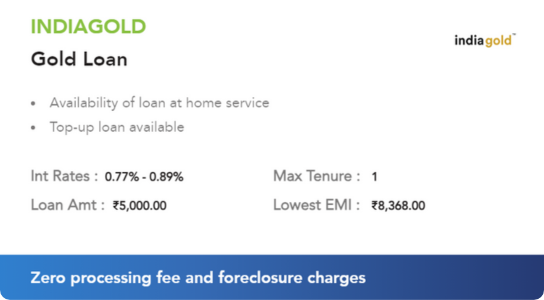

Gold Loan Offers

Gold Loan Offers

View and improve your

credit score - for free.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

View and improve your

credit score - for free.

✔ Recognise the quality of your score.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

Trending Loan Offers

Trending Loan Offers

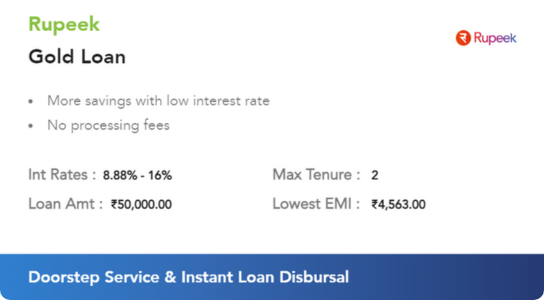

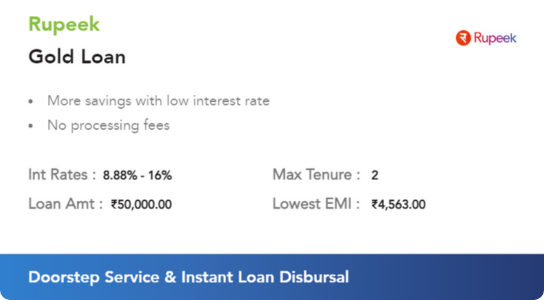

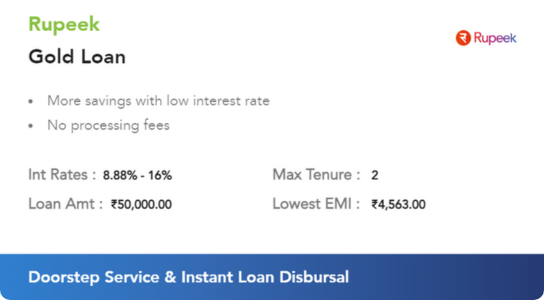

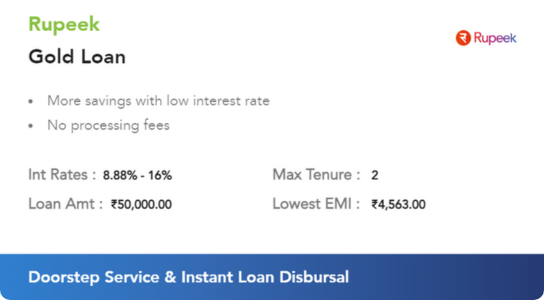

Get Gold Loan with No EMI Option from Rupeek

Rupeek Gold Loans are quick secured loans with no EMI option and interest rates starting at 8.88% per annum. You can get an emergency loan ranging from Rs 50000 to Rs 20 lakhs against gold jewels, coins, and ornaments. With the bullet repayment option, you repay the entire amount at the end of the term.

Get Gold Loan with No EMI Option from Rupeek

Rupeek Gold Loans are quick secured loans with no EMI option and interest rates starting at 8.88% per annum. You can get an emergency loan ranging from Rs 50000 to Rs 20 lakhs against gold jewels, coins, and ornaments. With the bullet repayment option, you repay the entire amount at the end of the term.

Financial Tools

Financial Tools

Related Blogs

Related Blogs

Gold Loans for Urgent Cash Needs

Apply for a fast gold loan by promising gold jewellery, ornaments, and coins to meet immediate cash needs. You can get a loan of up to Rs 1.5 crore at an interest rate of 7.50% per year for a period of 3 months to 3 years. There is a low EMI load, no end use restrictions, and no income eligibility limits.

Let’s find the best Gold Loan for you.

You are only a few steps away from receiving the greatest Gold loan offer in your city. Share your name, email address, and mobile number to receive a list of the finest gold loan schemes that meet your needs.

Faster Processing

Gold loans are completed more quickly than other sorts of bank loans. When the gold weight and purity are successfully verified, the payment is transferred to your bank account immediately. You can apply online.

No Income Proof and Credit Score

Gold loans are immediate, secured loans. Neither income evidence nor credit score qualifications are considered. These are emergency loans for difficult conditions such as unemployment, business failure, or unexpected cash shortages.

Low-Interest Rate

Gold loans are available at as low as 7.50% p.a. For shorter tenure, effective interest rate will be much lower @ 0.62 % per month. You can opt for No EMI or interest only EMI with bullet repayment.

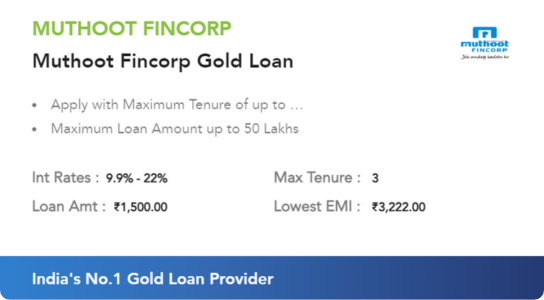

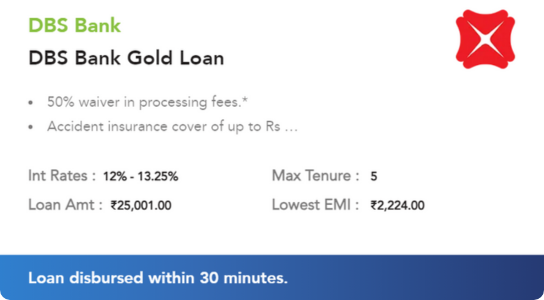

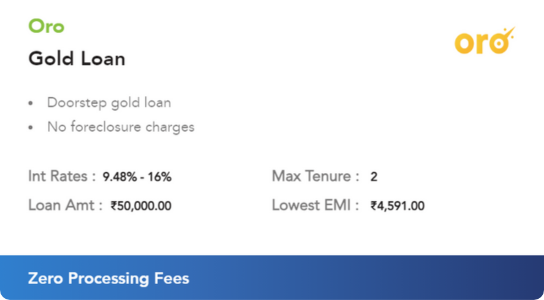

Gold Loan Offers

View and improve your

credit score - for free.

✔ Learn tips on how to make it better.

✔ Open offers based on your rating.

Trending Loan Offers

Get Gold Loan with No EMI Option from Rupeek

Rupeek Gold Loans are quick secured loans with no EMI option and interest rates starting at 8.88% per annum. You can get an emergency loan ranging from Rs 50000 to Rs 20 lakhs against gold jewels, coins, and ornaments. With the bullet repayment option, you repay the entire amount at the end of the term.

Financial Tools

From Our Blog

Learn More About Gold Loan

| Name of the Lender | Gold Loan Interest Rate | Processing Fees |

| Rupeek | 9.69% | Rs. 0 |

| Oro | 10.56% | Rs. 0 |

| Axis Bank | 12.50% to 17.50% | 1% plus applicable taxes |

| Kotak Mahindra Bank | 10% to 17% p.a. | Up to 2% of Loan amount + applicable GST |

| ICICI Bank | 10% p.a. | 1.0% of Loan Amount |

| HDFC Bank | 9.50% p.a. | 1% of Disbursal Amount |

| Union Bank of India | 9.40% p.a. | 1% of the Principal Loan Amount |

| Central Bank of India | 9.05% p.a. | 0.5% of the Loan Amount Plus tax |

| Bank of Baroda | 8.75% p.a. | 0%- 0.5% of the Loan Amount (Max. Rs. 3,500) |

| Punjab National Bank | 8.75% p.a. | 0.75% of Loan Amount |

| Canara Bank | 7.65% p.a. | 0.50% of the Loan Amount |

| State Bank of India | 7.50% p.a. | 0.5% of the Loan Amount + GST |

The Gold Loan is preferred for the following reasons:

- The security stipulated could be a product which is accessible at nearly each Indian domestic.

- The strategy included for a Gold Advance is exceptionally basic and the advance will be dispensed at the squint of any eye. It is that easy to profit a Gold Credit.

- There’s no expand confirmation in regard of wage, credit score, etc. Indeed a housewife who has no salary but has sufficient gold to pledge can profit a Gold Credit.

- There’s no ought to deliver any confirmation for the veritable buy of the gold that’s being vowed.

- It is an all-purpose advance that can be utilized for any reason. It can be utilized for arranging a wedding, arranging a occasion, buy of contraptions, for instruction costs, buy of property, etc. The conclusion utilize of the continues will not be addressed.

The benefits and features of the Gold Loan are as detailed below:

Reason: It is an all-purpose advance. It can be utilized for different purposes but for infamous exercises and exercises protested by law. It can be utilized for solidification of obligations, for arranging a wedding, for travel, for restorative crises, for buy of gold adornments, etc. Gold is given for rural as well as non-agricultural purposes. Within the case of farming, the advance is given for edit development and for investment in cultivate gear conjointly for allied-agricultural exercises.

Qualification: The essential necessity is the accessibility of the desired amount of gold. Too, the age of the candidate ought to be over 18. The candidate ought to be able to enter into a contract with the bank/financial institution and for that, the allowed age is over 18 years. Within the case of Gold Credit for rural purposes, verification of landholding should be submitted. This is often required since Gold Advances given for agrarian purposes are qualified for intrigued subvention.

Quantum: The credit quantum is proportionate to the weight of the gold promised. The rate per gram of gold with respect to the credit is settled by the loaning institution, which changes from time to time. It depends on the winning advertise rate for gold. Distinctive loan specialists have distinctive rates as per the credit arrangement of the institution. The quantum can too be based on the overall advertise esteem of the gold being promised. A edge of 25% to 35% will be set on the advertise cost of the gold. In other words, loan-to-value (LTV) will be 65% to 75% of the market cost of the gold pledged. Within the case of Gold Advance for rural purposes, the credit is based on the scale of back.

Intrigued: The intrigued rates are much lesser than the rates connected to Individual Credits. In case the amount of gold is relatively greater than the advance selected for, a few of the moneylenders encourage reduce the rate of interest. Interest is based on the virtue of gold in some of the banks/financial educate.

Turnaround time:

The method included for profiting a Gold Advance is checking the virtue and weight of the gold by the appraiser, which can allow the moment quantum qualification. The documentation is additionally negligible. A few of the educate confine the documentation to an application-cum-agreement shape that can be completed with extraordinary ease. The endorsed sum will be right away credited to your bank account. The turnaround time for the entire prepare can be as speedy as the squint of any eye.

Reimbursement: There are numerous alternatives for reimbursement of the Gold Loan. The reimbursement choices change from loan specialist to loan specialist but will be inside the alternatives said underneath:

The loan can be reimbursed in a structured way that is, in simple portions by way of Likened Month to month Portions (EMIs). This is tailor-made for people who have a normal source of salary like salaried individuals.

The advance can be availed within the frame of an overdraft. This is often by and large favored by businessmen who will be needing funds for day-to-day operations of the commerce. They would prefer having get to to reserves at all times. In other words, they ought to be able to pull back cash when required and the stores that are credited back to the account ought to be accessible for usage once more when required instep of going for a new credit each time. Moreover, by selecting for an overdraft office, they can have control over the intrigued payable since beneath this office intrigued is connected as it were on the sum used and not on the whole overdraft constrain.

EMI as it were for intrigued and vital can be paid as and when stores are accessible. In this alternative, intrigued ought to be paid as and when due and portion installments can be made towards the foremost. This is once more is favored by businessmen who would select to pay the principal sum as and when there is a surplus inflow of stores into the trade.

Bullet installment is installment of both intrigued and central in one protuberance entirety on the development of the advance. For persons who have made an speculation and will be expecting a protuberance whole sum within the future, this choice will be helpful. For occasion, any venture made in a settled deposit or a repeating store will bring a protuberance sum amount on development which can be used to clear the Gold Credit exceptional.

Preparing charges: The preparing charges will be exceptionally ostensible. A few of the banks provide Gold Advances at zero handling charges.

Pre-closure charges: Banks/financial teach permit closure of the Gold Advance some time recently development at nil or ostensible charges.

No salary confirmation required: In spite of the fact that a few of the banks/financial teach prefer applicants with a steady wage, most of them don’t demand on salary proof.

Credit score: Gold could be a security which can be exchanged very easily. This quality of security is the reason that monetary educate give Gold Advances to candidates indeed with a moo credit score or no credit score. A credit score is not a obligatory eligibility criterion for availing a Gold Credit.

Security measures: You’ll be able confidently pledge your gold with rumored financial institutions without being sceptical almost the security measures. The gold promised with these teach will be profoundly secure since they are put away in safety vaults kept in strong rooms.

The following are the eligibility criteria for availing a Gold Loan:

- The applicant should be aged above 18 years

- The applicant should have the gold of 18 to 22-carat purity to pledge for the loan. If gold coins are pledged, then the purity should be 24 carats.

- If the loan is availed for agricultural purposes, proof of landholding should be available

- Some of the banks/institutions insist on a stable income though most of them don’t

The documents required for a Gold Loan are as mentioned below:

- Residential proof: Aadhaar Card, Voter’s ID Card, Driving Licence, Utility bills, etc.

- Photo identity proof: Passport, PAN Card, Driving Licence, Voter’s ID Card, etc.

- Passport-seized photographs

- Proof of landholding if the Gold Loan is availed for agriculture and allied activities

| Gold Loan | Personal Loan |

| Gold Loan is a secured loan | A Personal loan is an unsecured loan |

| To avail a Gold Loan, there is no need for income proof as well as a good credit score. |

|

| The loan can be utilised for any purpose except in the case of a loan availed for agricultural purpose. If availed for the purpose of agriculture, then it should be for raising a crop or for investment in farm machinery or any agricultural allied activities. | The loan is an all-purpose loan without any restrictions on end-use. |

| The quantum is decided by the weight of the gold that is going to be pledged. The gold should be of 18 to 22 carat. The quantum normally will be up to 75% of the market price of the gold. In some banks, an amount per gram is stipulated as per the market trend and it will be based on this value and the weight of the gold. | The loan is based on the income of the applicant. |

| The margin of 25% to 35% on the market price of the gold will be stipulated. LTV will be 65% to 75% of the market value of the gold. | No margin is required. 100% loan will be provided with a stipulation of 40% to 60% debt to income ratio. The net take-home salary after providing for the existing commitments and the proposed EMI should be 40% to 60% of the gross salary. |

| There are various repayment options, but normally it is a short-term to medium-term loan. | The loan can be repaid within 5 years |

| The loan processing is simple due to the liquidity nature of the security. | Elaborate verification process since the loan is unsecured. |

| Simple documentation | Process and assessment are elaborate, but the documentation is simple. |

| If the instalments have been defaulted or if there is an undue delay in clearing the dues in the loan, the gold pledged will be auctioned and the outstanding will be cleared with the auction proceeds. If there is any residual amount after the adjustment, the same will be credited to the bank account of the applicant. | There is no recourse for recovery other than initiating recovery steps since there is no security. |

| Most of the banks/financial institutions do not charge any processing fees and even if charged, it will be nominal. No pre-payment charges for Gold Loan. | Both processing charges and pre-payment charges are collected at rates between 1% to 4% on the outstanding balance. |

| The loan can be availed by anybody who is 18 years old or above and is having gold to pledge. | Can be availed only by individuals, self-employed individuals/professionals, and businessmen who have a stable income. |

| The rate of interest is competitive | The rate of interest is on the higher side |

You ought to be mindful and consider a few of these things articulated underneath some time recently applying for a Gold Advance:

Foundation Check: You ought to get it the foundation of the person/institution where you’re swearing your profitable resource and profiting a loan. On the off chance that you’re drawing closer a neighborhood pawnbroker to profit a Gold Advance, the procedure may be basic and you’ll be getting the advance immediately. But what is the safety of your security? There might be a robbery within the shop and the gold may be stolen or there may be a fire accident. Anything might happen. What is the safe-keeping degree received? Usually the foremost imperative figure you’ve got to consider whereas you’re vowing your gold to profit the credit.

You ought to do a foundation check around the institution where you’re vowing your resource and find out that the exchange that’s being put through isn’t a false one.

To maintain a strategic distance from all these questions and fears, it is continuously prescribed to approach banks/financial educate of great notoriety. The safe-keeping of the gold is guaranteed in these places. The gold will be put away in fire and burglary verification security vaults which are kept interior a solid room. The gold that’s within the care of these teach will too be covered by insurance.

Advertise Investigate: You’ve got to do advertise inquire about to get it the best bargain. The primary institution you’re drawing nearer may not be giving you the deal simply merit. Do a intensive investigate and collect comparative data of the Gold Credit Intrigued Rates, handling expenses, evaluation charges, pre-closure charges, etc. Break down the comparative information to almost five or six and select the leading among them.

Check who is giving you the best choice when it comes to the loan amount. Each institution has a different level of edge stipulated. Go for the bargain where you get the most elevated esteem for the resource.

Reimbursement: Get it the different reimbursement choices that are accessible and select the one that’s comfortable for you. You ought to moreover get it the consumption included in regard of the intrigued out-go in each choice. Have a dialog with the moneylender and choose on the choice as it were once you have caught on the suggestions each alternative carries. The different reimbursement alternatives are:

Compared month to month portions: If you are a salaried individual or a individual with normal wage, this choice will be perfect for you. The EMI consists of both the intrigued and the central component and so the vital gets reduced proportionately. The intrigued is charged on the exceptional balance and so the intrigued component keeps diminishing and inevitably, the alteration towards the vital component out of the EMI will increment. This will keep control of your use towards intrigued.

No pre-payment charges are collected for Gold Credits. In between, in the event that you’ve got excess funds, you can store the same in the credit account. The foremost component will reduce to that degree and you’ll save on the interest out-go.

Bullet installment: You may not be able to form a commitment for installment each month but are able to pay the money in a knot whole at some point afterward, at that point the bullet installment is the choice for you. You’ll be able pay the collected intrigued and the central at the time of development in one knot entirety. In this case, the intrigued will be compounded each quarter and so the intrigued you’ll be paying at the conclusion of the term will be impressively tall.

Overdraft office: Typically a spinning facility and the interest will be charged on the sum that will be used. You can operate this account all through the term that’s stipulated. Amid this period, you can withdraw the sum at whatever point you wish and deposit back when the reserves are available. This is comparative to a current account, but the difference is the funds within the current account is your possess stores for which you are doing not pay any intrigued, while in an overdraft facility you will be using the stores given by the money related institution for which you will ought to pay a fetched.

Partial repayment: In this option, there’s no repayment design drawn by the bank/financial institution which needs to be taken after. You can make a installment at whatever point reserves are accessible. This is often once more reasonable for people who do not have a customary salary. Typically appropriate for businessmen who don’t have a standard design for pay.

EMI as it were for intrigued: You may be paying the interest at whatever point due and the principal amount will be paid at the conclusion of the tenure. This way, you’ll be avoiding compounding of intrigued.

Edge: A margin is set between 25% to 35% for Gold Loans. If the LTV Ratio is high, then the hazard figure for the lenders increments. So, they consider various components whereas settling the LTV. On the off chance that you’re a long-standing customer of the bank and have a great relationship, you’ll be able arrange on the margin. Otherwise, the edge set is 25% to 35%. If in case the borrower comes up short to pay both the principal and the intrigued on the due date, at that point the intrigued keeps accumulating which results in the disintegration of edge, which increases the hazard factor for the borrowers.

Gold Acknowledged for Promise: Gold only in the shape of adornments is acknowledged as security. Gold bars and coins are not accepted as security. Be that as it may, Gold coins acquired from banks which are of 24-carat virtue are acknowledged, but there’s a limitation on the amount. Gold coins as it were up to 50 grams can be acknowledged as security as per the rules of the Save Bank of India.

If you want a higher quantum, at that point it can be combined security of both the gold coins and the ornaments.

Immaculateness of Gold: Some time recently drawing closer a lender, you should know the purity of the gold that you are attending to pledge. Banks/financial teach acknowledge only gold with 18 to 22-carat purity. For gold coins, the virtue level expected is 24 carats. It is better you vow adornments with no jewels studded in them since the weight of the gems will not be considered and you may conclusion up getting a lower credit sum.

Be mindful of all the above important factors some time recently drawing closer the bank/financial educate and strike the leading bargain.

Gold is an effective inflation hedge because it protects your wealth when currencies fall in response to market collapses. We just seen the power of yellow metal as markets suffered as a result of pandemic-related uncertainty. Gold reached new heights, allowing people to rebalance their portfolios. LoansWala has compiled a table with city-specific gold rates in India.

| Gold Rates (22 Carat) 1g – 15 June 2021 | |||

| Cities | Today | Yesterday | Daily Price Change |

| Bengaluru | Rs. 4,550 | Rs. 4,550 | Rs. 0 |

| Chennai | Rs. 4,576 | Rs. 4,575 | Rs. 1 |

| Delhi | Rs. 4,765 | Rs. 4,765 | Rs. 0 |

| Hyderabad | Rs. 4,550 | Rs. 4,550 | Rs. 0 |

| Jaipur | Rs. 4,765 | Rs. 4,765 | Rs. 0 |

| Kolkata | Rs. 4,777 | Rs. 4,777 | Rs. 36 |

| Lucknow | Rs. 4,765 | Rs. 4,765 | Rs. 30 |

| Mumbai | Rs. 4,760 | Rs. 4,776 | Rs. -16 |

| Patna | Rs. 4,760 | Rs. 4,776 | Rs. -16 |

| Surat | Rs. 4,823 | Rs. 4,823 | Rs. 0 |

| Gold Rates (24 Carat) 1g – 15 June 2021 | |||

| Cities | Today | Yesterday | Daily Price Change |

| Bengaluru | Rs. 4,963 | Rs. 4,964 | Rs. -1 |

| Chennai | Rs. 4,576 | Rs. 4,575 | Rs. 1 |

| Delhi | Rs. 5,180 | Rs. 5180 | Rs. 0 |

| Hyderabad | Rs. 4,550 | Rs. 4,550 | Rs. 0 |

| Jaipur | Rs. 5,180 | Rs. 5,180 | Rs. 0 |

| Kolkata | Rs. 4,777 | Rs. 4,777 | Rs. 0 |

| Lucknow | Rs. 5,180 | Rs. 5,180 | Rs. 0 |

| Mumbai | Rs. 4,860 | Rs. 4,876 | Rs. -16 |

| Patna | Rs. 4,860 | Rs. 4,876 | Rs. -12 |

| Surat | Rs. 5,023 | Rs. 5,023 | Rs. 0 |

The loan amount is based on the weight of the gold given as security. If gold ornaments with gems are presented as security, the weight of the stones will be deducted from the total weight of the ornament. The value of the pledged gold is then determined using the current market rate. The loan amount selected will be based on the LTV stipulated, which varies by lender. The amount could range from 65% to 75% of the security’s market value.

If the price of gold falls, the LTV value rises, increasing the risk for the lender. There will be erosion along the margin. If the margin erosion exceeds the required level, the borrower may be asked to deposit the amount necessary to restore the margin to the appropriate level. The other alternative will be to bring in more security.

Yes. The customer will be asked to open a Savings Bank Account at the time of availing the loan.

Lenders guarantee the absolute safety of the gold in their control. The gold will be stored in fireproof vaults that are housed in strong rooms that meet the strictest security standards. Insurance against fire and burglary will be offered for the gold held in their control.

No. No third-party guarantee is insisted for Gold Loans.

If the Gold Loan is defaulted on after the required period and the borrower fails to make payment despite many reminders and constant efforts by the lenders, the gold pledged will be auctioned. The auction will take place only with prior notice to the borrower and after publication in local publications. The auction proceeds will then be applied to the outstanding sum in the Gold Loan account, with the remaining value credited to the borrower’s savings bank account.